Introduction

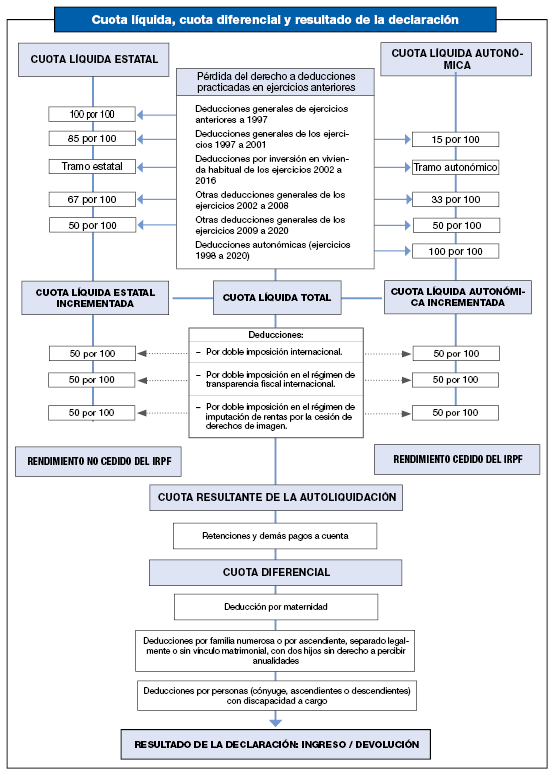

Once the amount of the net quotas, state and regional, has been quantified, and taking into account the transfer of the PIT For the Autonomous Communities, the remaining operations to be carried out are shown, in graphic and summarized form, in the following table: