Improving efficiency. Indicator IV of the Strategic Plan

The main strategic objective of the Tax Agency is to improve voluntary compliance with tax obligations. To achieve this objective, it implements a variety of measures, including civic-tax education, assistance and information for taxpayers, prevention of tax and customs fraud, post-clearance control actions, the promotion of anti-fraud regulatory changes, collaborations with other organizations, cooperative relations, etc.

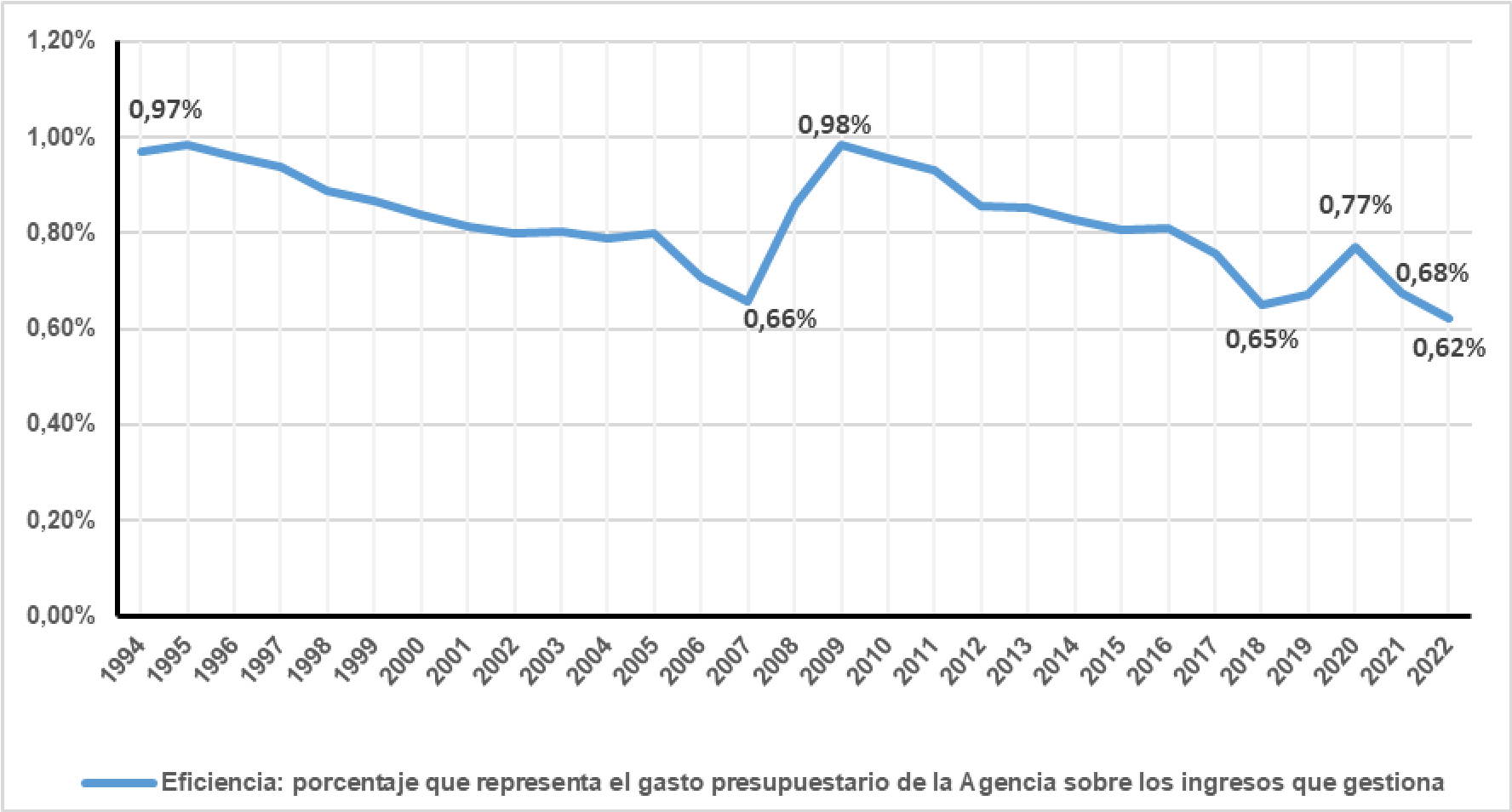

In addition to improving voluntary compliance, the Tax Agency is also focusing on improving its efficiency in an autonomous and complementary manner. Efficiency is measured by the relationship between the Tax Agency's budget expenditure and the net tax revenues managed annually. This indicator, known as Indicator IV of the Strategic Plan, is essential to evaluate its performance.

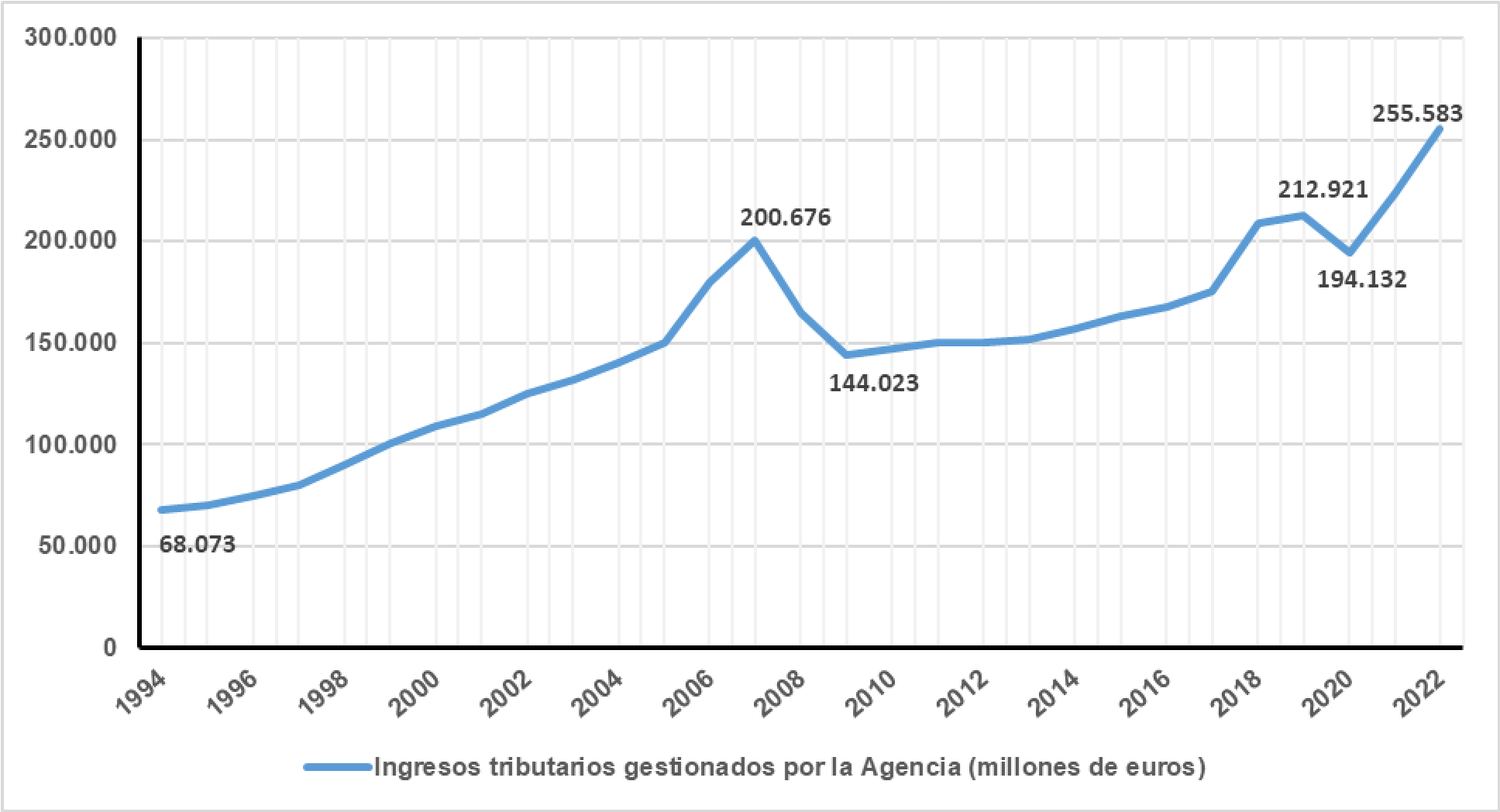

Over the years, net tax revenues have fluctuated. They grew steadily between 1995 and 2007. The economic crisis of 2008-2009 caused a decline, followed by a return to growth that began in 2010 and was cut short between 2019-2020, when the pandemic interrupted this trend. However, in 2021, there was a strong recovery that allowed revenue to reach 223.545 billion euros, with an increase of 15.15% compared to the previous year. This recovery continued in 2022, with revenues of 255.583 billion euros, which represents an increase of almost 14.33% compared to the previous year.

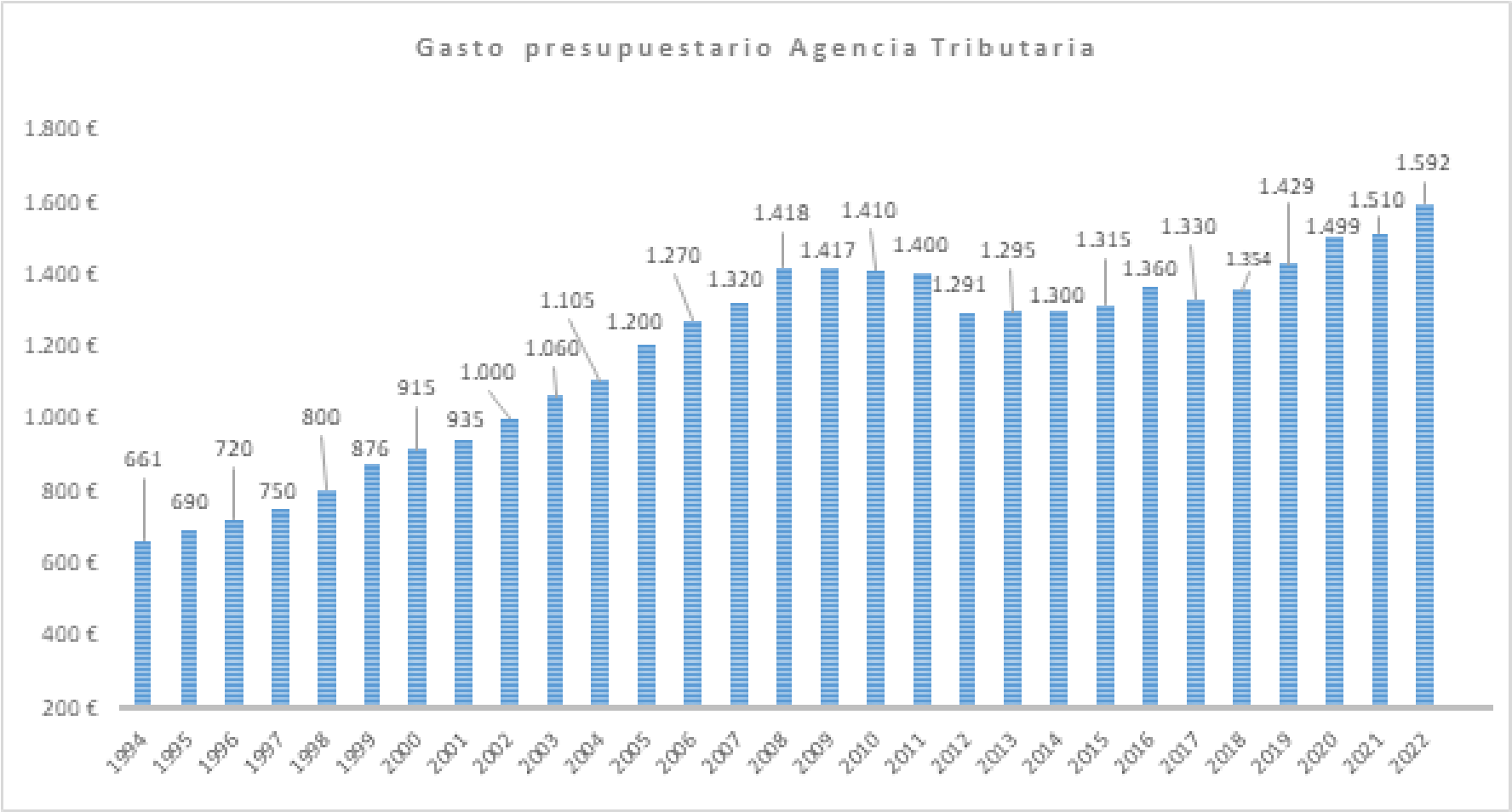

As for the budget expenditure of the Tax Agency, it experienced restrictions during the economic crisis, but has been gradually recovering. In 2019, the 2008 figure was exceeded for the first time, with spending continuing to increase in 2022 . This increase is related to the gradual recovery of the size of the workforce with the aim of placing it at a number close to what has been historically usual, an objective clearly established in the 2020-2023 Strategic Plan.

The relationship between tax revenue data and budget expenditure shows that, in the period from 1995 to 2022, the collection managed by the Tax Agency multiplied by 3.8, while budget expenditure multiplied by only 2.4.

This combination of data allows the calculation of the efficiency ratio of the organization, which represents the annual budgetary cost of the Tax Agency in relation to the net tax revenues it manages in each fiscal year.

The following table shows the evolution of the ratio and how in 2022 it stood at 0.62%, which meets the efficiency target committed by the Tax Agency in its Strategic Plan.

The pandemic had a negative impact on the activity of the Tax Agency in 2020. This situation had a strong impact on the net tax revenues managed by the Tax Agency, with a fall of almost 8.8%, an aspect that affected the evolution of efficiency.

However, in 2021 and 2022, there was a strong recovery, with increases of 15.15% and 14.33%, respectively, in managed net tax revenues. This has also been accompanied by an increase in the efficiency of the Tax Agency, with the ratio reaching 0.62% for the first time in 2022, more than meeting the objective that the annual budgetary cost of the organization does not exceed 0.7 % of the net tax revenues it manages.

Based on the above, the Strategic Plan seeks to maintain the efficiency ratio of the Tax Agency at around 0.7% (below the average of the countries in our environment), that is, the annual budgetary cost of the organization must not exceed 0.7% of the net tax revenues it manages, understanding that this figure is compatible with the expansion of the workforce necessary to recover the pre-crisis staff, while remaining below the average of comparable countries in terms of efficiency.