5.3.1. How does one voluntarily adopt SII?

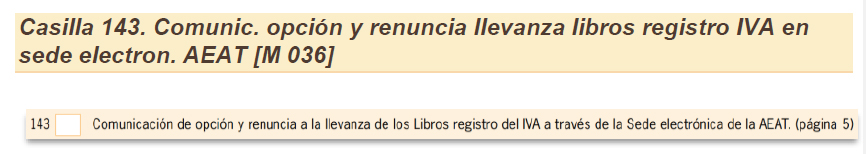

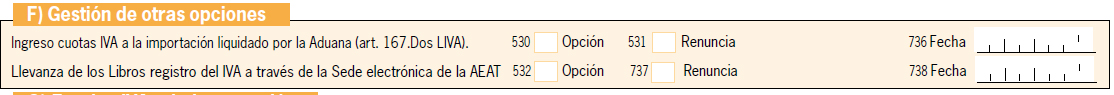

There is the possibility of joining the SII voluntarily, choosing at any time by submitting form 036 (boxes 143 and 532), being included from the day after the liquidation period in which said option was exercised ends.

EXAMPLE :

A company that opts for the SII, submitting form 036 on February 10, 2021, will be included in the system from April 1, 2021.

Information regarding invoices issued and received before April 1 will be submitted by December 31, 2021 (inclusive). Those issued or received later will be sent within the specific SII deadlines already mentioned.

Taxpayers included in the SII are not required to file the Annual Declaration of Transactions with Third Parties, form 347 New window , and the Annual Summary Declaration of Value Added Tax, form 390 New window .

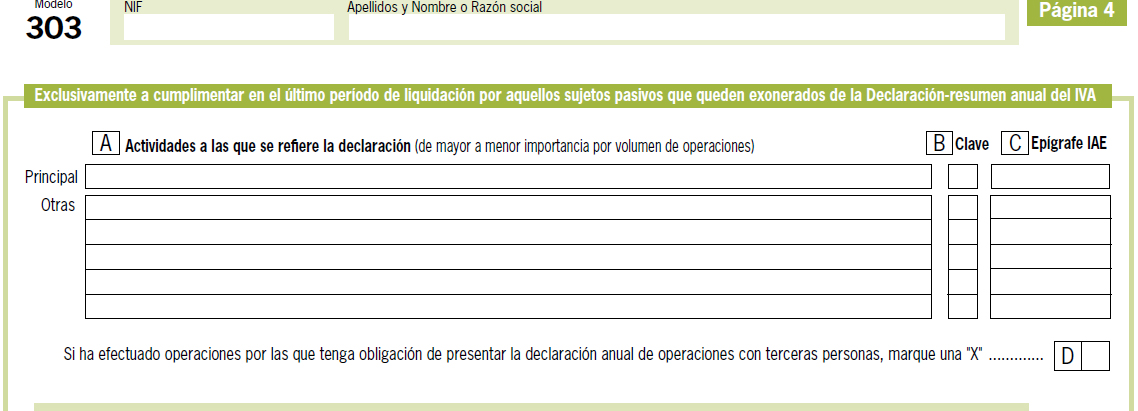

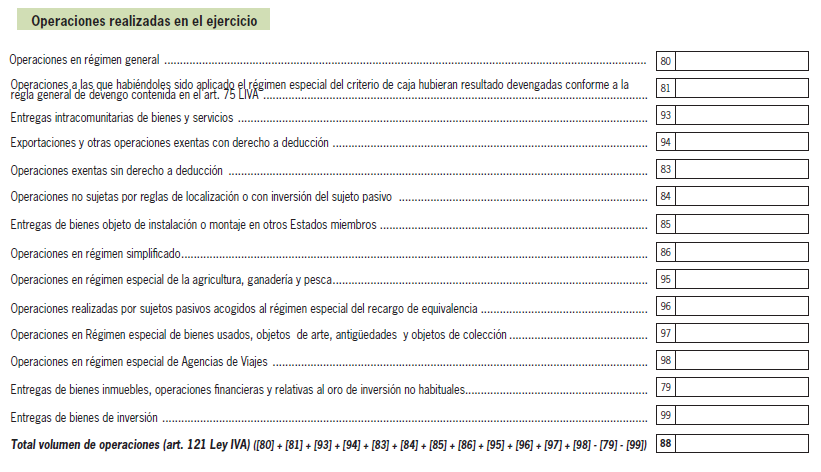

This exemption entails the necessary completion of additional boxes in the self-assessment corresponding to the last settlement period of the financial year.