Measuring induced effects. Indicator II of the Strategic Plan

The second of the indicators provided for in the Strategic Plan to measure and evaluate the medium-term evolution of voluntary compliance with tax obligations is the measurement of induced effects.

In order to improve voluntary compliance, the Tax Agency develops two main lines of action: On the one hand, assistance and prevention; and, on the other hand, the detection, regularization and, where appropriate, sanctioning of tax non-compliance through control actions.

Both lines of action are two sides of the same coin: promoting voluntary compliance. In the first case, assistance and prevention, its purpose is clear; As for control actions, they not only seek the regularization and payment of defrauded fees, but also the achievement of optimal levels of tax compliance. In short, is intended to redirect non-compliant taxpayers without requiring periodic control actions . The purpose of measuring the induced effects of these control actions is to measure both the impact of the complementary self-assessments that have been directly or indirectly induced as a consequence of the control activity, as well as the subsequent behaviour of the taxpayer (or his/her environment) after the control actions. These induced effects may occur in the year of the audit (immediate) or in subsequent years (sustained).

Transparency initiatives and the provision of tax data to taxpayers also lead to changes in their tax behaviour, effects induced by auditing activities, which can be quantified more easily.

Thus, for example, the information received by automatic exchange with countries of the European Union on income from work, directors, pensions and real estate income to reinforce extensive control in the PIT, both on non-declarants and on declarants who had concealed certain income obtained in other countries, of which there is now systematic knowledge. In 2021, and beyond the usual intensive control actions, these extensive control actions have generated liquidations by the Tax Agency and late declarations by taxpayers for a total amount of more than 51 million euros .

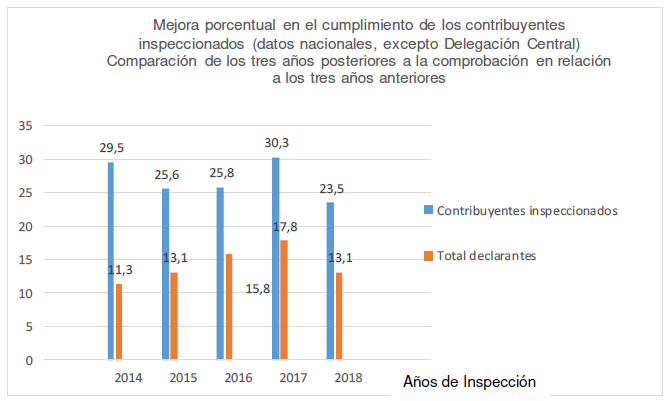

For years, the Tax Agency has established systems aimed at measuring the induced effect of inspection actions . The following table reflects the previous and subsequent behavior of taxpayers inspected by the Inspection area from 2014 to 2018 compared to the behavior of all taxpayers. Specifically, the evolution of the amounts of the self-assessments submitted in the three years following the inspection is compared with the three previous years

As can be seen in the table, in general the inspected taxpayers increase their tax revenues to a greater extent than the rest of the taxpayers in the same time period which can undoubtedly be considered as an induced effect of the control actions on the taxpayers and shows how the control route also produces an improvement in voluntary compliance.