1.4. Organisation

The governing bodies of the Tax Agency are the President, who is the Secretary of State for the Treasury and Budgets, the General Director, the Senior Management Board, the Steering Committee and the Co-ordinating Committee for the Regional Directorate.

It is the President's duty to perform the executive management of the Tax Agency and to legally represent it in any kind of act or contract, and it's the General Director's duty to manage its routine functioning.

The Permanent Steering Committee is presided over by the President of the Tax Agency or, in his absence, by the General Director, who is the Vice-President. Part of it are the Directors of the Departments and Services of the Tax Agency, and the Central Delegate for Major Taxpayers and the Head of the Madrid Regional Office attend the meetings.

Members of the Permanent Steering Committee at 31 December 2012

- Miguel Ferre Navarrete, President

- Beatriz Gloria Viana Miguel, General Director

- Mª Ángeles Fernández Pérez, Director of the Taxation Management Department

- Luis Ramón Jones Rodríguez, Director of the Financial and Tax Audit Department

- Ana Fernández-Daza Álvarez, Director of the Tax Collection Department

- Pilar Jurado Borrego, Director of the Customs and Excise Department

- Domingo Javier Molina Moscoso, Director of the Tax Agency's IT Department

- Sara Ugarte Alonso-Vega, Director of the Human Resources Department.

- Elena Guerrero Martínez, Director of the Planning and Institutional Relations Service

- Juan Manuel Herrero de Egaña Espinosa de los Monteros, Director of Legal Services

- Mª Teresa Campos Ferrer, Director of Internal Audit Services

- Pedro Gómez Hernández, Director of the Financial Management Service

- Rubén Víctor Fernández de Santiago, Director of the Tax and Statistics Studies Service

- Francisco Muñoz de Morales Anciola, Director of the Director General's Office

- Ángel Mariano Serrano Gutiérrez, Central Delegate for Major Taxpayers

- Raquel Catalá Polo, Head of the Madrid Regional Office

The Co-ordinating Committee for the Regional Directorate is chaired by the General Director of the Tax Agency and is composed by the members of the Permanent Steering Committee, as well as by the Central Delegate for Major Taxpayers and by all the Special Delegates of the Tax Agency.

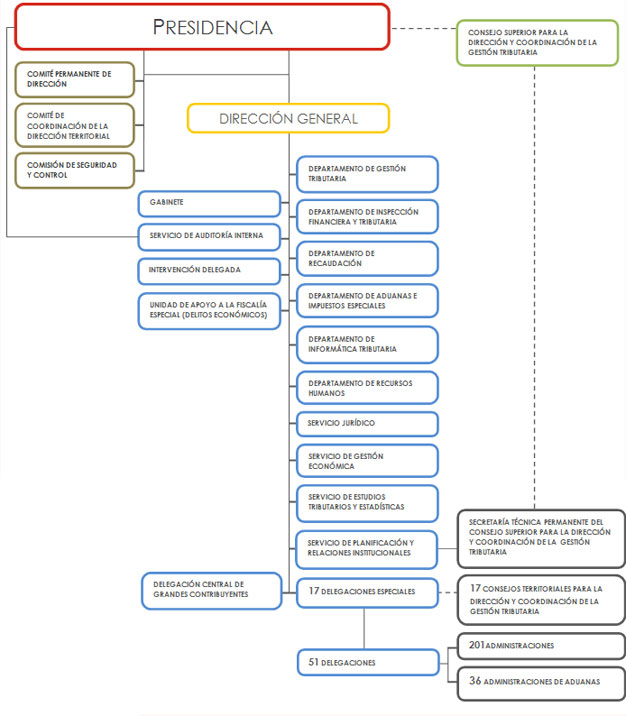

The structure of the Tax Agency is divided into Central Services and Regional Services.

The Central Services are based in an organisation model of functional operational areas and support areas.

The Regional Services, as of 31 December 2012, were constituted by 17 Special Delegations -one in each Autonomous Community- and 51 Delegations -normally, coinciding with provinces-, inside which 237 Administrations are integrated, 36 of them are Customs offices.(1)

In 2006, the Central Delegation of Large Taxpayers was created, an agency with jurisdiction throughout the national territory, with functions aimed at coordinated control and improving attention and service to large taxpayers.

(1) As of the closing date of the Annual Report -July of 2013- the regional services are constituted by 17 Special Delegations, 39 Delegations, 232 Administrations, 36 of them being Customs offices.

The basic organization chart of the Tax Agency as of 31st December 2012 is shown in the following diagram: