c. What types of mutual agreement procedures are there?

Depending on the applicable legislation, there are three types of mutual agreement procedure:

-

Those conducted under the applicable Tax Treaty, which are regulated in Title II of the Regulation on Mutual Agreement Procedures.

Although the majority of the applicable tax treaties in Spain are consistent with Article 25 of the OECD Model Tax Convention on Income and on Capital [OECDMC], each of the conventions applicable in Spain is unique.

Consequently, it is vitally important for the taxpayer to pay attention to the provisions of the applicable Tax Treaty, especially as regards the time limit for requesting the initiation of the procedure and also as regards the possible existence of an arbitration stage.

Example: Example: The time limit for requesting the initiation of a mutual agreement procedure under the Tax Treaty with Portugal is two years. With the United States, however, it is five years.

For these purposes, it is necessary to take into account any amendments introduced by the Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting [the Multilateral Convention] in relation to mutual agreement procedures. The OECD website lists the Tax Treaty which are amended by the Multilateral Convention.

-

Those conducted under the Arbitration Convention, which are regulated in Title III of the Regulation on Mutual Agreement Procedures.

Broadly speaking, the Arbitration Convention is used to settle cases of transfer pricing between Member States of the European Union.

Its scope of application is limited by:

-

European Union membership. All of the countries involved must belong to the European Union.

Example: Example: a taxpayer cannot request the initiation of a mutual agreement procedure under the Arbitration Convention in order to eliminate double taxation arising from transactions between a Spanish company and a Japanese company, because Japan is not a Member State of the European Union.

-

The nature of the dispute. This procedure is only applicable when double taxation arises either from a transfer pricing adjustment or from the attribution of profits to a permanent establishment. That is, if the adjustment in one of the Member States finds that there is a permanent establishment in that Member State that had not been declared, it would not be possible to request the mutual agreement procedure on the basis of the Arbitration Convention in order to determine the existence or otherwise of the permanent establishment, but it would be possible for the subsequent attribution of profits to that permanent establishment, where applicable.

-

-

Those conducted under the Directive, which are regulated in Title IV of the Regulation on Mutual Agreement Procedures.

The Directive has been fully transposed in Spain by means of Royal Decree-Law 3/2020, of 4 February, which entered into force on 6 February 2020, and Royal Decree 399/2021, of 8 June, which entered into force on 10 June 2021.

In general, the Directive applies to requests submitted on or after 1 July 2019 and which refer to tax periods beginning on or after 1 January 2018.

Nevertheless, where the request was submitted on or after 1 July 2019 and the question to which the mutual agreement procedure relates includes income or capital obtained before and after 1 January 2018, the competent authorities concerned may agree to apply the Directive to earlier tax periods, on a case-by-case basis, if there is provision for arbitration in the applicable international convention or treaty.

Example: Example: On 11 December 2020, a taxpayer submits a request for the initiation of a mutual agreement procedure under the Directive to the competent authorities of Spain and Italy, relating to transfer pricing and fiscal years 2015 to 2018.

As a general rule, the mutual agreement procedure will only be initiated under the Directive in relation to the fiscal year 2018.

However, under Spanish law and if Italian domestic law does not prevent it, the competent authorities of Spain and Italy could also agree to conduct the mutual agreement procedure under the Directive for fiscal years 2015, 2016 and 2017.

The Directive serves to resolve disputes between Member States of the European Union arising from the application of conventions for the avoidance of double taxation relating to income and capital.

That implies:

-

As in the case of the Arbitration Convention, all of the countries involved in the procedure must be Member States of the European Union.

-

Unlike the Arbitration Convention, the scope of application of the Directive is not restricted to transfer pricing and the attribution of profits to permanent establishments. All that it requires is the existence of an applicable convention for the avoidance of double taxation of income and capital, whether that is a Tax Treaty or the Arbitration Convention itself.

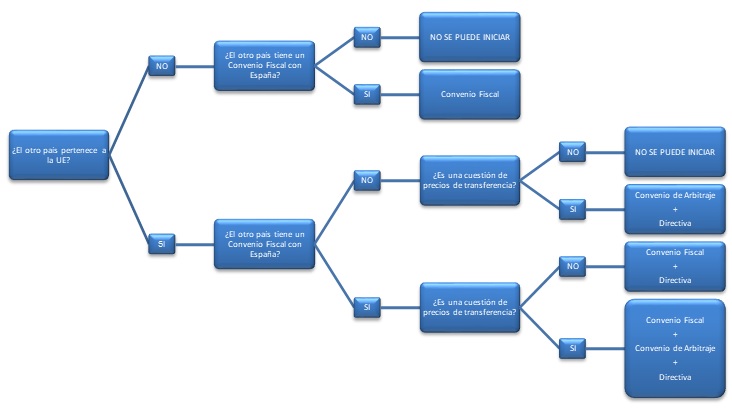

The following table summarises the types of mutual agreement procedures applicable according to the criteria set out above, without prejudging whether or not the other applicable requirements are satisfied:

The taxpayer must decide what type of procedure to initiate, expressly stating it in the request.

-