5.5. Fractional payments of companies

If the net amount of turnover during the twelve months prior to the date on which the tax period begins on account of which the corresponding fractional payments must be made has not exceeded the amount of 6 million euros, these must be made on form 202, applying the calculation method provided for in section 2 of article 40 of the Corporate Tax Law New window , during the first twenty calendar days of the months of April, October and December.

The deadline for submission with direct debit payment will be from the 1st to the 15th of each month.

If the deadline for filing falls on a non-working day, the deadline ends on the next working day and the direct debit period will generally be extended by the same number of days as the deadline for filing the declaration.

Calendar of non-working days New window .

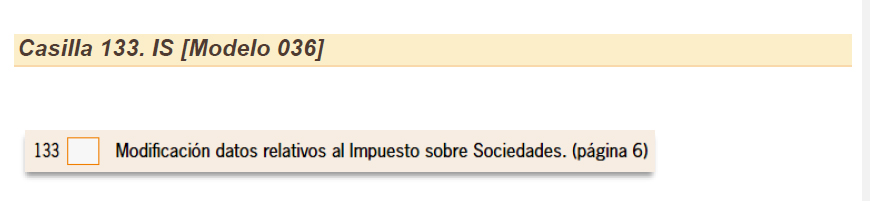

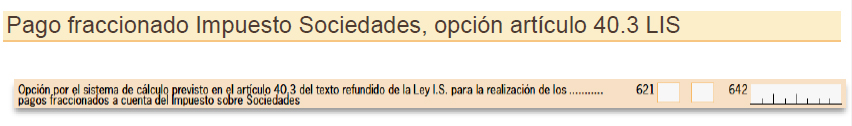

However, there is the possibility of opting for the calculation method provided for in section 3 of article 40 of Law New window by exercising this option by filing form 036 New window , during the month of February of the calendar year from which it must take effect, provided that the tax period to which the aforementioned option refers coincides with the calendar year. In the contrary case, the option must be exercised in the corresponding census declaration during the 2 months counted from the start of the said tax period, or within the period between the start of the said tax period and the end of the period for making the payment corresponding to the said tax period when this latter period is less than 2 months.

The taxpayer will be bound to this modality of split payment for payments corresponding to the same tax period and subsequent ones, as long as its application is not waived by submitting form 036, which must be submitted within the same time periods established in the previous paragraph.