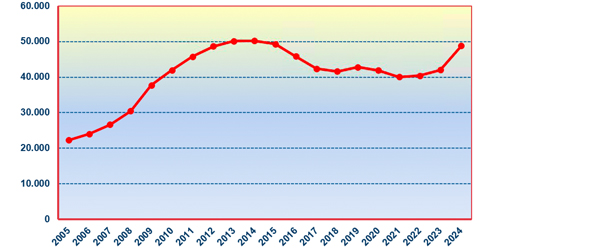

Table no. 40. Evolution of outstanding debt

|

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

|

|---|---|---|---|---|---|---|---|---|---|---|

|

Outstanding debt as of December 31(*) |

22,253 |

23,986 |

26,652 |

30,425 |

37,690 |

41,959 |

45,736 |

48,674 |

50,174 |

50,226 |

|

Rate of variation |

4.7% |

7.8% |

11.1% |

14.2% |

23.9% |

11.3% |

9.0% |

6.4% |

3.1% |

0.1% |

|

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

|

|---|---|---|---|---|---|---|---|---|---|---|

|

Outstanding debt as of December 31(*) |

49,272 |

45,849 |

42,365 |

41,628 |

42,770(**) |

41,911 |

42,020 |

40,421 |

42.036 |

48.797(***) |

|

Rate of variation |

-2.0% |

-6.9% |

-7.6% |

-1.7% |

2.7% |

-2.0% |

0.3% |

-3.8% |

4% |

16.1% |

(*) Amounts in millions of euros.

(**) In 2019, there was an extraordinary charge of 1.3 billion euros in compensation for acts of terrorism.

(***) The debt as of December 31, 2024, does not take into account the purges that have been carried out to eliminate the declarations to be entered that were falsified and incorrectly attributed by third parties to REDEF taxpayers. With the tax clearance process practically complete, and with the corresponding reductions in these declarations, as of June 15, 2025, the outstanding debt as of December 31, 2024, would have stood at €43.797 billion, 4.2% more than the previous year. Additionally, debt verification of €367 million remains to be completed, which could lead to additional debt write-offs for the same reasons mentioned.

Evolution of outstanding debt as of December 31 for the years 2005-2024