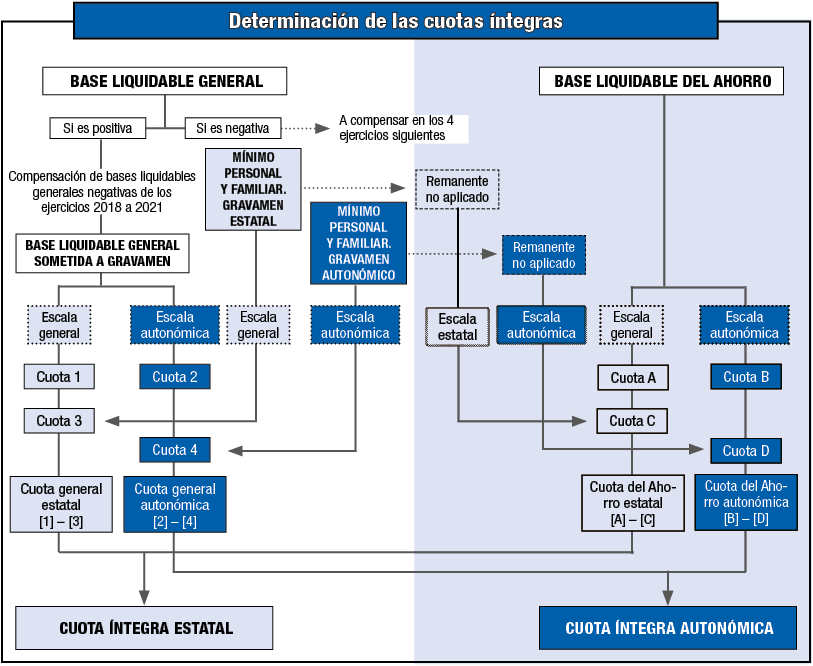

Graphic scheme: Application of personal and family minimum and determination of full contributions

Taxation of the general taxable base

The taxation of the general taxable base of personal income tax is structured in four phases:

Phase 1: The general and regional scales of the following are applied to the entire general taxable base, including the amount corresponding to the personal and family minimum that forms part of it: PIT obtaining the corresponding partial quotas (Quota 1 and Quota 2).

Phase 2: The general scale of the taxable base corresponding to the state personal and family minimum established in the Personal Income Tax is applied to the part of the general taxable base. PIT, obtaining the partial quota (Quota 3).

Phase 3: The corresponding autonomous scale is applied to the part of the general taxable base corresponding to the personal and family minimum increased or decreased by the amounts established, where applicable, by the Autonomous Community in its autonomous regulations, obtaining the partial quota (Quota 4).

In the 2022 financial year, the Autonomous Community of Andalusia, the Autonomous Community of Galicia, the Autonomous Community of the Balearic Islands, the Community of Madrid, the Autonomous Community of La Rioja and the Valencian Community have regulated amounts of the personal and family minimum different from those established in the Law of PIT. Consequently, taxpayers resident in its territory must apply, for the purposes of the autonomous tax (phase 3), the amounts regulated in the regulations of said Autonomous Community.

The rest of the taxpayers (including those of the Community of Castilla y León, which has set amounts for the personal and family minimum of identical amounts to those established in the Personal Income Tax Law) must apply the same amount of the personal and family minimum for the purposes of the state tax (phase 2) and the regional tax (phase 3).

Phase 4: The general state full quota (Quota 1 minus Quota 3) and the general autonomous full quota (Quota 2 minus Quota 4) are calculated from the four partial quotas obtained.

Taxation of the taxable base of savings

The taxation of the taxable base of personal income tax savings is structured in four phases:

Phase 1: The amount of the taxable savings base is taxed at the rates of the state and regional savings scale, set for 2022, obtaining the corresponding partial quotas (Quota A and Quota B).

Phase 2: The amount of the state quota resulting from applying the scale to the taxable savings base (Quota A) will be reduced, where applicable, by the amount derived from applying to the remainder of the unapplied state personal and family minimum (that is, to the excess of the aforementioned minimum over the amount of the general taxable base) the state savings scale set for 2022 (Quota C).

Phase 3: The amount of the regional quota resulting from applying the scale to the taxable savings base (Quota B) will be reduced by the amount derived from applying to the unapplied remainder of the regional personal and family minimum (that is, to the excess of the aforementioned minimum over the amount of the general taxable base) the regional savings scale set for 2022 (Quota D).

Phase 4: From the four partial quotas obtained, the full quota of state savings (Quota A minus Quota C) and the full quota of regional savings (Quota B minus Quota D) are calculated.