Information note on the options for filing and paying the debt resulting from the self-assessment of form 210

An Information Note has been published on the Electronic Office regarding the options for filing and paying the debt resulting from self-assessment form 210 (IRNR-Income Tax for Non-Residents without a permanent establishment).

It is published in the following location within the "Information" section:

You can access the note at the following link: Forms of presentation and payment of Form 210

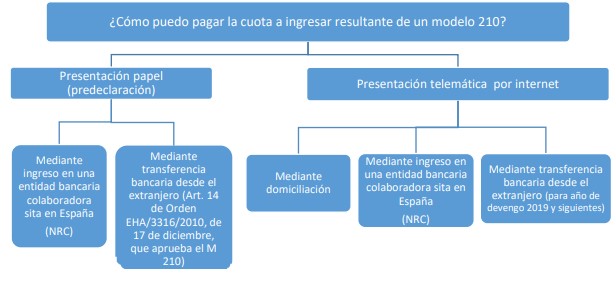

The Note contains all the information on the different forms of payment permitted by current regulations, differentiating between the form 210 and its presentation, whether in paper format or online.

As a new feature, from June 1, 2022, payment can be made by transfer from a foreign bank account to the “AEAT Transfer Account” opened in collaborating entities, keeping in mind that the source account cannot be an account opened in a collaborating entity. The significant regulations in this matter are:

- Order EHA/3316/2010, of 17 December, in particular the amendment incorporated in article 14 by Order HFP/915/2021, of 1 September, applicable to the pre-declaration of form 210.

- Resolution of January 18, 2021, of the Directorate of the State Tax Administration Agency, on electronic income through the Electronic Office, which deals with the electronic submission, in general, of self-assessments with recognition of debt and payment by bank transfer, applicable to the electronic submission of form 210.