1.2 Importing accounting data

Information relating to the balance sheet, the profit and loss account and the statement of changes in equity can be completed automatically by importing them, thus avoiding manual completion.

This import of financial statements may be carried out for entities subject to the accounting standards of the Bank of Spain, insurance entities, collective investment institutions, mutual guarantee companies, and those not subject to specific regulations.

The incorporation of this data will be carried out by importing an XML file, which must conform to a specific scheme whose design is defined in the file “mod2002019.xsd” which is available on the Tax Agency website for developer companies.

Accounting data import process :

The import process is only applicable when creating a new declaration.

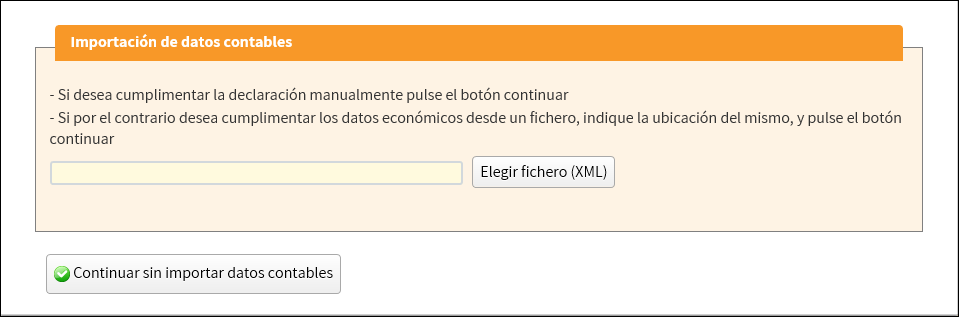

Once the declaration characters have been selected (type of entity and, if applicable, the account status associated with it), a pop-up window will appear that will allow you to select the XML file to import:

If you choose not to select a file, data inclusion will be manual. If, on the other hand, a file is selected, the form will automatically import the data into the corresponding sections.

The XML file is read sequentially and data will only be incorporated into the declaration if the file is correct.

The import process may generate warnings (![]() ) or errors (

) or errors (![]() ), and in both cases it allows generating a report with the anomalous situations found.

), and in both cases it allows generating a report with the anomalous situations found.

Warnings provide warnings about the XML file but do not prevent the data from being imported.

On the other hand, if errors are found, no data will be incorporated into the declaration but it will be fully processed in order to be able to display said errors on the screen to the user.