A) General concepts

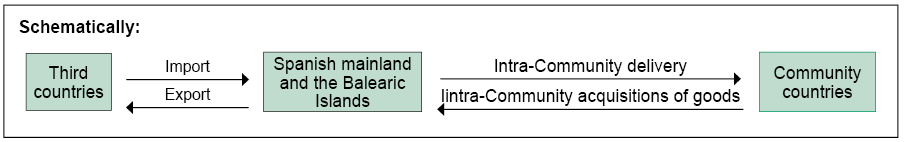

In the field of VAT The terms "import" and "export" are used only when they concern acquisitions or deliveries of goods to non-Community countries, i.e. entries into and exits from the Community, and intra-Community acquisitions and intra-Community deliveries of goods when they concern acquisitions and deliveries of goods to Community countries, i.e. purchases from and sales to Member States of the Community.

Two new taxable events appear here: importation, to refer to the entry into the territory of the Community of goods from third countries and the intra-community acquisition as entry into the Spanish territory of VAT (from which the Canary Islands, Ceuta and Melilla are excluded) of goods that come from another State member of the European Union.

Imports and intra-Community acquisitions are taxed differently: While the former must be settled at Customs (without prejudice to the possibility of deferring payment in certain cases), the latter are settled as part of the self-assessment that is periodically submitted for all operations.

In intra-Community trade, there is a different treatment depending on whether the purchases are made by individuals or by businessmen:

-

As a general rule, deliveries of goods to individuals are taxed in the country of origin, that is, in the country of the business person making the delivery.

-

Deliveries of goods to businessmen or professionals, subject to VAT, are taxed in the country of destination, that is, in the country of the businessman who acquires them, as an intra-community acquisition of goods.

Furthermore, the general regime for intra-Community acquisitions does not apply to acquisitions made in a Member State that are taxed under the special regime for used goods, works of art, antiques and collector's items. This is because the operation of this special regime requires that taxation be located in the State of origin.

In order for imports and intra-community acquisitions to be subject to tax, the following requirements must be met:

-

The operation must be configured as an intra-community acquisition or import.

-

It must be carried out in the territory of application of Spanish VAT.

-

The operation must not be included among the non-taxable assumptions provided for in the Law.

-

The operation must not be included among the exemption assumptions provided for in the Law.