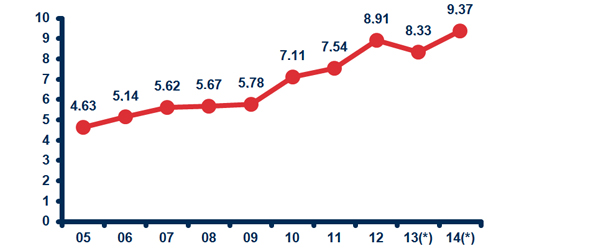

Table 18. Efficiency index

| 05 | 06 | 07 | 08 | 09 | 10 | 11 | 12 | 13(*) | 14(*) | |

|---|---|---|---|---|---|---|---|---|---|---|

| Results | 5,525.97 | 6,406.63 | 7,433.79 | 8,054.03 | 8,119.27 | 10,042.87 | 10,463.00 | 11,517.28 | 10,950.18 | 12,317.72 |

| Costs (Oblig. Recognised)(**) | 1,193.30 | 1,245.48 | 1,321.54 | 1,418.31 | 1,404.65 | 1,410.59 | 1,386.72 | 1,291.36 | 1,313.24 | 1,313.67 |

| Results/Costs | 4.63 | 5.14 | 5.62 | 5.67 | 5.78 | 7.11 | 7.54 | 8.91 | 8.33 | 9.37 |

(*) Starting in 2013, the reduction of refunds deriving from applications for rectification of self-assessments is included.

(**) This magnitude refers to the total operating cost of the Tax Agency which, in addition to the fight against fraud, fulfills its goals of information and assistance to the taxpayers, collection management and customs functions.

Results / Costs