Frequently Asked Questions (HTML version)

Frequently asked questions about the Financial Transaction Tax in HTML version (12/19/23)

Tax return and payment

Yes, you must submit the tax return corresponding to the settlement period with the information required for this purpose and without having to make any payment with respect to said exempt transactions.

The Financial Transaction Tax must be submitted electronically via the Internet by submitting Form 604 and its information annex.

To complete form 604 and its informative annex, you may use the forms available at the AEAT Electronic Office or a computer program that allows you to obtain the corresponding files.

Until 2023 included:

-

Both the information annex and the self-assessment must be submitted exclusively to the AEAT .

From 2024 onwards:

-

The list of companies whose stock market capitalization on 1 December of the previous year exceeds 1,000 million euros, which is published annually on the electronic headquarters of the AEAT , adds a column indicating the administration competent for the collection (based on the registered office of the entity whose shares are subject to the Tax).

-

Informative annex:

-

The information annex must be submitted necessarily to the AEAT . It will include all subject operations regardless of the administration to which the levy corresponds.

-

If the information annex includes acquisitions of shares in companies with registered offices in the Basque Country or Navarre (see list of entities published on the Electronic Office), it must also be submitted to the corresponding Provincial Treasury when required by the latter (for these purposes, you must contact each Provincial Treasury).

-

-

Self-assessment

-

From the informative annex, you must determine the operations that correspond to the AEAT and to each of the Provincial Treasuries.

-

Once the previous step has been completed, form 604 will be completed and submitted, in which the operations corresponding to AEAT will be self-assessed and information on the operations corresponding to each of the Provincial Treasuries will be included.

-

If there are operations that correspond to one of the Provincial Treasuries, a self-assessment will be submitted to them, adjusted to the model and deadlines that each one determines.

-

The settlement period coincides with the calendar month.

The deadline for submission is from the 10th to the 20th of the month following the corresponding monthly settlement period.

However, for this first year of application, 2021, the presentation and payment of the self-assessments corresponding to the months of January and February 2021 will be carried out within the period provided for the presentation and payment of the self-assessment corresponding to the month of March 2021 (from April 10 to 20, 2021).

If the submission corresponds to 2024 and later, you must consult the submission deadlines established by the Basque Country and Navarre Tax Authorities for the submission of the annexes and self-assessments that must be submitted to them (see FAQ 6.32 What is the procedure for submission from January 1, 2024?).

Form 604 and its informative annex must be submitted by the taxpayer, except in cases where, in accordance with the provisions of the Tax Regulations, it is mandatory or the taxpayer has opted to submit the form through a central securities depository (DCV) established in Spanish territory in the name and on behalf of the taxpayer.

To address this issue, first of all, it is necessary to distinguish whether the acquisitions of securities are recorded in accounts linked to a registration system managed by a central securities depository (CSD) established in Spanish territory or in a registration system managed by a CSD established outside Spanish territory:

If the acquisitions are recorded in accounts linked to a registration system managed by a DCV established in Spanish territory, form 604 and its informative annex will be submitted through said DCV in the following cases:

-

It is mandatory that when taxpayers, whether acting on their own behalf or on behalf of others, have an account in the central register of the central securities depository established in Spanish territory or have an account in the detailed registers of one of the entities participating in said central securities depository.

-

When taxpayers not included in letter a) above choose to file through the DCV established in Spanish territory. To do so, taxpayers will designate at least one participating entity in said CSD.

If the acquisitions are recorded in accounts linked to a registration system managed by a DCV established outside of Spanish territory, Form 604 and its information annex may be submitted through a DCV established in Spanish territory:

-

Optionally, when there is a collaboration agreement between a DCV established in Spanish territory and the DCV established outside Spanish territory.

-

Optionally and in the absence of the collaboration agreement referred to in letter a) above, when the CSD established outside Spanish territory is included in the third party account of an entity participating in a CSD established in Spanish territory designated by the issuing entity to keep the accounting records of the securities, and there is a prior agreement for presentation between the CSD located outside Spanish territory and the aforementioned participating entity.

This option may be used by taxpayers who have an account in the DCV established outside of Spanish territory or in one of its participating entities.

-

Optionally, when there is an express agreement between the taxpayer and an entity participating in a CSD established in Spanish territory.

This agreement shall include all acquisitions recorded in accounts linked to a registration system managed by a CSD established outside Spanish territory, except those for which the taxpayer has exercised the presentation options provided for in letters a) and b) above, unless the taxpayer decides to include them in this option.

The provisions of this letter c) will also be applicable when the taxable person is an entity participating in a CSD established in Spanish territory, in which case an agreement will not be necessary.

When any of the acquisitions must be declared, either compulsorily or by option, through a DCV established in Spanish territory, the self-assessment submitted by said DCV will include all acquisitions subject to the Tax made in the settlement period.

In the information annex of form 604, the following must be reported for each operation record:

-

If the transaction is declared by the taxpayer: Field 116 of type 2 record in the information annex must be completed with an “X”.

-

If the transaction is declared through the central securities depository and the reason why this is done: In field 117 of the type 2 record of the information annex, the type of presentation assumption through the DCV located in Spanish territory must be completed in accordance with the following keys:

-

Key “A” - Assumption provided for in article 3.a) of the ITF Regulations.

-

Key “B” - Assumption provided for in article 3.b) of the ITF Regulations.

-

Key “C” - Assumption provided for in article 4.1.a) of the ITF Regulations.

-

Key “D” - Assumption provided for in article 4.1.b) of the ITF Regulations.

-

Key “E” - Assumption provided for in article 4.1.c) of the ITF Regulations.

-

Key “F” - Assumption provided for in article 2.2 of the ITF Regulations.

-

Example 1.A taxpayer, who is a participating entity in the Spanish DCV, carries out or intervenes in an acquisition of securities subject to tax, on its own behalf or on behalf of a client, which is reflected in the registration system managed by the aforementioned DCV.

The taxpayer must submit and pay the self-assessment of the tax through the Spanish DCV (article 3.a) of the RDITF).

The information and the amount of the tax will be sent to the Spanish DCV by the taxpayer itself, an entity participating in said DCV.

Example 2.A taxpayer who is not a participating entity in the Spanish DCV, but who has an account in the detailed register of a participating entity in said Spanish DCV of which he is a client, carries out or intervenes in an acquisition of securities subject to tax, on his own behalf or on behalf of a client, which is reflected in the registration system in charge of said DCV.

The taxpayer must submit and pay the self-assessment of the tax through the Spanish DCV (article 3.a) of the RDITF).

The information and the amount of the tax will be sent to the Spanish DCV by the participating entity in which the taxpayer has an account.

This assumption will also apply if the participating entity is another central securities depository established outside Spanish territory.

Example 3 . A taxpayer who is not a participating entity in the Spanish DCV and who does not have an account in the detailed register of a participating entity in said Spanish DCV, carries out or intervenes in an acquisition of securities subject to tax, on his own account or on behalf of a client, which is reflected in the registration system managed by said DCV.

The taxpayer may choose to submit and pay the self-assessment of the tax through the Spanish DCV (article 3.b) of the RDITF).

The information and the amount of the tax will be sent to the Spanish DCV by a participating entity previously designated by the taxpayer. Said participating entity will be one whose accounts in the Spanish DCV participate in the chain of custody of the securities to be acquired.

Example 4. A taxpayer carries out or participates in an acquisition of securities that is subject to tax and is reflected in the registration system managed by a foreign DCV. There is a collaboration agreement between the foreign DCV and the Spanish DCV.

The taxpayer may choose to submit and pay the self-assessment of the tax through the Spanish DCV (article 4.1.a) of the RDITF).

The information and the amount of the tax will be sent to the Spanish DCV by the foreign DCV in accordance with the procedure set out in the corresponding collaboration agreement.

Example 5. A taxpayer carries out or participates in an acquisition of securities that is subject to tax and is reflected in the registration system managed by a foreign DCV. There is no collaboration agreement between the foreign DCV and the Spanish DCV. The foreign DCV appears in the third-party account of an entity participating in the Spanish DCV, responsible for keeping the accounting records corresponding to the issue of the securities.

The taxpayer may choose to submit and pay the self-assessment of the tax through the Spanish DCV when there is an agreement to this effect between the aforementioned participating entity and the foreign DCV and provided that the taxpayer has an account in the aforementioned foreign DCV or in one of its participating entities (article 4.1.b) of the RDITF).

The information and the amount of the tax will be sent to the Spanish DCV by the participating entity in which the foreign DCV has the account.

Example 6. A taxpayer carries out or participates in an acquisition of securities that is subject to tax and is reflected in the registration system managed by a foreign DCV. There is no collaboration agreement between the foreign DCV and the Spanish DCV and the circumstances provided for in the previous example do not exist.

The taxpayer may choose to submit and pay the self-assessment of the tax through the Spanish DCV when he or she expressly agrees to do so with an entity participating in the latter. This agreement will not be necessary if the taxpayer is a participating entity in the Spanish DCV (article 4.1.c) of the RDITF).

The information and the amount of the tax will be sent to the Spanish CSD by the participating entity with which the taxpayer has concluded the agreement or by the taxpayer itself, if it has the status of participating entity in said Spanish CSD.

Please note that the filing and payment of the self-assessment through the Spanish DCV, in all these examples, will oblige the taxpayer to follow this procedure for all purchases of subject securities that correspond to the same settlement period.

The information and the amount of tax corresponding to the remaining acquisitions must be sent to the Spanish DCV through the participating entity designated by the taxpayer, and which in examples 1, 2, 3, 5 and 6 must be the one provided for in such examples. The designation of a participating entity will not be necessary for taxpayers who have such status.

In accordance with article 2.2.a) of the Tax Law, the acquisition of depositary certificates representing shares subject to tax will be taxed under the terms indicated in said article.

The taxpayer may choose to file and pay the self-assessment of the tax through a Spanish DCV if a collaboration agreement between said Spanish DCV and a foreign DCV is applicable, when the recording of the acquisitions of the subject deposit certificates is carried out in accounts linked to the registration system of said foreign DCV (article 4.1.a) of the RDITF). In this case, the information and the amount of the tax will be sent to the Spanish CSD by the foreign CSD in accordance with the procedure set out in the corresponding collaboration agreement.

In the absence of a collaboration agreement, the taxpayer may choose to submit and pay the self-assessment of the tax through a Spanish DCV if this is expressly agreed with an entity participating in said Spanish DCV (article 4.1.c) of the RDITF). The information and the amount of the tax will be sent to the Spanish DCV by the aforementioned participating entity. This agreement will not be necessary if the taxpayer is a participating entity in the Spanish DCV.

To submit Form 604 and its information annex, the following is required:

-

The taxpayer must have a NIF, or failing that, have been assigned an Individual Identification Code (CII).

-

The presenter must have NIF or CII.

-

The presenter must have an electronic certificate.

This is the code that identifies those taxpayers who do not have a Spanish tax identification number.

The individual identification code may only be used for procedures associated with the submission of Form 604 and its information annex.

This code may not be used for any other purpose.

The individual identification code is obtained by means of a request that will be submitted through the Electronic Office of the State Tax Administration Agency, in which the identification data of the taxpayer will be provided that allows their unique identification.

The application for the individual identification code must be submitted prior to submitting Form 604 and its information annex.

This procedure can be accessed at the following link:

https://sede.agenciatributaria.gob.es/Sede/en_gb/procedimientoini/GC44.shtml

Note: Applications for allocation of the CII submitted by entities that are not taxpayers of the Financial Transaction Tax will not be accepted.

In any case, the application for the assignment of the individual identification code may be submitted by the taxpayer.

However, in cases where Form 604 is submitted through the Central Securities Depository established in Spanish territory, the application may also be submitted through said DCV.

The presentation of form 604 and its informative annex is carried out in accordance with the following procedure:

-

Any taxpayer who does not have NIF must obtain the individual identification code beforehand.

-

The taxpayer shall communicate to DCV , directly or through its participating entities, the information contained in article 5.2 of the Financial Transaction Tax Regulations. The communication will be made before the 10th of the month following the corresponding monthly settlement period. The information will comply with the technical requirements determined by the DCV.

-

The taxpayer who does not have the status of a participating entity in the DCV established in Spanish territory, must pay the participating entity in whose detailed register he has an account or that he has designated, the amount derived from the self-assessment. Payment will be made before the 10th of the month following the corresponding monthly settlement period.

-

The DCV established in Spanish territory, between the 10th and 20th of the month following the corresponding monthly settlement period, shall submit on behalf of and for the account of each taxpayer Form 604 and its informative annex, submitting the annex first and stating on Form 604 the supporting document number obtained when submitting the annex.

-

The DCV established in Spanish territory, between the 10th and 20th of the month following the corresponding monthly settlement period, will pay the amount derived from the self-assessments.

-

For 2024 and later, if in a period there are operations that correspond to any of the Foral Treasuries of the Basque Country or Navarre, you must submit to them the informative annex (when the corresponding Foral Treasuries so require) and the self-assessment adjusted to the model and deadlines that they determine. (See FAQ 6.2 How do I file the self-assessment of the Financial Transaction Tax? )

The presentation of form 604 and its informative annex is carried out in accordance with the following procedure:

-

Any taxpayer who does not have NIF must obtain the individual identification code beforehand.

-

Any taxpayer who does not have an electronic certificate must obtain one beforehand.

-

The taxpayer must pay the debt arising from form 604 in accordance with the procedure described in article 7.a) of Order HAP/2194/2013, of November 22. If you do not have an open account with any entity collaborating in the collection management, payment can be made by transfer.

-

The taxpayer shall submit the information annex of Form 604 between the 10th and 20th of the month following the corresponding settlement period.

-

Once the annex has been submitted and between the 10th and 20th of the month following the corresponding settlement period, the taxpayer will submit form 604, stating the receipt number obtained when submitting the annex and, where applicable, the complete reference number obtained when making the payment.

-

For 2024 and later, if in a period there are operations that correspond to any of the Foral Treasuries of the Basque Country or Navarre, you must submit to them the informative annex (when the corresponding Foral Treasuries so require) and the self-assessment adjusted to the model and deadlines that they determine. (See FAQ 6.2 How do I file the self-assessment of the Financial Transaction Tax? )

Yes, the self-assessment can have a result of zero.

For example, the result could be zero if all included transactions are exempt.

No, Form 604 cannot have a negative result.

The general procedures for correcting errors in submitted self-assessments apply to Form 604 and its information annex: supplementary self-assessment (1) and request for rectification of self-assessments.

Furthermore, in the Tax on Financial Transactions, when in relation to a transaction that has given rise to the payment of a tax quota for the tax, the taxpayer notes an error or other circumstances for which it must be rectified, and this results in the inadmissibility or an excess of the tax quota paid for said transaction, the taxpayer may rectify the transaction in a self-assessment of the tax that is submitted within the period of four years following the date of payment of the aforementioned tax quota, reducing said quota or excess from the amount of the quota to be paid corresponding to the self-assessment in which the rectification is made, without in any case the result of the latter being able to be negative.

This special rectification procedure will be incompatible with the ordinary procedure for rectification of self-assessments provided for in article 120.3 of the LGT and in articles 126 to 128 of the RGAT.

(1) In the case of the Financial Transaction Tax, the procedure for filing the supplementary self-assessment will be as follows:

-

First, a supplementary information annex shall be submitted, recording “C” in position 121 of the type 1 record and the supporting document number of the annex it complements in positions 123-135 of the type 1 record.

-

Once the complementary information annex has been submitted, form 604 must be submitted, indicating that it is a complementary self-assessment and stating the supporting document number of form 604 that it complements.

The supplementary self-assessment and the regularization through the procedure provided for in the second paragraph of this question will be submitted by the DCV or by the taxpayer, depending on which one or the other is required to submit form 604.

The rectification in accordance with the ordinary procedure for rectification of self-assessments provided for in article 120.3 of the LGT and in articles 126 to 128 of the RGAT, shall be submitted by the taxpayer.

On an individual basis for each operation. However, intraday transactions that give rise to the calculation of a tax base under the terms set out in article 5.3 of the Tax Law will be declared as a single record (in this case they are grouped together).

It is the reference assigned by the taxpayer to each operation that allows its unique identification.

No, for each transaction the type key for the reason for filing will be recorded through the corresponding DCV established in Spanish territory.

In the event of choosing to submit and deposit through the central securities depository established in Spanish territory, the option will take effect at least in the monthly settlement period following the month in which the option was communicated and in subsequent monthly periods as long as its revocation is not communicated.

These keys are those provided in field 117 of record type 2 of the information annex. Depending on the type of presentation assumption through the DCV located in Spanish territory, the following keys exist:

-

Key “A” - Assumption provided for in article 3.a) of the ITF Regulations.

-

Key “B” - Assumption provided for in article 3.b) of the ITF Regulations.

-

Key “C” - Assumption provided for in article 4.1.a) of the ITF Regulations.

-

Key “D” - Assumption provided for in article 4.1.b) of the ITF Regulations.

-

Key “E” - Assumption provided for in article 4.1.c) of the ITF Regulations.

-

Key “F” - Assumption provided for in article 2.2 of the ITF Regulations.

Yes, it is mandatory to indicate for each transaction whether it is on one's own account or on behalf of another.

This information must be provided through the information annex of form 604 for each operation. Specifically, this information will be provided by completing field 114 of type 2 record of the aforementioned annex, with one of the following two keys depending on whether it is submitted on one's own account or on behalf of another:

-

Key “P”: If the transaction is executed by the taxpayer on his own behalf.

-

Key “A”: If the transaction is executed by the taxpayer on behalf of third parties.

No. For the same settlement period, the presentation of form 604 and its informative annex must be carried out by the central securities depository or by the taxpayer in accordance with the criteria included in the frequently asked question When is form 604 and its informative annex presented through the Central Securities Depository (DCV) established in Spanish territory? .

If you choose to submit and pay self-assessments through the DCV, the option will take effect at least in the monthly settlement period following the month in which said option was communicated and in subsequent monthly periods as long as its revocation is not communicated.

For the same operation, different causes of exemption may occur, which may be recorded according to the following keys and positions of record type 2 of the informative annex:

Position 260: Key “A” (exemption article 3.1.a) of Law 5/2020, of October 15, on the Tax on Financial Transactions)

Position 261: Key “B” (exemption from article 3.1.b) of Law 5/2020, of October 15, on the Tax on Financial Transactions)

Position 262: Key “C” (exemption article 3.1.c) of Law 5/2020, of October 15, on the Tax on Financial Transactions)

Position 263: Key “D” (exemption 3.1.d) of Law 5/2020, of October 15, on the Tax on Financial Transactions)

Position 264: Key “E” (exemption article 3.1.e) of Law 5/2020, of October 15, on the Tax on Financial Transactions)

Position 265: Key “F” (exemption article 3.1.f) of Law 5/2020, of October 15, on the Tax on Financial Transactions)

Position 266: Key “G” (exemption article 3.1.g) of Law 5/2020, of October 15, on the Tax on Financial Transactions)

Position 267: Key “H” (exemption article 3.1.h) of Law 5/2020, of October 15, on the Tax on Financial Transactions)

Position 268: Key “I” (exemption article 3.1.i) of Law 5/2020, of October 15, on the Tax on Financial Transactions)

Position 269: Key “J” (exemption article 3.1.j) of Law 5/2020 of October 15, on the Tax on Financial Transactions)

Position 270: Key “K” (exemption article 3.1.k) of Law 5/2020 of October 15, on the Tax on Financial Transactions)

Position 271: Key “L” (exemption article 3.1.l) of Law 5/2020, of October 15, on the Tax on Financial Transactions)

Position 272: key “M” (Other exemption assumptions. When using this key, it will be mandatory to indicate the exemption applied in the “Description” field (positions 387-430 record type 2). This key will be used in particular for:

-

The exemption provided for in Transitional Provision 41 of Law 27/2014. (Only for periods 01-2022 to 07-2023). In the description field, DT41 will be indicated.

-

The exemption provided for in article 3.1.m) of Law 5/2020, of October 15, on the Tax on Financial Transactions. (For periods 07-2022 and following). In the description field, 3.1.M will be indicated.

The date of registration shall be recorded, which shall coincide, in the case of operations that are subject to liquidation, with the date of effective liquidation. However, when the taxpayer has opted for the theoretical settlement date for the purposes of settling the tax in accordance with the terms set out in article 9 of the RDITF, the theoretical settlement date shall be recorded.

For the same operation, only one key may be used to indicate the method of determining the tax base, using one of the following keys provided in position 191 of record type 2 of the information annex:

Key “A”: This key will be entered when the tax base consists of the amount of the consideration without including transaction costs derived from market infrastructure prices, brokerage commissions, or any other expense associated with the operation. (Article 5.1 of the Financial Transactions Tax Law).

Key “B”: This key will be entered when the tax base consists of the value corresponding to the closing of the most relevant regulated market by liquidity of the security in question on the last trading day prior to the transaction. (Article 5.1 of the Financial Transactions Tax Law).

Key “C”: When the acquisition of securities comes from convertible or exchangeable bonds or obligations or other negotiable securities that give rise to the acquisition, the tax base will be the value established in the issuing document of these. (Article 5.2.a) of the Financial Transactions Tax Law).

Key “D”: When the acquisition proceeds from the execution or settlement of options or other derivative financial instruments that grant a right to acquire or transfer the securities subject to the tax, the taxable base will be the exercise price set in the contract. (Article 5.2.b) of the Financial Transactions Tax Law).

Key “E”: When the acquisition is made through a derivative instrument that constitutes a forward transaction, the tax base will be the agreed price, unless said derivative is traded on a regulated market, in which case the tax base will be the delivery price at which said acquisition must be made upon maturity. (Article 5.2.c) of the Financial Transactions Tax Law).

Key “F”: When the acquisition proceeds from the liquidation of a financial contract defined in the fourth paragraph of article 2.1. of Order EHA/3537/2005, of November 10, which develops article 27.4 of Law 24/1988, of July 28, of the Securities Market; The taxable base will be the value corresponding to the closing of the most relevant regulated market by liquidity of the security in question on the last trading day prior to the transaction. (Article 5.2.d) of the Financial Transactions Tax Law).

Key “G”: In the case of intraday transactions provided for in article 5.3 of the Financial Transaction Tax Law, the taxable base established in this same article for these cases.

Example: In January 2021, entity “A”, with NIF XXXXX, which does not have the status of a participating entity in the central securities depository, is the taxpayer of the following operation:

| Example | |

|---|---|

| Acquisition | on behalf of others |

| Record | Acquisition recorded in A's account at an entity participating in the DCV |

| Titles acquired | 10,000 |

| ISIN code | AAAAA |

| Issuing NIF | BBBBB |

| Settlement date | 20 January 2021 |

| Transaction | subject not exempt |

| P. unitary acquisition | 1 |

| BI | 10,000x1=10,000 |

| Tax payable | 10,000x 1x 0.2/100= 20 |

| Date of communication to the DVC | 01/02/2021 |

| Payment date | 01/02/2021 |

January 2021 Type 1 registration of the informative annex (assuming this is the only operation for this taxpayer in this period)

| January 2021 Type 1 registration of the informative annex | |

|---|---|

|

Record type |

1 |

|

Form |

ATF |

|

Financial year |

2021 |

|

Tax ID/CII |

XXXXX |

|

Business name |

A |

|

Identification number attached |

ATFEEEEE |

|

Supplementary or substitute annex |

in white |

|

Identification number attached above |

in white |

|

Period |

1 |

|

Total number of declared op. |

1 |

|

Total number of non-exempt subject op. |

1 |

|

BI total op non-exempt subjects |

10,000 (type 2 records in which the exempt/non-exempt operation is S and is also not a rectification) |

|

Total op. fee subject not exempt |

20 (type 2 records in which the exempt/non-exempt operation is S and is also not a rectification) |

|

Total number of exempt op. |

in white |

|

Total amount of exempt op. |

in white |

|

Total number of corrections |

in white |

|

Total BI/amount of corrections |

in white |

|

Share resulting from rectifications |

in white |

|

Theoretical settlement date option |

in white |

|

Revocation of theoretical settlement date |

in white |

January-2021: Type 2 record of the information annex.

| January-2021: Type 2 record of the informative annex | |

|---|---|

|

Record type |

2 |

|

Form |

ATF |

|

Financial year |

2021 |

|

NIF |

XXXXX |

|

Period |

1 |

|

Reference |

CCCCCCCCCC |

|

Operation on own/other's account |

A |

|

Type of presentation through DVC |

A |

|

Assumption of presentation of the taxpayer |

in white |

|

Number of titles acquired |

10,000 |

|

ISIN code you. Acquired |

AAAAA |

|

Issuing NIF |

BBBBB |

|

Issuing LEI |

in white |

|

Settlement/registration date |

20/01/2021 |

|

Execution date |

in white |

|

Type of non-exempt/exempt transaction |

S |

|

Determination of the tax base |

A |

|

Number of titles acquired |

in white |

|

Net securities acquired |

in white |

|

Total amount of the transactions |

in white |

|

Non-exempt tax base |

10,000 |

|

Assumption of exemption |

in white |

|

Exempt acquisition amount |

in white |

|

Tax rate |

20 |

|

DCV communication date |

01/02/2021 |

|

Payment date |

01/02/2021 |

|

Adjustment |

in white |

|

Rectification exercise |

in white |

|

Rectification period |

in white |

|

BI Rectified/Rectified amount |

in white |

|

Tax liability adjusted |

in white |

|

Amount of rectification (Fee) |

in white |

|

Rectification result (BI/Amount) |

in white |

|

Description |

ZZZZZZZ |

January 2021 model 604

| January 2021 model 604 | |

|---|---|

|

BI (box 01) |

10,000 |

|

Quota (box 02) |

20 |

|

BI Rectification (box 03) |

in white |

|

Rectification of Quota (box 04) |

in white |

|

Exempt Op. (box 05) |

in white |

|

To be deducted from complementary self-assessment (box 06) |

in white |

|

Self-assessment result (box 07) |

20 |

Example: In January 2021, entity “A”, with NIF XXXXX, which does not have the status of a participating entity in the DCV, is the taxpayer of the following operation:

| Example | |

|---|---|

|

Acquisition |

on behalf of others |

|

Record |

Acquisition recorded in A's account at an entity participating in the DCV |

|

Titles acquired |

10,000 |

|

ISIN code |

AAAAA |

|

Issuing NIF |

BBBBB |

|

Settlement date |

20/01/2021 |

|

Transaction |

subject to and exempt by article 3.1.b) of Law 5/2020 |

|

P. unitary acquisition |

1 |

|

Date of communication to the DVC |

01/02/2021 |

January 2021 Type 1 registration of the informative annex. (assuming this is a single transaction for this taxpayer in this period)

| January 2021 Type 1 registration of the informative annex | |

|---|---|

|

Record type |

1 |

|

Form |

ATF |

|

Financial year |

2021 |

|

Tax ID/CII |

XXXXX |

|

Business name |

A |

|

Identification number attached |

ATFEEEEE |

|

Supplementary or substitute annex |

in white |

|

Identification number attached above |

in white |

|

Period |

1 |

|

Total number of declared op. |

1 |

|

Total number of non-exempt subject op. |

0 |

|

BI total op non-exempt subjects |

in white |

|

Total op. fee subject not exempt |

in white |

|

Total number of exempt op. |

1 |

|

Total amount of exempt op. |

10,000 |

|

Total number of corrections |

in white |

|

Total BI/amount of corrections |

in white |

|

Share resulting from rectifications |

in white |

|

Theoretical settlement date option |

in white |

|

Revocation of theoretical settlement date |

in white |

January-2021: Type 2 record of the information annex.

| January-2021: Type 2 record of the informative annex | |

|---|---|

|

Record type |

2 |

|

Form |

ATF |

|

Financial year |

2021 |

|

NIF |

XXXXX |

|

Period |

1 |

|

Reference |

CCCCCCCCCC |

|

Operation on own/other's account |

A |

|

Type of presentation through DVC |

A |

|

Assumption of presentation of the taxpayer |

in white |

|

Number of titles acquired |

10,000 |

|

ISIN code you. Acquired |

AAAAA |

|

Issuing NIF |

BBBBB |

|

Issuing LEI |

in white |

|

Settlement/registration date |

20/01/2021 |

|

Execution date |

in white |

|

Type of non-exempt/exempt transaction |

E |

|

Determination of the tax base |

in white |

|

Number of titles acquired |

in white |

|

Net securities acquired |

in white |

|

Total amount of the transactions |

in white |

|

Non-exempt tax base |

in white |

|

Assumption of exemption |

B |

|

Exempt acquisition amount |

10,000 |

|

Tax rate |

in white |

|

DCV communication date |

01/02/2021 |

|

Payment date |

01/02/2021 |

|

Adjustment |

in white |

|

Rectification exercise |

in white |

|

Rectification period |

in white |

|

BI Rectified/Rectified amount |

in white |

|

Tax liability adjusted |

in white |

|

Amount of rectification (Fee) |

in white |

|

Rectification result (BI/Amount) |

in white |

|

Description |

ZZZZZZZ |

January 2021 model 604:

| January 2021 model 604 | |

|---|---|

|

BI (box 01) |

in white |

|

Quota (box 02) |

in white |

|

BI Rectification (box 03) |

in white |

|

Rectification of Quota (box 04) |

in white |

|

Exempt Op. (box 05) |

in white |

|

To be deducted from complementary self-assessment (box 06) |

in white |

|

Self-assessment result (box 07) |

0 (blank) |

Example: In January 2021, entity “A”, with NIF XXXXX, which does not have the status of a participating entity in the DCV, is the taxpayer of the following operation:

| Example | |

|---|---|

|

Acquisition |

on behalf of others |

|

Record |

Acquisition recorded in A's account at an entity participating in the DCV |

|

Titles acquired |

10,000 |

|

ISIN code |

AAAAA |

|

Issuing NIF |

BBBBB |

|

Settlement date |

20 January 2021 |

|

Transaction |

subject not exempt |

|

P. unitary acquisition |

1 |

|

BI |

10,000x1=10,000 |

|

Tax payable |

10,000x 1x 0.2/100= 20 |

|

Date of communication to the DVC |

1 February 2021 |

|

Payment date |

1 February 2021 |

In February 2021, the taxpayer became aware that the previous transaction was exempt under Article 3.1.c) of Law 5/2020.

The communication to the DCV takes place on March 1, 2021. In February, it also carried out two taxable and non-exempt transactions with a total taxable base of 20,000 and a total quota of 40.

January 2021 Type 1 registration of the informative annex:

<

| January 2021 Type 1 registration of the informative annex | |

|---|---|

|

Record type |

1 |

|

Form |

ATF |

|

Financial year |

2021 |

|

Tax ID/CII |

XXXXX |

|

Business name |

A |

|

Identification number attached |

ATFEEEEE |

|

Supplementary or substitute annex |

in white |

|

Identification number attached above |

in white |

|

Period |

1 |

|

Total number of declared op. |

1 |

|

Total number of non-exempt subject op. |

1 |

|

BI total op non-exempt subjects |

10,000 (type 2 records in which the exempt/non-exempt operation is S and is also not a rectification) |

|

Total op. fee subject not exempt |

20 (type 2 records in which the exempt/non-exempt operation is S and is also not a rectification) |

|

Total number of exempt op. |

in white |

|

Total amount of exempt op. |

in white |

|

Total number of corrections |

in white |

|

Total BI/amount of corrections |

in white |

|

Share resulting from rectifications |

in white |

|

Theoretical settlement date option |

in white |

|

Revocation of theoretical settlement date |

in white |

January-2021: Type 2 record of the informative annex

| January-2021: Type 2 record of the informative annex | |

|---|---|

|

Record type |

2 |

|

Form |

ATF |

|

Financial year |

2021 |

|

NIF |

XXXXX |

|

Period |

1 |

|

Reference |

CCCCCCCCCC |

|

Operation on own/other's account |

A |

|

Type of presentation through DVC |

A |

|

Assumption of presentation of the taxpayer |

in white. |

|

Number of titles acquired |

10,000 |

|

ISIN code you. Acquired |

AAAAA |

|

Issuing NIF |

BBBBB |

|

Issuing LEI |

in white |

|

Settlement/registration date |

20 January 2021 |

|

Execution date |

in white |

|

Type of non-exempt/exempt transaction |

S |

|

Determination of the tax base |

A |

|

Number of titles acquired |

in white |

|

Net securities acquired |

in white |

|

Total amount of the transactions |

in white |

|

Non-exempt tax base |

10,000 |

|

Assumption of exemption |

in white |

|

Exempt acquisition amount |

in white |

|

Tax rate |

20 |

|

DCV communication date |

01/02/2021 |

|

Payment date |

01/02/2021 |

|

Adjustment |

in white |

|

Rectification exercise |

in white |

|

Rectification period |

in white |

|

BI Rectified/Rectified amount |

in white |

|

Tax liability adjusted |

in white |

|

Amount of rectification (Fee) |

in white |

|

Rectification result (BI/Amount) |

in white |

|

Description |

ZZZZZZZ |

January 2021 model 604:

| January 2021 model 604 | |

|---|---|

|

BI (box 01) |

10,000 |

|

Quota (box 02) |

20 |

|

BI Rectification (box 03) |

in white |

|

Rectification of Quota (box 04) |

in white |

|

Exempt Op. (box 05) |

in white |

|

To be deducted from complementary self-assessment (box 06) |

in white |

|

Self-assessment result (box 07) |

20 |

February 2021 Type 1 registration of the informative annex:

| February 2021 Type 1 registration of the informative annex | |

|---|---|

|

Record type |

1 |

|

Form |

ATF |

|

Financial year |

2021 |

|

Tax ID/CII |

XXXXX |

|

Business name |

A |

|

Identification number attached |

ATFEEEEE |

|

Supplementary or substitute annex |

in white |

|

Identification number attached above |

in white |

|

Period |

2 |

|

Total number of declared op. |

3 |

|

Total number of non-exempt subject op. |

2 |

|

BI total op non-exempt subjects |

20,000 |

|

Total op. fee subject not exempt |

40 |

|

Total number of exempt op. |

in white |

|

Total amount of exempt op. |

in white |

|

Total number of corrections |

1 |

|

Total BI/amount of corrections |

0 |

|

Share resulting from rectifications |

-20 |

|

Theoretical settlement date option |

in white |

|

Revocation of theoretical settlement date |

in white |

|

Theoretical settlement date option |

in white |

|

Revocation of theoretical settlement date |

in white |

February-2021: Type 2 record of the informative annex (details of the rectification):

| February-2021: Type 2 record of the informative annex | |

|---|---|

|

Record type |

2 |

|

Form |

ATF |

|

Financial year |

2021 |

|

NIF |

XXXXX |

|

Period |

2 |

|

Reference |

CCCCCCCCCC |

|

Operation on own/other's account |

A |

|

Type of presentation through DVC |

A |

|

Assumption of presentation of the taxpayer |

in white |

|

Number of titles acquired |

10,000 |

|

ISIN code you. Acquired |

AAAAA |

|

Issuing NIF |

BBBBB |

|

Issuing LEI |

in white |

|

Settlement/registration date |

20 January 2021 |

|

Execution date |

in white |

|

Type of non-exempt/exempt transaction |

E |

|

Determination of the tax base |

in white |

|

Number of titles acquired |

in white |

|

Net securities acquired |

in white |

|

Total amount of the transactions |

in white |

|

Non-exempt tax base |

10,000 |

|

Assumption of exemption |

C |

|

Exempt acquisition amount |

in white |

|

Tax rate |

20 |

|

DCV communication date |

01/02/2021 |

|

Payment date |

01/02/2021 |

|

Adjustment |

X |

|

Rectification exercise |

2021 |

|

Rectification period |

1 |

|

BI Rectified/Rectified amount |

10,000 |

|

Tax liability adjusted |

0 |

|

Amount of rectification (Fee) |

-20 |

|

Rectification result (BI/Amount) |

0 |

|

Description |

ZZZZZZZ |

January 2021 model 604:

| January 2021 model 604 | |

|---|---|

|

BI (box 01) |

20,000 |

|

Quota (box 02) |

40 |

|

BI Rectification (box 03) |

0 |

|

Rectification of Quota (box 04) |

-20 |

|

Exempt Op. (box 05) |

in white. |

|

To be deducted from complementary self-assessment (box 06) |

in white. |

|

Self-assessment result (box 07) |

20 |

The difference between the number of titles acquired and the number of titles transferred will be recorded.

However, if the number of titles transferred is greater than or equal to the number of titles acquired, zero will be entered in the “Net titles acquired” field.

Example: In May 2021, entity “A”, with NIF XXXXX, which does not have the status of a participating entity in the DCV, declares the following operation as non-exempt subject:

|

Example | |

|---|---|

|

Acquisition |

on behalf of others |

|

Record |

Acquisition recorded in A's account at an entity participating in the DCV |

|

Titles acquired |

10,000 |

|

ISIN code |

AAAAA |

|

NIF issuer |

BBBBB |

|

Settlement date |

May 20, 2021 |

|

Transaction |

subject not exempt |

|

P. unitary acquisition |

1 |

|

BI |

10,000x1=10,000 |

|

Tax payable |

10,000x 1x 0.2/100= 20 |

|

Date of communication to DCV |

June 1, 2021 |

|

Payment date |

June 1, 2021 |

On June 15, 2021, the taxpayer becomes aware that the previous transaction was not taxable.

In June, it also carried out two taxable and non-exempt transactions with a total taxable base of 20,000 and a total quota of 40.

May 2021 Type 1 registration of the informative annex:

|

May 2021 Type 1 registration of the informative annex | |

|---|---|

|

Record type |

1 |

|

Form |

ATF |

|

Financial year |

2021 |

|

NIF /CII |

XXXXX |

|

Business name |

A |

|

Identification number attached |

ATFEEEEE |

|

Supplementary or substitute annex |

in white |

|

Identification number attached above |

in white |

|

Period |

5 |

|

Total number of declared op. |

1 |

|

Total number of non-exempt subject op. |

1 |

|

BI total op non-exempt subjects |

10,000 (type 2 records in which the exempt/non-exempt operation is S and is also not a rectification) |

|

Total op. fee subject not exempt |

20 (type 2 records in which the exempt/non-exempt operation is S and is also not a rectification) |

|

Total number of exempt op. |

in white |

|

Total amount of exempt op. |

in white |

|

Total number of corrections |

in white |

|

Total BI/amount of corrections |

in white |

|

Share resulting from rectifications |

in white |

|

Theoretical settlement date option |

in white |

|

Revocation of theoretical settlement date |

in white |

May-2021: Type 2 record of the informative annex

|

January-2021: Type 2 record of the informative annex | |

|---|---|

|

Record type |

2 |

|

Form |

ATF |

|

Financial year |

2021 |

|

NIF |

XXXXX |

|

Period |

5 |

|

Reference |

CCCCCCCCCC |

|

Operation on own/other's account |

A |

|

Type of presentation through DCV |

A |

|

Assumption of presentation of the taxpayer |

in white |

|

Number of titles acquired |

10,000 |

|

ISIN code you. Acquired |

AAAAA |

|

NIF issuer |

BBBBB |

|

Issuing LEI |

in white |

|

Settlement/registration date |

May 20, 2021 |

|

Execution date |

in white |

|

Type of non-exempt/exempt transaction |

S |

|

Determination of the tax base |

A |

|

Number of titles acquired |

in white |

|

Net securities acquired |

in white |

|

Total amount of the transactions |

in white |

|

Non-exempt tax base |

10,000 |

|

Assumption of exemption |

in white |

|

Exempt acquisition amount |

in white |

|

Tax rate |

20 |

|

DCV communication date |

01/06/2021 |

|

Payment date |

01/06/2021 |

|

Adjustment |

in white |

|

Rectification exercise |

in white |

|

Rectification period |

in white |

|

BI Rectified/Rectified amount |

in white |

|

Tax liability adjusted |

in white |

|

Amount of rectification (Fee) |

in white |

|

Rectification result (BI/Amount) |

in white |

|

Description |

ZZZZZZZ |

May 2021 model 604:

|

January 2021 model 604 | |

|---|---|

|

BI (box 01) |

10,000 |

|

Quota (box 02) |

20 |

|

BI Rectification (box 03) |

in white |

|

Rectification of Quota (box 04) |

in white |

|

Exempt Op. (box 05) |

in white |

|

To be deducted from complementary self-assessment (box 06) |

in white |

|

Self-assessment result (box 07) |

20 |

June 2021 Type 1 registration of the informative annex:

|

February 2021 Type 1 registration of the informative annex | |

|---|---|

|

Record type |

1 |

|

Form |

ATF |

|

Financial year |

2021 |

|

NIF /CII |

XXXXX |

|

Business name |

A |

|

Identification number attached |

ATFEEEEE |

|

Supplementary or substitute annex |

in white |

|

Identification number attached above |

in white |

|

Period |

6 |

|

Total number of declared op. |

3 |

|

Total number of non-exempt subject op. |

2 |

|

BI total op non-exempt subjects |

20,000 |

|

Total op. fee subject not exempt |

40 |

|

Total number of exempt op. |

in white |

|

Total amount of exempt op. |

in white |

|

Total number of corrections |

1 |

|

Total BI/amount of corrections |

- 10,000 |

|

Share resulting from rectifications |

-20 |

|

Theoretical settlement date option |

in white |

|

Revocation of theoretical settlement date |

in white |

|

Theoretical settlement date option |

in white |

|

Revocation of theoretical settlement date |

in white |

June-2021: Type 2 record of the informative annex (details of the rectification):

|

February-2021: Type 2 record of the informative annex (details of the rectification) | |

|---|---|

|

Record type |

2 |

|

Form |

ATF |

|

Financial year |

2021 |

|

NIF |

XXXXX |

|

Period |

6 |

|

Reference |

CCCCCCCCCC |

|

Operation on own/other's account |

A |

|

Type of presentation through DCV |

A |

|

Assumption of presentation of the taxpayer |

in white |

|

Number of titles acquired |

10,000 |

|

ISIN code you. Acquired |

AAAAA |

|

NIF issuer |

BBBBB |

|

Issuing LEI |

in white |

|

Settlement/registration date |

May 20, 2021 |

|

Execution date |

in white |

|

Type of non-exempt/exempt transaction |

E |

|

Determination of the tax base |

in white |

|

Number of titles acquired |

in white |

|

Net securities acquired |

in white |

|

Total amount of the transactions |

in white |

|

Non-exempt tax base |

10,000 |

|

Assumption of exemption |

in white |

|

Exempt acquisition amount |

in white |

|

Tax rate |

20 |

|

DCV communication date |

15/06/2021 |

|

Payment date |

in white |

|

Adjustment |

X |

|

Rectification exercise |

2021 |

|

Rectification period |

5 |

|

BI Rectified/Rectified amount |

0 |

|

Tax liability adjusted |

0 |

|

Amount of rectification (Fee) |

-20 |

|

Rectification result (BI/Amount) |

- 10,000 |

|

Description |

NS |

June 2021 model 604:

|

January 2021 model 604 | |

|---|---|

|

BI (box 01) |

20,000 |

|

Quota (box 02) |

40 |

|

BI Rectification (box 03) |

- 10,000 |

|

Rectification of Quota (box 04) |

-20 |

|

Exempt Op. (box 05) |

in white |

|

To be deducted from complementary self-assessment (box 06) |

in white |

|

Self-assessment result (box 07) |

20 |

For the sole purpose of completing declaration , as long as the ATF registration designs are not modified, when the number of securities acquired, or the number of securities transferred or net securities acquired in the case of intraday operations, is not an integer, said number will be rounded to the nearest non-zero integer.

The above will not affect the amount of the fee to be paid or the amount of the exempt transaction, which must be declared for the actual amounts without taking into account rounding.

On the one hand, Law 1/2022, of February 8, which modifies Law 12/2002, of May 23, which approves the Economic Agreement with the Autonomous Community of the Basque Country, has incorporated the agreement of the ITF , approved by Law 5/2020, of October 15, on the Tax on Financial Transactions.

Furthermore, Law 22/2022, of October 19, which modifies Law 28/1990, of December 26, which approves the Economic Agreement between the State and the Foral Community of Navarra, incorporates the Tax on Financial Transactions into the Agreement.

As a result of the above, Order HFP/308/2023, of March 28, has approved a new self-assessment model for the Tax on Financial Transactions that will be applied for periods 01-2024 and following, which implies modifications in the presentation procedure. The submission procedure for periods 01-2024 and following is detailed below.

First of all, it should be noted that the list of companies whose stock market capitalization on December 1 of the previous year exceeds 1,000 million euros, which is published annually on the Electronic Office of the AEAT , adds a column indicating the administration competent for the tax (based on the registered office of the entity whose shares are subject to the Tax).

Although there are no changes in the content of the information annex, for periods 01-2024 and following, its presentation will be carried out as follows:

-

The information annex must be submitted necessarily to the AEAT . It will include all subject operations regardless of the administration to which the levy corresponds.

-

If the information annex includes acquisitions of shares in companies with registered offices in the Basque Country or Navarre (see list of entities published on the Electronic Office), it must also be submitted to the corresponding Provincial Treasury when required by the latter (for these purposes you must contact each Provincial Treasury).

As regards the self-assessment for periods 01-2024 and following, it will be carried out as follows:

-

From the informative annex, the operations that correspond to the AEAT and to each of the Provincial Treasuries will be determined.

-

Once the previous step has been completed, the new form 604 will be completed and submitted, in which the operations corresponding to the AEAT will be self-assessed and the information on the operations corresponding to each of the Provincial Treasuries will be included.

-

If there are operations that correspond to any of the Provincial Treasuries, a self-assessment adjusted to the model and deadlines that each of them determines will be submitted to them.

The deadline for submission to the AEAT is not modified: from the 10th to the 20th of the month following the corresponding monthly settlement period.

In the case of self-assessments that include operations whose levy corresponds to one of the Provincial Treasuries of the Basque Country or Navarre, you must consult the deadlines established by each of the Provincial Treasuries for the presentation of the annexes and self-assessments that you must submit to them (see FAQ 6.32 What is the procedure for submission from January 1, 2024?).

The rectification procedures described in FAQ 6.17 remain in effect with the specific details detailed below.

Supplementary self-assessments.

-

If the completed self-assessment corresponds to periods prior to 01-2024, the supplementary self-assessment is submitted exclusively to the AEAT using the model approved by Order HAC/510/2021, of May 26.

-

If the completed self-assessment corresponds to 01-2024 and following, the supplementary self-assessment is submitted to the AEAT and, where applicable, to the corresponding Provincial Treasury following the procedure described in FAQ 6.32.

Request for rectification of self-assessments.

-

If the application refers to a self-assessment corresponding to periods prior to 01-2024, will be submitted exclusively to the AEAT .

-

If the application refers to a self-assessment corresponding to 01-2024 and following, it will be submitted to the AEAT and, where appropriate, to the corresponding Provincial Treasury.

Rectification in accordance with the special procedure provided for in article 10 of RD 366/2021, of May 25.

-

They will be declared in the information annex without any particularity.

-

If the rectified operation corresponds to 01-2024 and following, it will be charged to the administration to which the levy corresponds.

-

If the rectified operation corresponds to 2023 and previous years, it will be charged to the AEAT .

Example. In February 2024, entity “A” is subject to ITF for the following operations:

|

Shares of company “B” |

|

|---|---|

|

Titles acquired |

10,000 |

|

ISIN code |

BBB |

|

NIF issuer |

BBBBB |

|

Transaction |

Subject not exempt |

|

Unit purchase price |

1 |

|

Taxable base |

10,000×1=10,000 |

|

Tax payable |

10,000×1×0.2÷100=20 |

|

Competent authority for the collection Payment date |

AEAT (Tax Agency) |

|

Shares of company “C” |

|

|---|---|

|

Titles acquired |

5,000 |

|

ISIN code |

CCC |

|

NIF issuer |

CCCCC |

|

Transaction |

Subject not exempt |

|

Unit purchase price |

1 |

|

Taxable base |

5,000×1=10,000 |

|

Tax payable |

5,000×1×0.2÷100=10 |

|

Competent authority for the collection Payment date |

BIZKAIA |

|

Shares of company “C” |

|

|---|---|

|

Titles acquired |

2,000 |

|

ISIN code |

DDD |

|

NIF issuer |

DDDDDD |

|

Transaction |

Exempt |

|

Unit purchase price |

1 |

|

Taxable base |

10000×1=10,000 |

|

Competent authority for the collection Payment date |

NAVARRE |

Entity “A” will proceed with the presentation as follows:

Financial Transactions Annex (ATF):

-

It will be completed without any specialty.

-

First of all, will necessarily be presented to the AEAT .

-

Bizkaia and Navarre: You should check whether they require the submission of the annex. If required, you will submit the annex to them, which will be identical to the one submitted to the AEAT .

-

Araba and Guipuzcoa: will not present anything.

Self-assessment

-

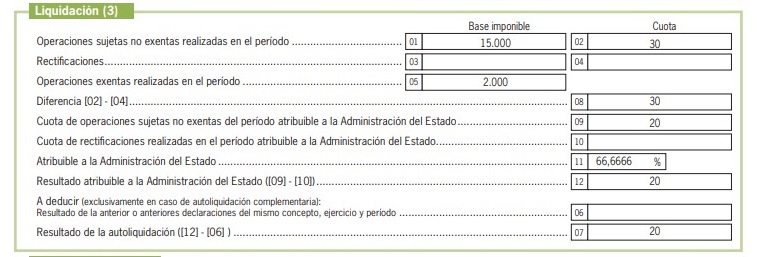

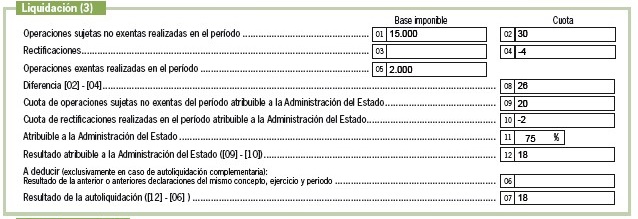

You will submit form 604 to the AEAT , with the following information in the “Settlement” and “Information on taxation by reason of territory” sections:

-

It will submit to Bizkaia and Navarra a self-assessment adjusted to the models approved by their Provincial Treasuries.

-

No self-assessment will be submitted to Araba or Guipúzcoa.

Example. The entity in the example in FAQ 6.35, , in addition to of the operations indicated in said FAQ, includes in the February 2024 self-assessment the rectification of the following exempt operations, which it mistakenly declared as taxable and not exempt:

|

Shares of company “E” declared in 10-2023 |

|

|---|---|

|

Titles acquired |

1,000 |

|

ISIN code |

EEA |

|

NIF issuer |

EEEEEE |

|

Transaction |

Subject not exempt |

|

Unit purchase price |

1 |

|

Taxable base |

1,000×1=1,000 |

|

Tax payable |

1,000×1×0.2÷100=2 |

|

Competent authority for the collection Payment date |

BIZKAIA |

|

Shares of company “F” declared in 01-2024 |

|

|---|---|

|

Titles acquired |

1,000 |

|

ISIN code |

FFF |

|

NIF issuer |

FFFFF |

|

Transaction |

Subject not exempt |

|

Unit purchase price |

1 |

|

Taxable base |

1,000×1=1,000 |

|

Tax payable |

1,000×1×0.2÷100=2 |

|

Competent authority for the collection Payment date |

BIZKAIA |

Entity “A” will proceed with the presentation as follows:

Financial Transactions Annex (ATF):

-

It will be completed without any specialty.

-

First of all, will necessarily be presented to the AEAT .

-

Bizkaia and Navarre: You should check whether they require the submission of the annex. If required, you will submit the annex to them, which will be identical to the one submitted to the AEAT .

- Araba and Guipuzcoa: will not present anything.

Self-assessment.

-

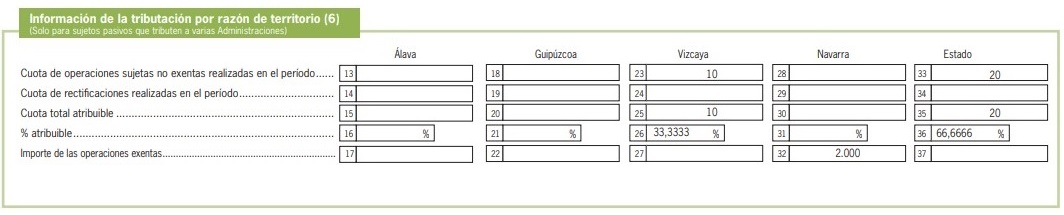

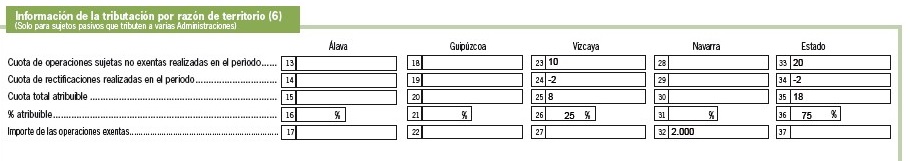

You will submit form 604 to the AEAT , with the following information in the “Settlement” and “Information on taxation by reason of territory” sections:

-

The corrections of 2023 and earlier are attributed to the AEAT .

-

The corrections for 2024 and later are attributed to the administration responsible for the tax.

-

-

It will submit to Bizkaia and Navarra a self-assessment adjusted to the models approved by their Provincial Treasuries.

-

No self-assessment will be submitted to Araba or Guipuzkoa.