Broadening of the tax bases. Strategic Indicator I

The main strategic objective of the Tax Agency is to improve voluntary compliance with tax obligations. To achieve this objective, it implements a wide range of measures including civic-tax education, the provision of information and assistance, the prevention of tax and customs fraud, post-clearance control actions, the promotion of anti-fraud regulatory changes, collaboration with other agencies and the promotion of cooperative relations, among others.

To assess the progress of its actions in the medium term, the Tax Agency's Strategic Plan 2020-2023 established seven strategic indicators. These indicators are updated annually, with the latest update being on December 31, 2022.

Although it may seem preferable to measure improvement in voluntary compliance by analysing tax revenues, these are influenced by numerous external factors such as economic growth, the evolution of domestic demand, employment rate, inflation, regulatory changes and the pace of refunds, which makes them not a consistent measure to assess voluntary compliance.

Instead, the tax base is used as a measure less influenced by external variables. The tax base is the amount used to calculate the tax rate, that is, the amount to which the tax rate is applied. By adding the tax bases of different taxes and correcting regulatory changes, an aggregate tax base is obtained in homogeneous terms.

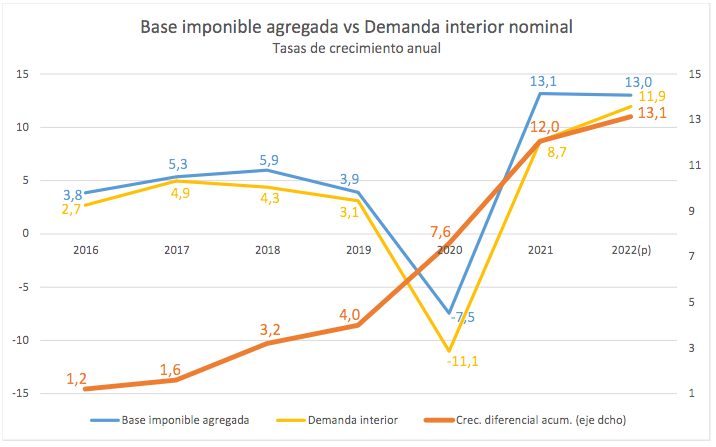

To assess the improvement in tax compliance, rates of change in the aggregate tax base are compared with relevant macroeconomic magnitudes such as nominal or nominal domestic demand. The key indicator that reflects how fiscal behavior evolves in the country focuses on whether the increase in aggregate tax bases is greater than that of nominal domestic demand during the economic upturn.

It is important to note that the figures for domestic demand and tax bases are subject to revision for at least two years, which requires considering these estimates with a certain degree of provisionality.

Furthermore, the economic cycle influences the evolution of this strategic indicator. For example, during downturns in the business cycle, such as in 2020, some components of the bases react more strongly than their National Accounting equivalents, and the pandemic has had a distorting effect on the accuracy of estimates in 2020-2021.

Despite these considerations, the data support the claim that over the most recent seven-year period (2016-2022), the aggregate tax base has experienced increases greater than nominal domestic demand. This is clearly reflected in the following graph, where a cumulative differential of 13.1 points can be observed over the period. These results have had a positive impact on tax collection and point towards an improvement in voluntary compliance, which is the central strategic objective of the Tax Agency.