12.2 Electronic Document Matching - Secure Verification Code (CSV)

The Tax Agency offers an application accessible both from the Internet and from the AEAT App, which allows you to compare documents and thus check the authenticity and integrity of a document belonging to the Tax Agency's document management through the secure verification code -CSV-.

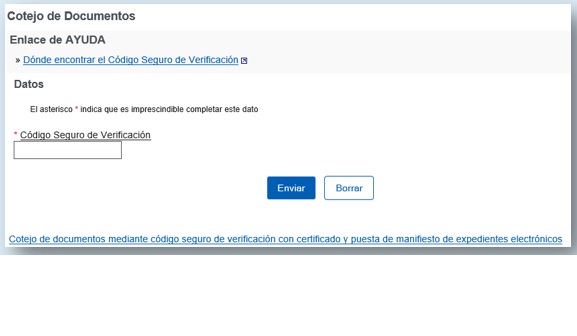

The administrative document issued by the Tax Agency has CSV printed at the bottom of its first page. The authenticity of said document can be verified on the Tax Agency website by accessing the option “Comparison of documents using a secure verification code (CSV)” where the digits of CSV that appear at the bottom of the first page of the document sent will be entered. In the case of the App, in addition to being able to enter the CSV , it is possible to read the QR code using the device's camera.

In general, identification is not required, however, in special cases, in addition to the CSV , identification with an electronic certificate, with DNIe or with Cl@ve will be required.

By entering the CSV , the administrative document to which said code is linked will be displayed, so that the identity between the document received and the one found in the electronic headquarters of the AEAT can be verified.

You can also check the authenticity of Tax Identification Cards with electronic code. By having the Electronic Code provided in the “Communication of the Tax Identification Number (NIF) Accreditation Card”, the validity of said Card can be verified and, additionally, accessed to its visualization.

Link to document verification