Processing tax residency forms

The common feature of most tax residency forms (for example, the 21RFI of Portugal, the 5000-ES of France and similar ones) is that, together with the sections in which the taxpayer declares the data of the income received in the country of the Treasury requesting the form, there is a section that must be completed by the AEAT certifying, where appropriate, the taxpayer's tax residency, by means of a handwritten signature by the official and the stamping of the AEAT seal on the paper form.

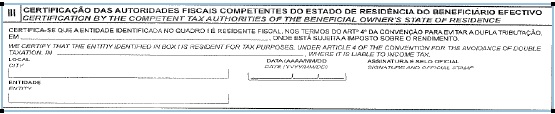

For example, in the Portuguese Model 21RFI, the certification of tax residence by the AEAT is carried out by signing and stamping the following section:

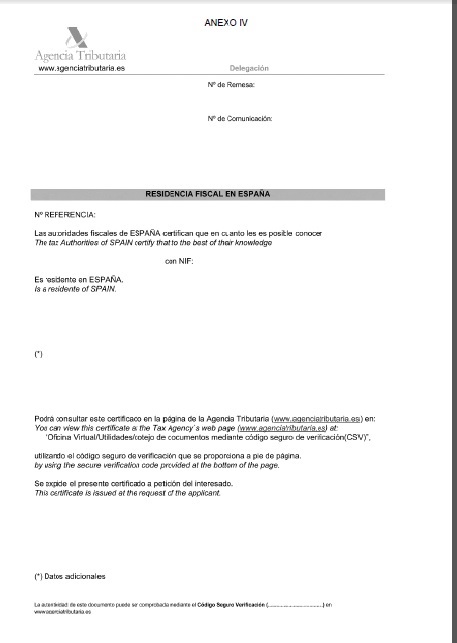

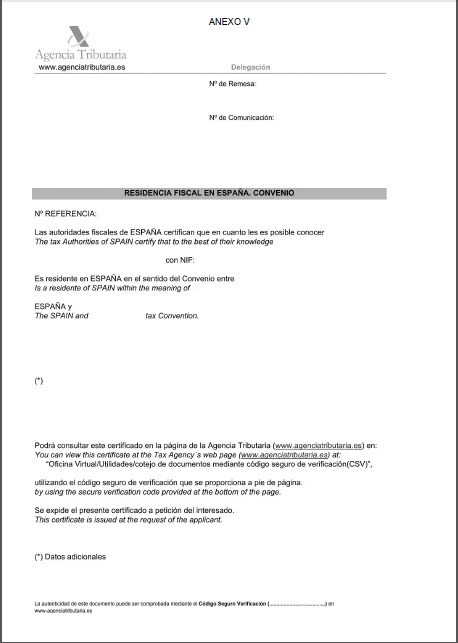

This method of certifying the tax residence of a taxpayer has no greater legal validity than that provided by the tax residence certificates approved by Order EHA/3316/2010, of December 17, the content of which appears in Annexes IV and V of the same (BOE No. 311, of December 23, 2010).

The tax residency certificates approved by said Order, unlike the tax residency forms of the different countries that are processed in person on paper, can be requested and obtained through the electronic headquarters of the Tax Agency by accessing the following link:

Tax certificates. Issue of tax certificates. Tax residence

To ensure the integrity of the document, so that the tax authorities of the countries in which the certificate must be submitted can verify it through the AEAT electronic office, said certificates are issued with a Secure Verification Code (CSV) and are accompanied by an annex explaining in detail, both in Spanish and English, the guarantee offered by the CSV, as well as the phases of the simple procedure for verifying tax certificates submitted by taxpayers to the tax authorities of the different countries.

The AEAT has notified the various countries of this system of certification of tax residency.

Consequently, the taxpayer must:

- Request and obtain the tax residency certificate through the Tax Agency's electronic office by accessing the aforementioned link:

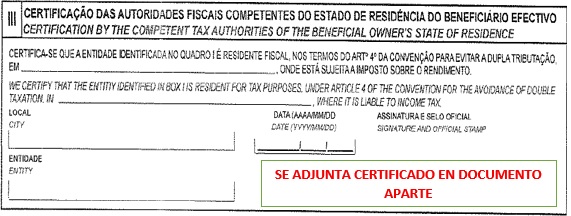

- In the section in which the AEAT certifies tax residency by signature and stamp, enter a notice indicating that said certification is attached in a separate document.

Continuing with the example of the Portuguese form 21RFI, that section, completed by the taxpayer, would look like this:

In the event that the authorities of the country in question request that, in addition to tax residency, some additional matter be certified (for example that it is subject to and not exempt from Corporate Tax) that is necessary to appear in the text of the certificate (Statement for funds and Statement for SICAVs form of Portugal, Attestation de domicile et de situation fiscale of France, among others), they must make the request for the tax residency certificate through section Other Certificates / Generic Certificates and mention the specific name of the form and the country to which it corresponds, or make the request for the tax residency certificate through the link mentioned above and provide the specific form using the link Submit document and/or allegations found in the same section from where the request is made.