3.3.2. Process description

When using the ordinary mechanism for collecting VAT on import, goods subject to customs relief pursuant to Article 23(1) or Article 25(1) of RFA can only be declared for release into free circulation in the Member State in which the dispatch or transport of the goods is completed, in accordance with Article 221(4) of AE CAU . This means that the Member State of import and the Member State of destination (consumption) must be identical. This is essential, since VAT is due in the importing Member State and it cannot collect VAT using the tax rate applicable in another Member State. The person filing the declaration can choose between a customs declaration with the H7, I1 or H1 data set (since the H6 data set is restricted to postal service operators).

At the time of importation, any person or persons designated or recognized as liable by the Member State of import, in accordance with Article 201 of the VAT Directive, may be liable for import VAT. In practice, generally the importer (i.e. the consignee) and, in the case of indirect representation, the declarant of the customs declaration, are jointly and severally liable for the payment of VAT on import.

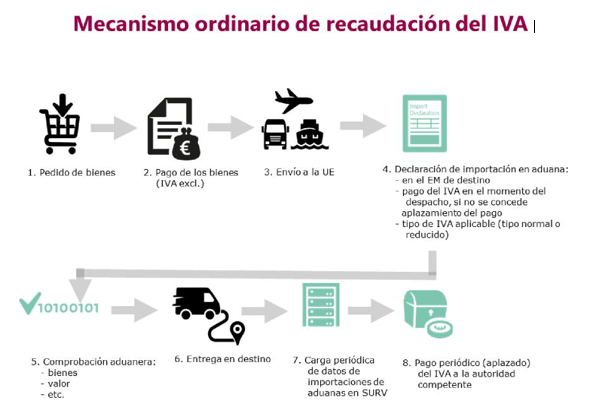

A more detailed summary of the parts of the standard procedure is shown in the following image: