The Tax Agency's management of mutual agreement procedures on transfer pricing

At the end of 2022, OECD celebrated "Legal Certainty Day", which presented 2021 Mutual Agreement Procedures statistics for 127 jurisdictions around the world and awarded awards to different States for their management of international tax controversies.

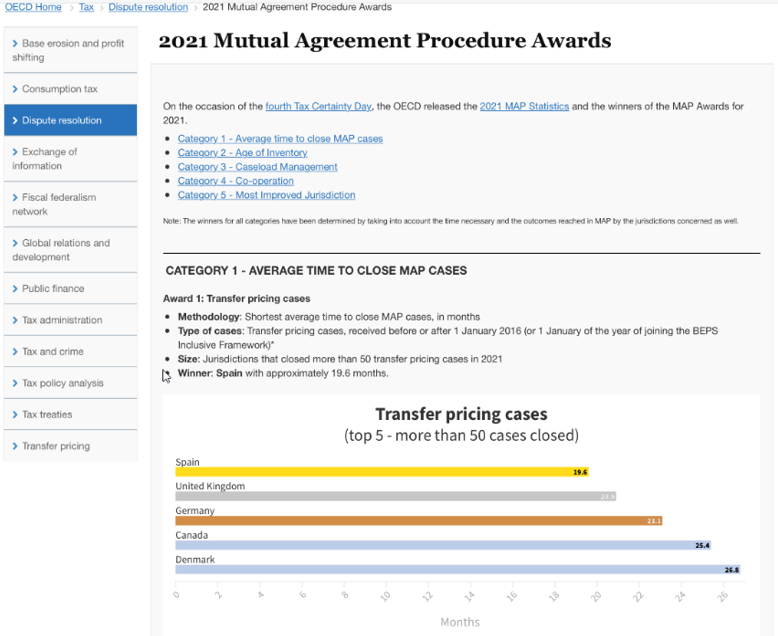

Among these awards, the one awarded to Spain stands out in category 1.1, relating to the average time for resolving mutual agreement procedures on transfer pricing.

This award recognises that Spain is the country in the world that has taken the least average time to resolve its transfer pricing disputes. This is in relation to all the cases that our country concluded in 2021, which reached a record number of 142. And taking into account, furthermore, that the outcome of most of these cases was positive; That is, they concluded with the elimination of double taxation.

The average time taken was 19.6 months, significantly below the 24 months established by the international minimum standard in this area, as well as the 32 months that have been used, on average, for all cases resolved globally last year.

Behind Spain in this category are the United Kingdom (20.9 months), Germany (23.1), Canada (25.4) and Denmark (26.8 months).

The agility in the resolution of mutual agreement procedures is a very important element in providing legal certainty to groups affected by international economic double taxation that transfer pricing adjustments usually generate.

The management of the Tax Agency in this area has been recognized in previous editions of these awards, as can be seen in the abundant information that the OECD website offers on this matter.

These recognitions, which are based on statistical data, are largely explained by a varied set of factors that can be grouped into two categories: strategic and operational factors.

The first ones refer to the decisions that each tax administration adopts regarding the general elements that define the activity of managing mutual agreement procedures. These include organisation, specialisation and integrated treatment of transfer prices.

In 2016, the Spanish Administration decided to transfer the jurisdiction of the mutual agreement procedures on transfer pricing to the Tax Agency. Given the nature of these cases, which relate to the particular situation of specific taxpayers, in which information and interaction with the verification and prior agreement functions are fundamental factors, this form of organisation presents unquestionable competitive advantages.

Still at the organizational level, but already linking with specialization, the Tax Agency decided in 2013 to create a central office specialized in international taxation and transfer pricing: the National Office of International Taxation. The experience and maturity acquired since then by the ONFI , in the treatment of transfer prices, also constitutes an advantage in the intense debate that is usually established with other tax administrations to resolve this type of dispute.

Finally, and although the mutual agreement procedure has its own rules and objectives, it should not be considered in isolation from the rest of the procedures that affect the transfer pricing policy of a group, whether they are inspections, APAS or the internal review procedure itself; Therefore, it is necessary to articulate a strategy that guarantees the appropriate interrelation between all of this, and which in Spain embodies the so-called 360 strategy on transfer pricing.

Operational factors include planning of negotiation rounds, tools for case monitoring, goal-orientation of procedures and human resources.

Negotiation rounds are planned more than a year in advance, with one or even two annual meetings being held with our main partners: European countries and the United States. Since the end of 2021, they have been in person again. As a result of the pandemic, videoconference meetings have become widespread, which in some cases can replace face-to-face meetings and, in other cases, can be used to prepare for them or to tie up loose ends.

Holding these rounds is key to closing cases; since a few months before the meeting the teams of both competent authorities must exchange position reports and the necessary information. The collaboration of contributors and advisors is very important at this stage to speed up discussions.

After each round of negotiations, it is necessary to closely monitor and follow up on the cases on which an agreement has been reached and on those on which an agreement has not been closed. For this, as well as to collect the statistical data required annually by the EU and the OECD , the involvement of the IT Department of the Tax agency; which has developed the computer application for processing mutual agreement procedures incorporated into the new Inspection Plan.

Along with the above, it is necessary to always keep in mind the objective of mutual agreement procedures: eliminate double taxation, which means that the competent authorities must reconcile the defence of technical arguments with the necessary pragmatism and flexibility, in order to maintain positions that allow agreements to be reached. Especially considering that Spain's agreements with its main partners include an arbitration clause, guaranteeing an agreement in any case, whether between competent authorities or by an arbitration commission.

mutual agreement procedures are processed and negotiated by people, so the human element is essential. The training and specialization of Spain's mutual agreement procedures team and the good understanding with the teams of other Administrations allows agreements to be reached within very reasonable time frames, which is precisely what the award received in 2022 from the OECDrecognizes.