What is the Income Tax reference number and what is it for?

The reference number allows you to access the different Income services available for each campaign, from requesting an appointment to obtaining your declaration through the Renta WEB system and filing the declaration of PIT, provided that it results in a refund or direct debit.

In addition, there are other procedures, such as requesting a tax certificate. PIT, which allow identification with the reference number, without the need for a certificate, DNI electronic or registration in Cl@ve.

Currently the data requested to obtain the Income reference is the amount of the box 505 of the Income Tax return for the 2023 fiscal year, although you can also obtain it if you access with an electronic certificate, DNIe either Key.

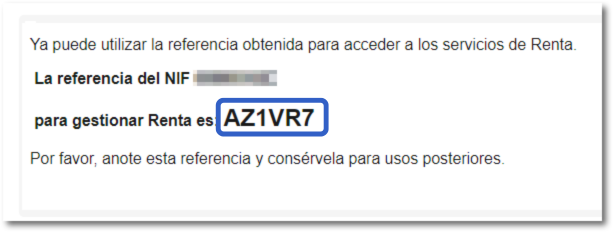

This reference consists of 6 characters and you can write it down and save it for later use.

You can also obtain the reference from the APP AEAT and you can consult it whenever you want in the application, in which you can include up to 20 users with their respective references.

Please note that if you have obtained a reference from the APP, obtaining a new one through the browser will revoke the previous one, so you will have to identify yourself again on the mobile device. Remember that only the last reference generated will be valid, either through the APP or from the website.