Financial requirements

One of the powers that the Tax Agency has to ensure the correct fulfillment of tax obligations is to obtain financial information, as established in article 93 of the General Tax Law (LGT).

This information is of great relevance to detect and prevent tax fraud , organized schemes, asset stripping aimed at thwarting debt repayment, capital transfers to non-cooperative jurisdictions, money laundering and other criminal activities. It is worth highlighting the guarantees offered by the regulations when establishing the authorization and control regime. Finally, it is not possible to forget, today, the need to enable the computer / telematic mechanisms that make effective the purpose for which the financial requirements have been created.

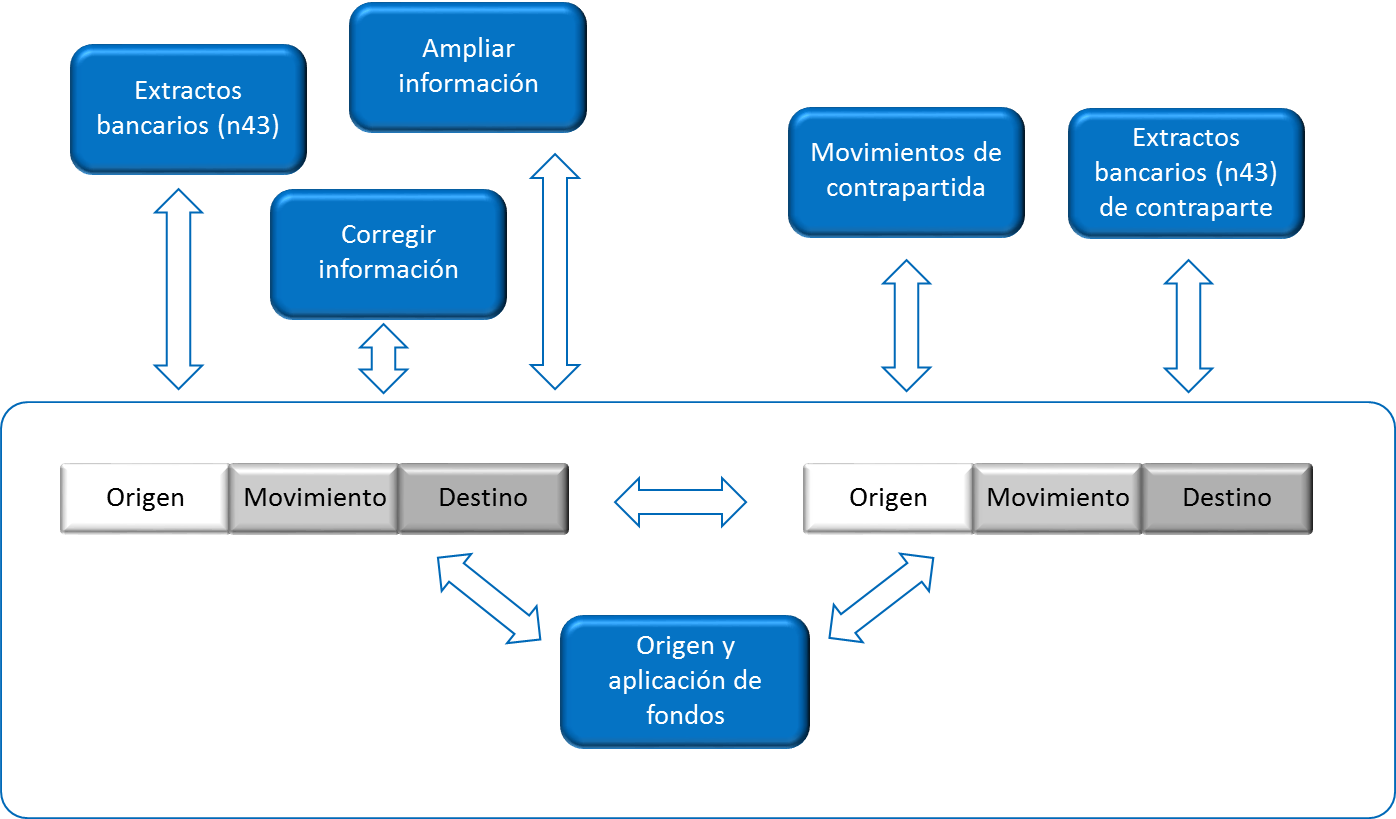

To this end, the Tax Agency has been promoting, in collaboration with financial institutions, the adoption of electronic means. In 2008(1) The AEAT established an automated procedure for the telematic exchange with credit institutions that voluntarily adhere to it, of the files that contain the information requests related to current account transactions and their corresponding responses, which will be adapted to the format of rule 43 of the Series of Banking Rules and Procedures. In 2021(2) The technology was renewed, the frequency of exchanges was improved, the required period was extended and a strategy to improve the accuracy of the requirements was initiated. This increased precision is based on communication from the counterparty of the movement and is materialized in continuous improvements in the digitalization of processes and the quality of information.

The new mechanism offers the following advantages :

-

Financial institutions can handle requirements in an automated manner, reduce costs and avoid errors,

-

Anti-fraud can more accurately determine the collaborators in breach,

-

Requiring information is avoided when it is possible to determine that the counterparty is not relevant to the breach and

-

A financial environment of collaboration is established with fiscal policies that increase certainty and security.

This strategy, geared towards digitalisation and precision in requirements, has proven to be a very useful tool in the fight against fraud, modern, agile and flexible, supported by the digitalisation of processes and collaboration with financial institutions.

(1) Resolution of December 16, 2008, of the Presidency of the AEAT.

(2) Resolution of December 21, 2021, of the Presidency of the AEAT.