Process description

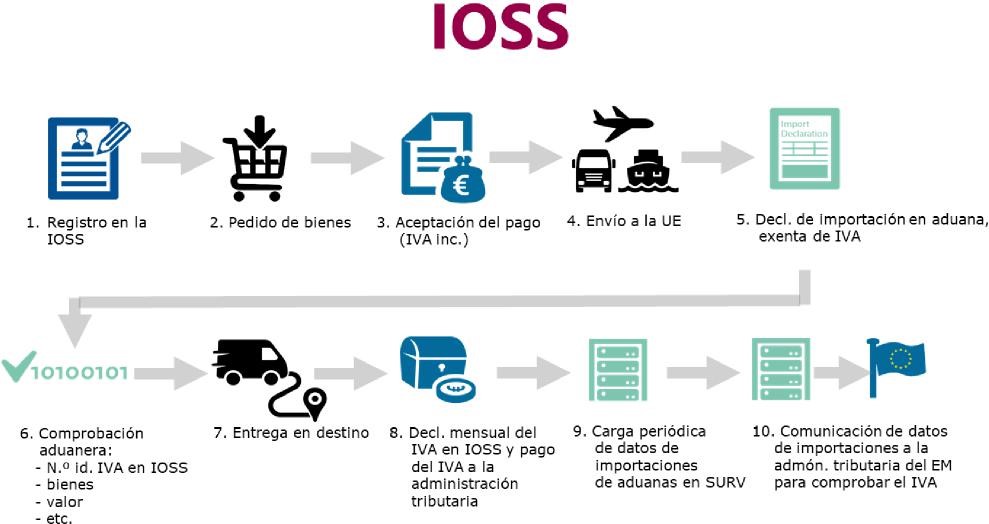

Broadly speaking, the IOSS works as follows:

- The seller registers for VAT purposes in a single Member State, applies and collects VAT on distance sales of goods dispatched or transported to consumers in the EU , and declares and settles said VAT to the Member State of identification, which will then distribute it among the Member States of destination of the goods.

- In this case, the goods are exempt from VAT when imported into the EU. The customs authorities of the Member State of import prepare a monthly list of the value of imports for each IOSS VAT identification number and share it with the tax administration of the Member State of identification.

The following image shows a summary of the IOSS process.11:

11 Please note that this is a simplified assumption and there are several alternatives. ( e.g. As regards payment, it can also be made upon delivery).