Classification according to its integration into the tax base

Regulations: Articles 45 and 46 Law PIT

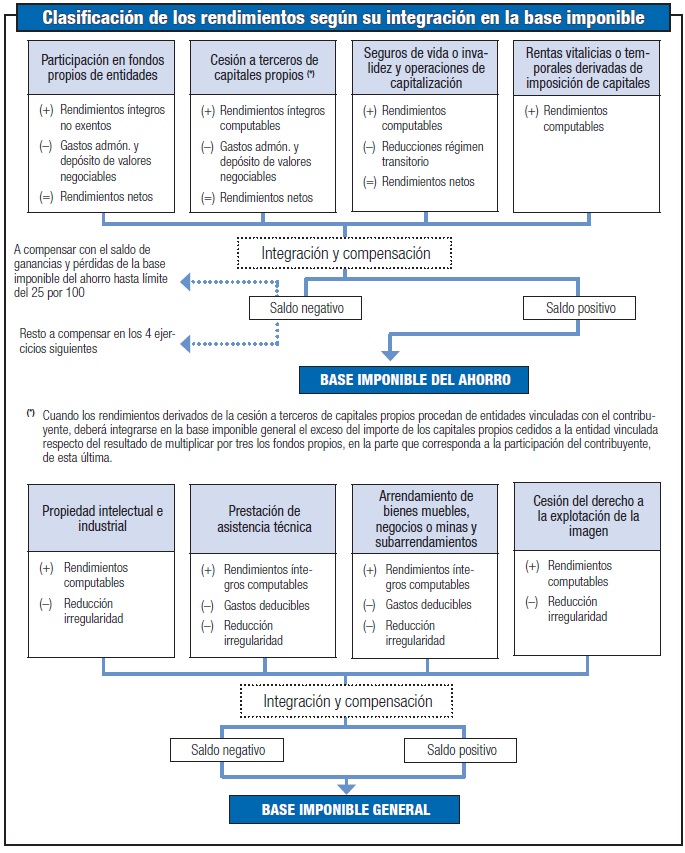

The current Law of PIT, in order to grant neutral treatment to income derived from savings, establishes the incorporation of all income thus classified, regardless of the financial instruments in which they materialize and the period of their generation, into a single base called the savings tax base.

The taxable savings base is made up of the following income:

- Derivatives of the participation of entities' own funds.

- Those derived from the transfer of own capital to third parties.

- Life or disability insurance derivatives and capitalization operations.

- Those arising from life annuities or temporary annuities derived from the imposition of capital.

The general tax base includes, among others, the following income:

- Those derived from intellectual and industrial property and the provision of technical assistance.

- Those derived from the leasing of movable property, businesses or mines and subleases and the transfer of the right to exploit the image.

The following image graphically represents the classification of income from movable capital according to its integration into the tax base: