2.3. Organisation

The governing bodies of the Tax Agency are: the Chairman, who is the Secretary of State for the Treasury and the Director-General, with the level of a Subsecretariat.

It is the President's duty to perform the executive management of the Tax Agency and to legally represent it in any kind of act or contract, and it's the General Director's duty to manage its routine functioning.

The advisory bodies of the Tax Agency's management are the Permanent Steering Committee and the Regional Management Coordinating Committee.

The Permanent Steering Committee is presided over by the President of the Tax Agency or, in his absence, by the General Director, who is the Vice-President. All the Directors of the Departments and Services of the Tax Agency form part of this Committee, and the Central Delegate for Large Taxpayers and the Special Delegate for Madrid also attend its meetings.

Members of the Permanent Management Committee on 31 December 2017

- José Enrique Fernández de Moya Romero, Chairman

- Santiago Menéndez Menéndez, General Director

- Rufino de la Rosa Cordón, Director of the Tax Management Department

- Luis María Sánchez González, Director of the Financial and Tax Audit Department

- Soledad García López, Director of the Tax Collection Department

- Pilar Jurado Borrego, Director of the Customs and Excise Department

- Manuel Alfonso Castro Martínez, Director of the Taxation IT Department

- Manuel José Rufas Vallés, Director of the Human Resources Department

- Diego Loma-Osorio Lerena, Director of Legal Services

- Mª Teresa Campos Ferrer, Director of Internal Audit Services

- Amparo Sebastiá Casado, Director of the Economic Management Service

- Rubén Víctor Fernández de Santiago, Director of the Tax and Statistics Studies Service

- Rosa Mª Prieto del Rey, Director of the Planning and Institutional Relations Service

- Francisco Javier Hernández García, Director of the Office of the Director-General

- Ignacio Huidobro Arreba, Central Delegate for Large Taxpayers

- Raquel Catalá Polo, Special Delegate for Madrid

The Co-ordinating Committee for the Regional Directorate is chaired by the General Director of the Tax Agency and is composed by the members of the Permanent Steering Committee, as well as by the Central Delegate for Major Taxpayers and by all the Special Delegates of the Tax Agency.

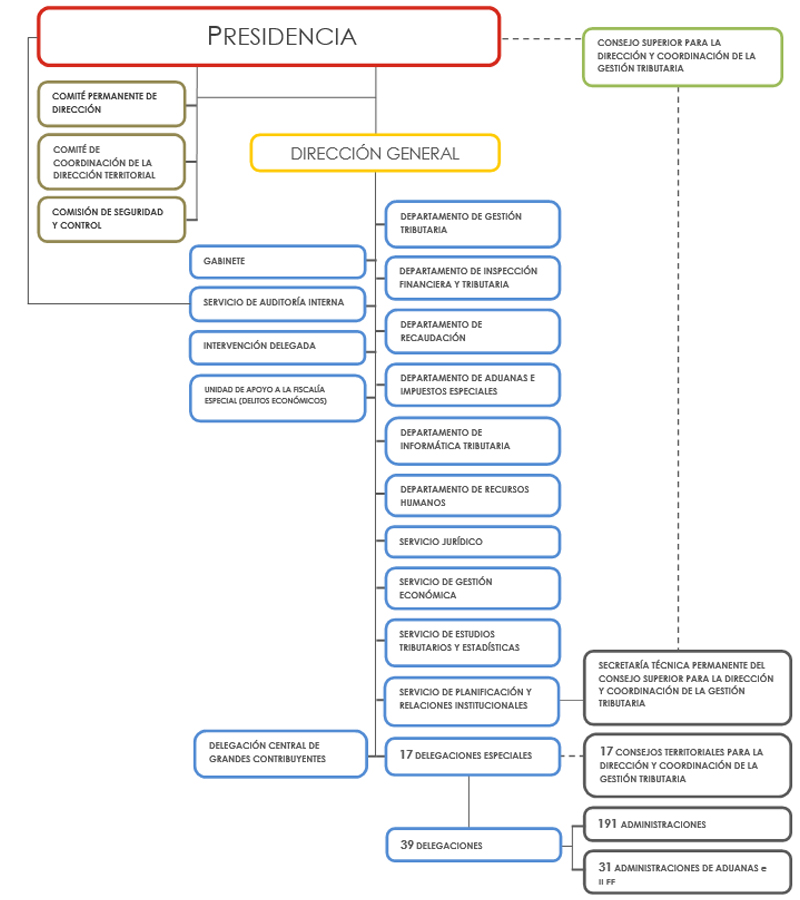

The structure of the Tax Agency is divided into Central Services and Regional Services.

The Central Services are based in an organisation model of functional operational areas and support areas.

On 31 December 2017, Territorial Services were formed of 17 Special Delegations - one for each Autonomous Community - and 39 Delegations, consisting in 191 Administrations and 31 Customs and Excise Duties Administrations.

In the year 2006 the Central Delegation for Large Taxpayers was created, a body with powers throughout the national territory, with functions of co-ordination and improvement of the assistance and the service of large taxpayers.

In addition, the Tax Agency forms part of and presides over collegiate bodies of coordination of the transferred taxes established in Act nº 22/2009 of 18 December: the Higher Council for Tax Coordination and Management (a collegiate body formed by representatives of the Tax Administration of the State and of the Autonomous Community regions and Cities with Statutes of Autonomy), and the Regional Councils for Tax Management and Coordination (collegiate bodies formed by representatives of the Tax Authorities of the State and of the Autonomous Community region or City with its respective Statute of Autonomy).

The basic Tax Agency flow chart of 31 December 2017 is shown below: