Measuring induced effects. Indicator II of the Strategic Plan

The second of the indicators contemplated in the 2020-2023 Strategic Plan to evaluate the medium-term evolution of voluntary compliance with tax obligations is aimed at measuring the effects that are observed in said compliance induced by the actions of the Tax Agency.

In order to improve voluntary compliance, the Tax Agency follows two fundamental lines of action: assistance and prevention, on the one hand, and the detection, regularisation and, where appropriate, sanctioning of tax non-compliance through control actions, on the other. Both lines of action are two facets of the same strategy: promote voluntary compliance.

The first line, assistance and prevention, aims to provide taxpayers with the necessary resources to facilitate compliance with their obligations. Instead, control actions not only seek to regularize and recover defrauded tax quotas, but also to achieve optimal levels of tax compliance. In short, the aim is to guide taxpayers towards compliance without the need for periodic inspections. Measuring the induced effects of these control actions involves assessing both the impact of the complementary self-assessments that have been generated directly or indirectly as a result of the control activities, and the subsequent behavior of the taxpayers (or their environment) after the control actions. These induced effects may manifest themselves immediately in the year of the review or in a sustained manner in subsequent years.

In addition, transparency initiatives and the provision of tax data to taxpayers also influence their tax behaviour, generating induced effects from verification actions, which can be quantified more precisely.

For example, information received through automatic data exchange with European Union countries on employment income, directors' pensions and real estate income has been used to strengthen extensive control in the Personal Income Tax (PIT), both for those who did not declare and for those who concealed certain income obtained in other countries. In 2022, inspection actions related to taxpayers who had financial accounts abroad, based on the information obtained under the European directive 'DAC2', the standard

Also, to discover funds hidden abroad, the information collected by the National Fraud Investigation Office ( ONIF ) on the use of cards issued abroad (cards'offshore') ha permitido a las diferentes dependencias territoriales de la Agencia liquidar deudas por un valor de 79 millones de euros el año 2022, una cifra similar a la del año anterior. Además, se han iniciado expedientes que involucran a 69 contribuyentes con tarjetas 'offshore' and which are expected to generate additional results in the future.

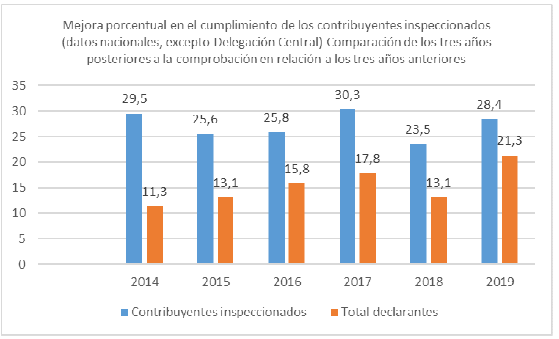

For years, the Tax Agency has implemented systems to measure the induced effect of inspection actions. The following table shows the behavior of taxpayers before and after being reviewed by the Inspection area in the years 2014 to 2019 compared to the behavior of the total number of taxpayers. Specifically, the evolution of the amounts of the self-assessments submitted in the three years following the inspection is compared with the three previous years.

As can be seen in the table, in general terms the inspected taxpayers increase their tax revenues in the three years following to a greater extent than the group of taxpayers in the same period , which can undoubtedly be considered as an induced effect of the control actions on the taxpayers and demonstrates how, through control, voluntary compliance can also be improved.