6.1 Incorporation of tax data

Incorporation of tax data

Filing a tax return through Renta Web is based on the existence of a file containing tax and personal data. A declaration can only be generated as the owner of the same when we have a DFP or DF file of tax data; otherwise, a declaration cannot be generated. If we do not have all the files of the holders, an individual declaration will be generated. To download the tax data file, you need an Internet connection and the following:

-

Electronic DNI or an electronic signature certificate accepted by the AEAT (for example, the one issued by the FNMT)

-

Access key through prior registration (Cl@ve PIN)

-

From the reference number of any of the tax products issued by the AEAT for the year 2023 (for example, the draft or the tax data).

This procedure concludes with the download of a DFP or DF file containing the tax information and personal data of the taxpayer available at that time. Please note that this information is updated regularly and may therefore vary throughout the campaign.

Once the personal data has been entered and the taxpayer's family situation has been determined, the declaration is accessed. As a general rule, all tax data must be included in the declaration, but certain characteristics allow them to be grouped into three types of data that require different treatments:

Directly transferable data. These are those that do not require any additional information to be included in the declaration; they are included automatically.

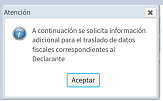

Data that needs to be accompanied by some type of complementary information without which they cannot be automatically incorporated into the declaration. In this case, the following message will appear warning of the existence of this type of data:

The list of possible tax data concepts to be incorporated will then appear, and you must select whether you wish to incorporate the concept into the declaration or not. If you choose not to include the tax data, you will have to fill it in manually in the declaration.

Data that by its nature is not directly transferable. This information is for informational purposes only and cannot be automatically transferred to the declaration. A message will appear in the incorporation notes.

Once finished, a list appears with the incorporated concepts and another with those not incorporated. This list can be consulted at any time from the menu View->Incorporated Tax Data.