Subscribe to notifications from the Tax Agency

Law 39/2015, on the Common Administrative Procedure of Public Administrations, of October 1, allows citizens to identify an electronic device and/or an email address that will be used to receive information notices from public administrations.

In this regard, the Tax Agency makes available to citizens who have previously given their consent and communicated a mobile phone number or an email address, certain information such as the notice of the availability of a notification issued to ultimately prevent it from being published in an Official Gazette, the start of new campaigns such as the Income Tax campaign, the announcement of new benefits or tax deductions, etc., without in any case implying the birth of a new tax obligation for the taxpayer.

In any case, this is an option that, once exercised, can be cancelled at any time.

Registration or modification to this service can be done through different means: census forms (030, 036 and 037), at the Tax Agency's Electronic Headquarters, in its own offices or in the app of the Tax Agency.

In the app, once has been identified, the option to confirm registration for this service to receive push messages on the same device is displayed.

Also, in this 2017 Income Tax campaign, when entering “Draft/declaration processing service (Renta WEB)”, among the available services the option “Contact information to receive AEAT notices” is displayed, which allows the taxpayer to register for this service.

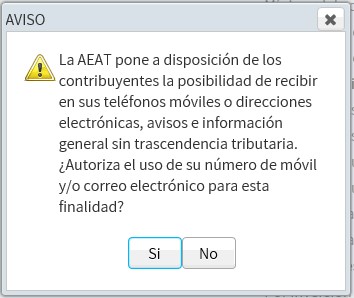

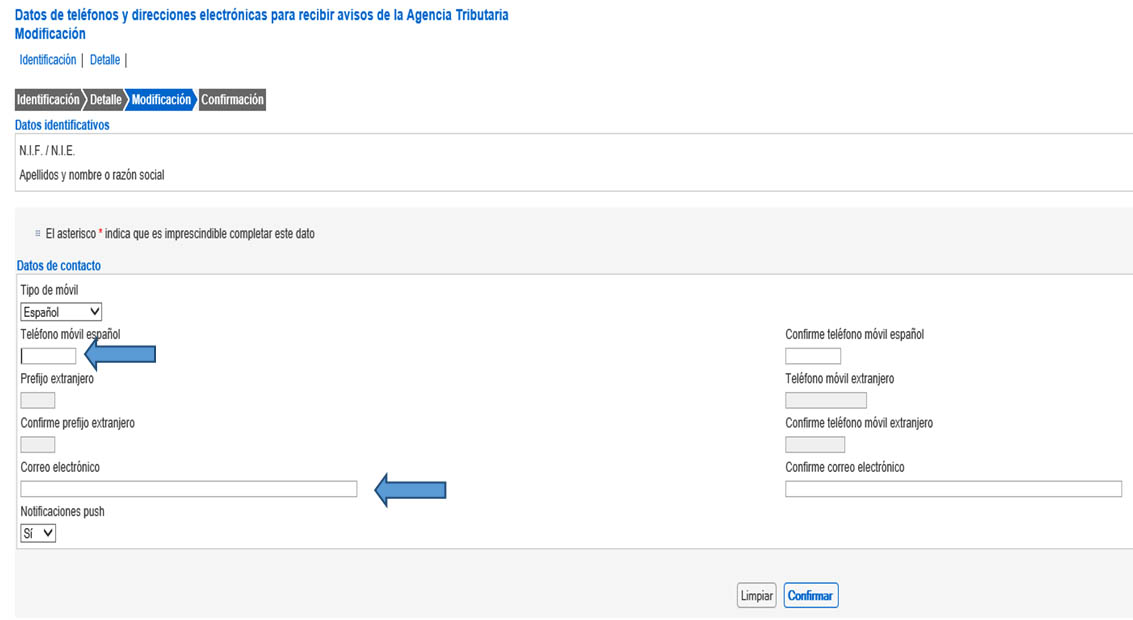

Likewise, when entering Renta WEB, when personal data is confirmed, the following message and screen are displayed: