Completion of the deduction extension. Exercises 2020 and 2021

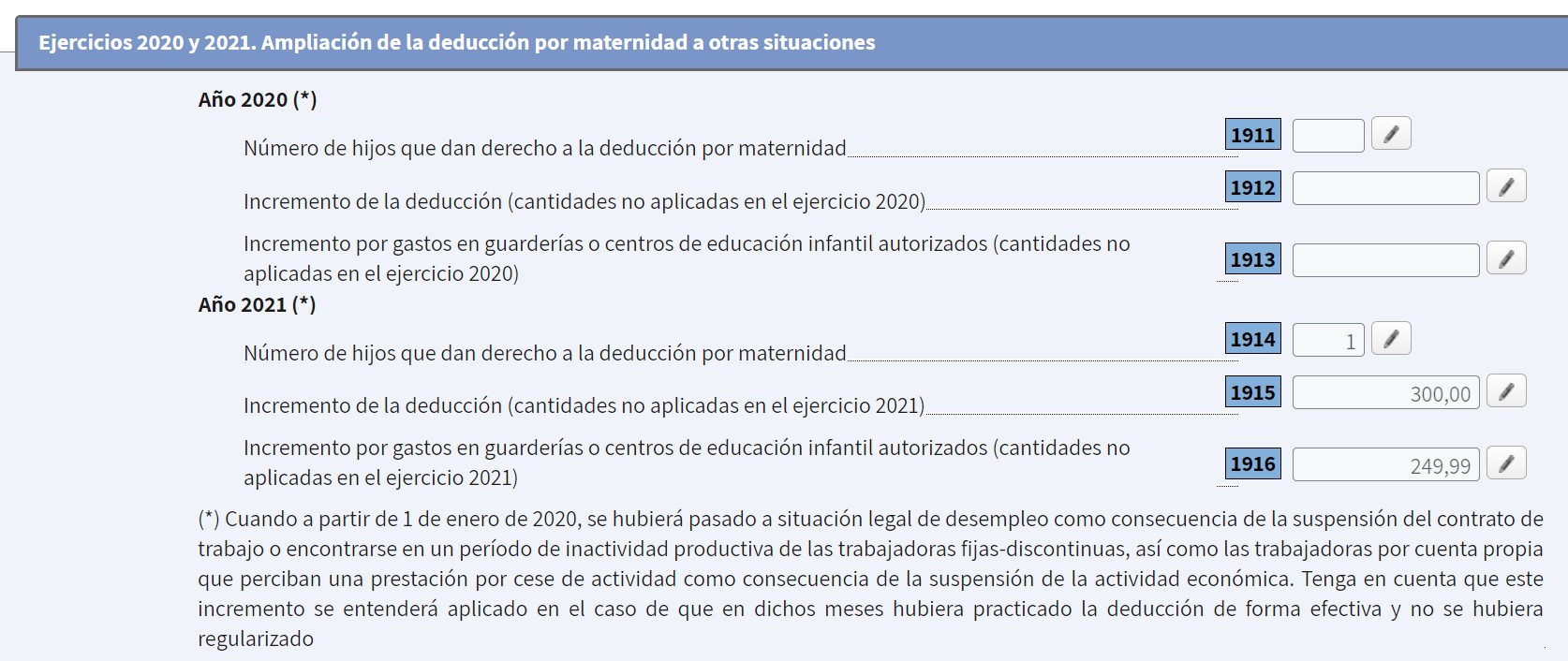

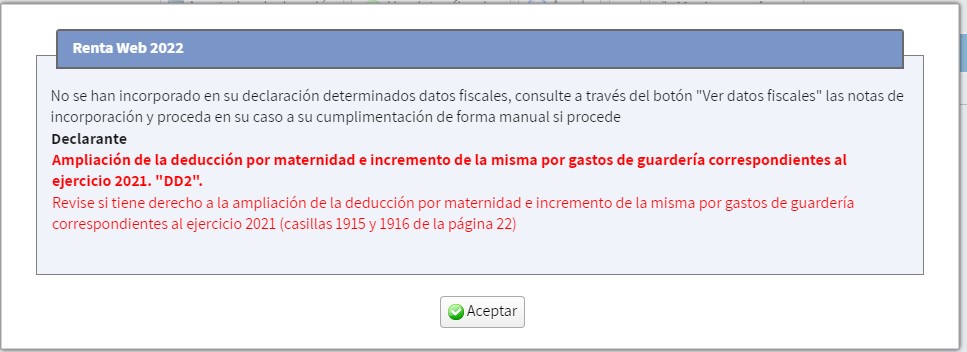

The extension of this deduction in relation to the 2020 and 2021 fiscal years will be included in the 2022 Web Income Tax return, boxes 1911 to 1916. When the AEAT can pre-calculate the amounts of this extension, they will automatically appear included in these boxes. Otherwise, if the Tax Agency does not have all the necessary information to provide the completed boxes, a notice will be displayed to the taxpayer in Renta Web 2022 so that they do not forget to complete these boxes.

Continuing with our example, we remember that this taxpayer had a child on 08/01/2020 (being working since before the birth of that child) and remains active until 09/30/2021 when she is placed in the ERTE situation with total suspension until 02/01/2022 when she resumes work. Subsequently, on 05/30/2022, he/she became unemployed.

In addition, the son has attended a daycare center during all the months of 2021 and 2022 except for the month of August of each year.

In 2020 and 2021, she already included in her declaration the amounts relating to the maternity deduction and the increase in childcare expenses that corresponded to her according to the original regulation of this deduction.

In this example:

-

In 2020, the mother applied the maternity deduction in her 2020 Income Tax return for the months in which she carried out an employed activity since the birth of the child (months from August to December).

In Renta Web 2022, no additional deductions may be applied for the year 2020, since this year none of the new situations that now generate the right to the deduction occurred and the taxpayer has already applied the deduction for the months in which she was entitled to the deduction with the original wording.

-

For 2021, she applied the maternity deduction in her 2021 Income Tax return for the months in which she was working (from January to September).

With the new circumstances that now grant the right to the deduction, in the 2022 Income Tax Return you are also entitled for the months of October to December 2021 (3 months x €100/month: 300 €). Since you did not include them in Income Tax 2021, the amount for these months will be reflected in box 1915 of Income Tax Web 2022.

The amount corresponding to the increase in childcare expenses for the months of October to December 2021, for which you are now entitled with the extension of the deduction to the cases of ERTE with total suspension that occurs in this example, will also be reflected in Renta WEB 2022. Since I do not include them in Income Tax 2021, the amount for these months will be included in box 1916 of Income Tax 2022 (3 months x €83.33/month: 249.99 €).

If the AEAT has all the data and background information necessary to calculate these amounts, when accessing Renta WEB you will be able to see the calculated amount corresponding to these deductions. In our example, box 1915 for the maternity deduction and box 1916 for the increase in childcare expenses will be filled in directly, without the taxpayer needing to take any action regarding this extension of the deduction.

In the event that the AEAT does not have all the necessary data to calculate these amounts, it will notify the taxpayer when they access Renta Web 2022, indicating the specific boxes where they must reflect both amounts, in our example boxes 1915 and 1916:

In these cases, the taxpayer must calculate the amount of the deduction extension as we have analyzed in our example and enter these amounts in the corresponding boxes.