3.1.2. Required to submit form 390

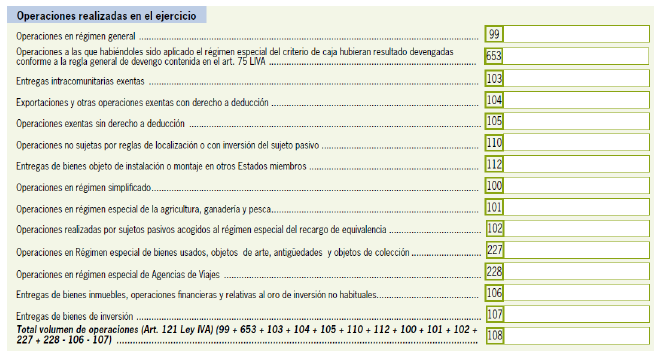

Taxpayers required to file Form 390 must declare the transactions carried out in each fiscal year, as well as the volume of transactions in Form 390.

Specifically, they must declare these operations in the following section of Form 390:

For more details about this section, its boxes and how they should be filled out, you can consult the Instructions for form 390 New window .

You can access the procedure at the following link:

Model 390. VAT. Annual Summary Statement New window .