How to obtain the Income Tax reference with a certificate or electronic ID

The references obtained for the previous year's Income Tax campaign are no longer valid and From March 12, 2025, it will be necessary to obtain a new reference for the 2024 Income Tax campaign., identifying yourself with box 505 of the Income Tax return for the year 2023, with Key or with certificate or DNI electronic.

Using the electronic certificate you can obtain the reference of the Income Tax file immediately; With it you can manage and streamline all Income Tax services, prepare the declaration using the Renta WEB service and submit it online, regardless of the result of the declaration.

You can obtain a valid Income Tax reference with a certificate or electronic DNI from the link from "Get your reference number" in the "Procedures" section of this help. Remember that the reference is shown directly on the screen or in the APP.

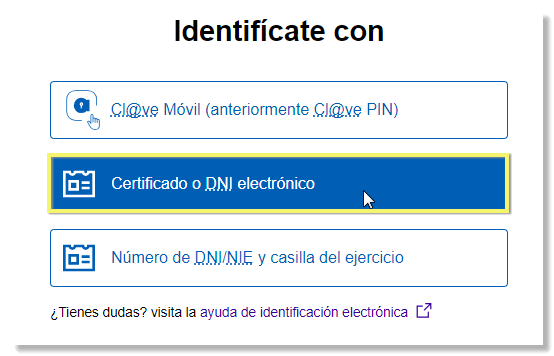

First, choose the identification system; in this case, "Certificate or electronic ID."

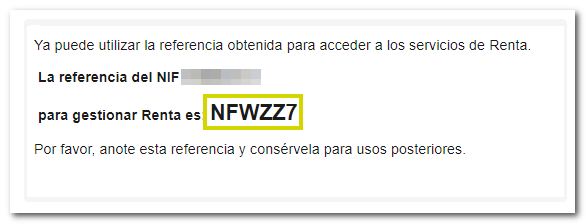

After choosing the certificate in the browser window, the 6-character reference for managing Income will immediately be displayed. Please write down or copy this reference for later use. However, you are allowed to obtain up to 10 Renta references per day and each of the references received will be different and will automatically revoke the one previously generated.

Please note that if you have obtained a reference from the APP, obtaining a new one through the browser will revoke the previous one, so you will have to identify yourself again on the mobile device. Remember that only the last reference generated will be valid, either through the APP or from the website.

Once you have obtained the reference, you will be able to manage any of the available Income services or those that allow identification in this way, such as requesting a tax certification. PIT.