Broadening of the tax bases. Indicator I of the Strategic Plan

The strategic objective of the Tax Agency is to improve voluntary compliance with tax obligations; To achieve this, it uses a combination of measures of a wide range of nature, ranging from civic-tax education, information and assistance, prevention of tax and customs fraud, a posteriori control actions, the promotion of anti-fraud regulatory changes, agreements with other organizations, cooperative relations, etc.

In order to measure the evolution of the results of its actions in the medium term, the Strategic Plan of the Tax Agency 2020-2023 established seven strategic indicators, whose evolution until 2018 was included in the initial draft. The data initially shown is updated annually, with the last update being dated December 31, 2021.

To measure the evolution of voluntary compliance, it might seem preferable to analyse the evolution of tax revenues; However, they are conditioned by a series of external variables (economic growth, evolution of internal demand, employment rate, inflation, regulatory changes, rate of returns, etc.) which mean that their use for the intended measurement – the evolution of voluntary compliance – is not sufficiently consistent.

Therefore, compared to tax revenues (which are nothing other than the amounts declared by taxpayers) there is another tax magnitude that is subject to fewer external variables and therefore distorts the comparison less: the tax base.

The tax base is understood to be the monetary (or other) amount that serves as a reference for calculating the tax rate, that is, the amount to which the tax rate (percentage) is applied. If we add the tax bases of the different taxes and, in addition, correct the regulatory changes between one year and another – so that they are comparable – we obtain the aggregate tax base in homogeneous terms .

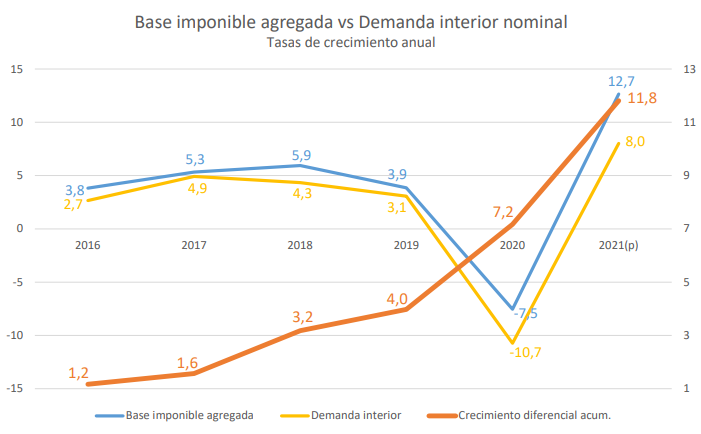

In order to assess whether tax compliance is improving we must compare the rates of change in the aggregate tax base with appropriate macroeconomic magnitudes that are as closely related as possible to tax revenues, such as nominal or nominal domestic demand.

Thus, the Strategic Plan considers that the indicator that most faithfully reflects how fiscal behavior evolves in our country is the one that compares the differential evolution of the aggregate tax bases with that of the reference macroeconomic magnitudes . This strategic indicator analyses whether the percentage increase in aggregate tax bases is higher than that of nominal internal demand throughout the upward economic cycle.

It should be noted that the figures for both domestic demand and tax bases are subject to revision for at least two years, which means that these estimates of the broadening effect must be assumed to be somewhat provisional.

On the other hand, it must always be taken into account that the evolution of this strategic indicator is conditioned by the economic cycle : For example, in the downward phases of the economic cycle (2020), some components of the bases (business profits, capital gains, capital income, nominal fuel consumption) react more intensely than their equivalents in National Accounting, to which is added the distorting effect of the pandemic on the precision and quality of their estimates in 2020-2021.

With all the above clarifications, it can be stated - and verified - that over the last six-year period (2016-2021) the aggregate tax base has been registering increases greater than those of nominal domestic demand, with an accumulated differential in the period of 11.8 points (it is worth highlighting the boost of almost five points in 2021), which has a positive effect on collection and allows us to infer an improvement in voluntary compliance in the period analyzed , which, as indicated at the beginning, constitutes the strategic objective of the Tax Agency.