Tax conflict. Indicator VI of the Strategic Plan

The Tax Agency is committed to applying the tax system in a general and fair manner to all taxpayers, although its actions sometimes generate conflict, that is, they cause taxpayers to file appeals or claims.

The sixth of the indicators provided for in the Strategic Plan to measure and evaluate the medium-term evolution of the results of the Tax Agency's activity focuses on the measurement of tax conflict. The indicator takes into account two magnitudes, the percentage of relative conflict and the number of resolutions/claims favorable to the Tax Agency.

Relative conflictivity relates the acts complained of with the totality of the actionable acts issued. The conflict is evaluated based on the number of appeals and claims filed and not their amount because the disputed amounts cannot be aggregated, since the concepts to which they refer are not: fees to be paid, fees to be returned, tax bases, etc. Furthermore, as we saw last week, the managed debt indicator presents information on the debt suspended by appeal or claim, allowing the medium-term assessment of conflict in terms of amount.

Considering the replacement resources and economic-administrative claims, in 2021 the relative conflictivity stood at 1.95% , which represents a decrease for the fifth consecutive year from 2.21 % of 2017.

On the other hand, focusing the study only on the administrative acts that are the subject of an economic-administrative claim and, where appropriate, of a subsequent contentious-administrative appeal, in 2021 the relative conflictivity in the economic-administrative route is 0.7% and in contentious-administrative proceedings it is 0.1% .

From the results of the claims and appeals filed, it appears that of the total acts issued by the Tax Agency and that are claimable, 0.30% are finally annulled by the courts, well on the way economic-administrative (0.28%) or in the contentious-administrative way (0.02%).

The previous annulment percentages include any economic-administrative resolution or ruling contrary to the Tax Agency, even if the estimate of the appeal or claim is partial and regardless of the scope of the appeal or claim filed, since the interested person has been able to challenge the act in its entirety or simply partial or formal aspects of it and also regardless of whether the reviewing body has been able to order the retroaction of the actions or the correction of any defect in the contested act and address the acts claimed in 2021, differentiating, as has been pointed out, depending on the reviewing body and the number of appeals. It is not evaluated based on amounts due to the difficulty of aggregation seen above. Furthermore, as we will see next week, the last of the strategic indicators indirectly allows for monitoring in terms of amount.

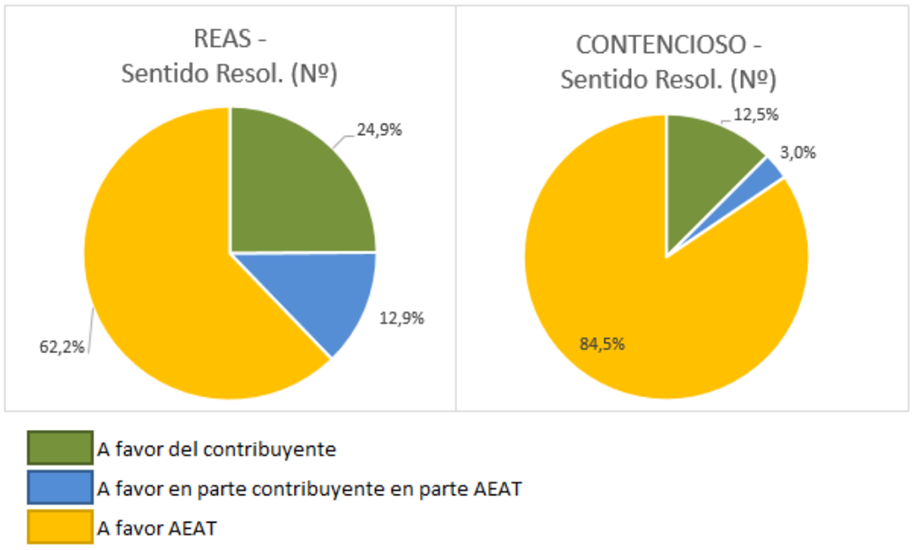

Finally, regarding the total and partial estimates of resources and claims, the percentages of the acts claimed in 2021, differentiating according to the reviewing body and taking into account the number of resources, are as follows:

The percentage of cases favorable to the AEAT is similar to that of 2020 in the economic-administrative claims and higher in the contentious-administrative route due to the withdrawals of the appellants before the jurisprudence of the Supreme Court in relation to the Tax on the Value of Electrical Energy Production.

The analysis of tax conflict, together with the study of the causes of challenge of administrative acts and the reasons for total or partial estimation of resources and claims, allows improving the quality and motivation of the administrative acts issued by the Tax Agency, to reduce conflict, as has been achieved in 2021, as well as to reduce the causes that cause resources and claims to be resolved unfavorably in the courts.