Use case #2

Multiple orders for different consumers.

Orders from different suppliers or electronic interfaces consolidated.

The value of each order is less than the threshold of 150 EUR .

The IOSS applies to some orders and not to others.

Starting points:

- There are two different providers or electronic interfaces.

- Supplier 1 uses the IOSS regime, while Supplier 2 does not.

- supplier 1 sells to six hundred consumers, while supplier 2 sells to four hundred consumers within the EU .

- The average order value is EUR 25.

- Both suppliers uniquely identify each order (for example, with an identification number that complies with ISO 15459-6).

- They select, pack and ship each of the sales in independent transport units. They identify each unit uniquely (for example, using an identification number that complies with ISO 15459-1).

- At the time of shipping each order and associated transport units, suppliers communicate all relevant details of each sale to the carrier transporting the orders to the EU. These would also include order identification numbers and the (multiple) identification numbers of the associated transport units, as well as the identification number for the purposes of theVAT of the IOSS (if applicable).

- The total number of transport units associated with the 1,000 orders is equal to 1,000.

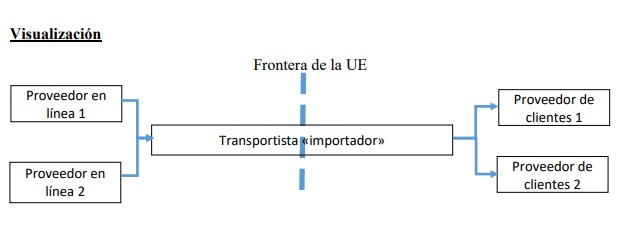

- Both platforms use the same carrier for primary transport to Europe.

- The carrier transporting these 1,000 individual transport units across the EU border consolidates these units into a single intermodal container.

- The total value of sales included in the container is EUR 25,000 (1,000*25 EUR).

- The carrier will carry out the customs declaration procedure associated with these imports into the EU.

- The carrier shall deconsolidate the contents of the container upon entry into the EU in order to transport each EEV to the intended consumers or countries of destination.

Declaration process:

The declaration procedure that the carrier must carry out is different for each of the two providers or electronic interfaces.

- For Supplier 1 (follow the procedure with IOSS according to the use case above):

- The carrier will declare the six hundred individual orders (and the associated transport units) in separate customs declarations to the customs authorities of the Member State through which the goods enter the EU.

- This will include the valid IOSS VAT identification number of Supplier 1, as well as the order and transport unit identification numbers. The order identification number must be included in the ED 12 08 000 000; the transport unit identification number, in the ED 12 05 000 000; and the IOSS VAT identification number, in the ED 13 16 000 000. Each statement shall also comply with all other requirements of DA with data set H7.

- The customs authorities of the Member State shall check each separate declaration (per order).

- The customs of the Member State may decide to inspect certain orders or transport units.

- For supplier 2 (not registered with the IOSS), the special regime procedure can be followed:

- The carrier will declare individual orders (and associated transport units) in separate customs declarations to the customs authorities using the H7 dataset.

- This will include the order identification number (if available) and the transport unit number. The order identification number must be included in the ED 12 08 000 000; and the identification number of the transport unit, in the ED 12 05 000 000.

- The customs authorities of the Member State shall check each separate declaration (per order).

- The customs of the Member State may decide to inspect certain orders or transport units.

- For EEVs to be delivered in the Member State of entry, clearance may be carried out before the customs authorities of the Member State of entry. For EEVs to be delivered to another Member State, it is mandatory to use the transit procedure, since these EEVs can only be ultimately cleared in the country of destination.

- EEVs shall be transported to the country of destination under the external transit regime.

- EEVs will be cleared in the country of destination in accordance with the regime applicable in that country.

- The accrued VAT will be settled in the country of destination.

- All orders and transport units that customs wishes to inspect will remain at the carrier's premises until the inspection is completed.

- The carrier may proceed to deliver orders and transport units once the inspection has been completed and the orders have been dispatched.

For logistical reasons, the separation of transport units between goods declared and non-declared through the IOSS may be carried out in the country of export. Alternatively, all goods (both declared and undeclared through IOSS) not destined for the Member State of first entry are placed under the external transit procedure and declared for release for free circulation at the customs of the Member State of end-use.