Frequently asked questions about Form 289

Skip information indexGeneral information requirements

The gross income derived from the sale or amortisation of financial assets paid or entered in the account, i.e. for the value of the asset disposal or refund obtained, must be reported. The income produced from this transaction in terms of interest shall not be reported.

Funds cannot be aggregated by countries, as, in accordance with the CRS, it must be registered as declarer of the fund, not the managing company.

No. The standards for the aggregation of the account balance do not apply to those that are excluded from the concept of financial account.

Technically, the label may be optional (assuming a choice between one type of information or another, from several possible options), but if it is legally required that said information be included in Form 289, the financial institution must complete the Form with the information it has on that information field, in all cases. That is, if you have it, you cannot choose whether to declare it or not.

Article 5 of Royal Decree 1021/2015, of November 13, establishes the information to be provided for each of the accounts subject to information communication, being Annex III of Order HAP/1695/2016, of October 25, by which Form 289 is approved, for the annual informative declaration of financial accounts in the field of mutual assistance, and by which other tax regulations are established, the one that details the content of the information that Form 289 must contain. For example, the type of account number must be provided, even though this information corresponds to an optional label in Form 289.

No. The tax identification number that must be obtained and included in Form 289 (within the TIN field) is the one issued by the jurisdiction of your residence and not the TIN assigned by the Spanish authorities (the NIF).

Therefore, the TINs that must be completed in form 289, being those issued by the country or jurisdiction of the person or entity not resident in Spain, must conform to the structure established in said country or jurisdiction .

For these purposes, you can access the portals for consulting information for each country regarding the issuance, obtaining and, where applicable, structure and operation of the corresponding TIN, through the section “Web portals for TIN (NIF) validations” of Form 289 found on the Electronic Office of the AEAT, whose link is:

https://sede.agenciatributaria.gob.es/Sede/en_gb/procedimientoini/GI42.shtml

To complete the information regarding the address of persons or entities not resident in Spain, the financial institution must proceed as follows, regardless of whether it is recorded in a free or structured format:

-

You must fill in the correct address in the jurisdiction in which you are resident in application of the due diligence rules.

-

It must always be completed with correct data that corresponds to the complete address provided by the person who holds ownership or control of certain financial accounts.

-

Therefore, should not include alphanumeric characters or words (***, 000, zzzz, nnn, among others) that do not constitute or form part of the real address of the owner or person exercising control.

The obligation to provide information relating to the address is established in article 5.1 a) of Royal Decree 1021/2015, of November 13, and the address associated with each of the accounts subject to communication of information must be provided. The specific details of the information to be provided can be found in number 18 of Annex III of Order HAP/1695/2016. As indicated in the Technical Manual for the presentation of Form 289, this information must be entered:

-

In structured format , through the fields established for this purpose, or

-

In free format , if the structured format is not possible or when the fields of the latter do not reflect all the casuistry of the address in the country of residence of the person or entity not resident in Spain that holds the ownership or control

The Technical Manual for filing Form 289, which is available on the AEAT Electronic Office in the section "Information on filing Form 289 via Web Service", is accessible via the following link:

https://sede.agenciatributaria.gob.es/Sede/en_gb/procedimientoini/GI42.shtml

When considering whether or not to record this value in Form 289, the following must be taken into account:

- The account number is not limited to IBAN or ISIN codes , but may be different depending on the category of financial account involved.

- Only in the event that the financial institution does not have any unique identifier, functional equivalent or numbering that allows it to identify the declared financial account, it must enter the characters "NANUM".

- If “NANUM” was entered because the information is aggregated by client in its databases, the financial institution must provide the identification numbers of the accounts individually considered as this aggregation is not correct according to the applicable regulations.

In short, the use of the value “NANUM”, must be considered exceptional, and should only be recorded in those cases where the financial institution does not have the identification code for the financial account in question.

The regulatory basis for the above is found in the following sections:

Article 5.1.b) of Royal Decree 1021/2015 , of November 13, which establishes the obligation to identify the tax residence of persons holding ownership or control of certain financial accounts and to report on them within the scope of mutual assistance, when determining the information to be provided for each of the accounts declared, among others, includes the following: "b) The account number ."

Likewise, Order HAP/1695/2016 , of October 25, approving model 289, for the annual information declaration of financial accounts in the field of mutual assistance, and amending other tax regulations, in Annex III, section 7, within the content of the declaration is included:

"7. Account number , indicating whether it is an IBAN or other bank account number, an ISIN or other securities identification number, or another identifier, such as the reference number of an insurance contract. When the declared financial account has an IBAN or ISIN code, it must be entered in form 289."

The account number is understood, as stated in section E of Section VIII of the Annex to Royal Decree 1021/2015:

"6. "Account number" means the identification number assigned by the financial institution to distinguish it from other accounts opened with it, including in this term an equivalent functional element.

Therefore, the account number is not limited to IBAN or ISIN codes, but may be different depending on the category of financial account, and only in the event that no unique identifier of the declared financial account is available, it must include the characters "NANUM" ( no account number ).

According to the Second Additional Provision of Royal Decree 1021/2015, its standards must be interpreted in accordance with the OECD Comments on the Model Agreement for the Competent Authority and the Common Information Communication Standard, in whose Annex 3 "User Guide to the Standard Common Report", section IVd. Account Number is specified:

"The account number used by the Financial Institution to identify the account in question must be provided. If the Financial Institution does not have an account number, the functional equivalent that the Financial Institution uses to identify the account will be provided. Required for financial institutions that have an account number (including alphanumeric identifiers).

For example: The account number may be that of a Custody Account or a Deposit Account; ii) the code (ISIN or other) related to a Debt or Equity Participation (if not held in a Custody Account), or iii) the identification code of a Cash Value Insurance Contract or an Annuity Contract.

In exceptional cases , where there is no account numbering system, "NANUM" will be used to indicate the absence of the account number, since this is a Validation element. This account number format is the same as that provided for by FATCA and can be used for both structured and free-form account numbers. A non-standard account identifier or insurance contract number may also be included in this field."

Finally, in the event that they have not provided an account number because they have submitted the aggregated information by client , in accordance with the applicable regulations, they should provide the identification numbers of the accounts individually considered , the aggregation by clients not being correct.

In no case will Form 289 include accounts whose ownership or control is held by persons whose sole jurisdiction of tax residence is Spain, even if they are undocumented accounts for which the financial institution should or may know that the ownership or control of said accounts corresponds to a tax resident in Spain.

Yes, it is compulsory.

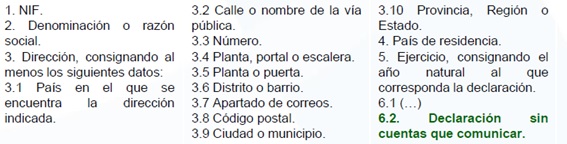

If, after applying the due diligence rules contained in the Annex to Royal Decree 1021/2015, of November 13 (RD of the CRS), it is concluded that there are no accounts subject to communication of information, the content of said declaration will be limited to points 1 to 5, and 6.2 of ANNEX III of Order HAP/1695/2016, of October 25, which approves model 289, after the modification introduced by Order HFP/1351/2021, of December 1.

To facilitate the submission of Form 289 “without accounts to report”, a simple Form called “Form 289” has been enabled. Presentation without accounts to report. "Highs", which is available on the Electronic Office: https://sede.agenciatributaria.gob.es/Sede/en_gb/procedimientoini/GI42.shtml

However, this presentation can also be made through the Web Service.

In accordance with the provisions of article 5.1 d) of Royal Decree 1021/2015, of November 13, which establishes the obligation to identify the tax residence of persons holding ownership or control of certain financial accounts and to report them within the scope of mutual assistance, among the information to be provided corresponding to each of the accounts subject to information communication the balance or value of the account at the end of the calendar year considered must be included . In the case of a cash value insurance contract or an annuity contract, the cash value or surrender value will be taken.

Without prejudice to how the cash value should be determined in accordance with the definition provided in Section VIII.C.8 of the Annex to Royal Decree 1021/2015, in accordance with Section VIII. C. 6 and 8 of the aforementioned Royal Decree, both in the annuity contract and in the insurance contract with cash value, for the purposes of calculating the balance or value of the financial account, the financial institution obliged to communicate information may use, where appropriate, the capitalization value or the redemption value referred to in Order EHA/3481/2008, of December 1, approving model 189 of the annual information declaration on securities, insurance and income.

For these purposes, Law 11/2021, of July 9, on measures to prevent and combat tax fraud, transposing Council Directive (EU) 2016/1164, of July 12 of 2016, which establishes rules against tax avoidance practices that directly affect the functioning of the internal market, modifying various tax rules and the regulation of gambling , has modified article 17 of Law 19/1991, of June 6, on the Wealth Tax , relating to life insurance and temporary or life annuities to which Order EHA/3481/2008, of in accordance with the following wording that must be taken into consideration, if applicable, for the purposes of determining the redemption or capitalization value:

One. Life insurance policies will be computed at their surrender value at the time the tax is due.

However, in cases where the policyholder does not have the right to exercise the right of total redemption on the date of accrual of the tax, the insurance will be computed for the value of the mathematical provision on the aforementioned date in the taxable base of the policyholder.

The provisions of the preceding paragraph shall not apply to temporary insurance contracts that only include benefits in the event of death or disability or other additional risk guarantees.

Two. Temporary or life annuities, established as a result of the delivery of a sum of money, movable or immovable property, must be computed at their capitalization value on the date of accrual of the Tax, applying the same rules as those established for the establishment of pensions in the Tax on Property Transfers and Documented Legal Acts.

However, when temporary or lifelong income is received from life insurance, these will be computed at the value established in section One of this article."

In the case of joint accounts, for the purposes of declaring the account balance in Form 289, each account holder will be assigned the total balance or value of the joint financial account at the end of the calendar year in question. It is also applicable for the purposes of aggregating balances, as set out in points 1 and 2 of section C of Section VII of Annex I of Royal Decree 1021/2015, of November 13, aggregation used to determine whether or not the thresholds established in said Annex are exceeded.

Information relating to other holders of declared joint accounts for whom information is not required in accordance with the provisions of Royal Decree 1021/2015 of 13 November should not be included in Form 289.

No. The amount of the "Income of funds" field of form 291 ( annual information declaration of the Income Tax for Non-Residents. Non-resident accounts without a permanent establishment ) does not correspond to the one that must be declared in the "Interests" field of Form 289.

This is because the "Funds inflows" field is defined in form 291 as the total annual amount by sum of entries to the credit of the account or sum of credits, which does not correspond, strictly speaking, with the concept of interest, as these are the total gross amount in the concept of interest paid or recorded in each case in the account (or in relation to the account) during the calendar year.

The account should not be declared in Form 289 if it is found that the requirements established by Royal Decree 1021/2015, of November 13, are met to consider it as one of the excluded accounts defined in section C.17 of Section VIII of Annex I.

Thus, in letter d) of section C.17 of Section VIII of Annex I, an excluded account is considered to be “an account held solely by the estate if the documentation for that account includes a copy of the will or the death certificate of the deceased .”

Please also note what is stated in number 92 of the Comments to Section VIII of the Common Reporting Standard (CRS):

92 Pursuant to subparagraph C(17)(d), an account relating solely to the estate of an individual may be an Excluded Account if the documentation for that account includes a copy of the decedent's will or death certificate . For this purpose, the Financial Institution Subject to Reporting must consider that the account retains the status it enjoyed prior to the death of the Account Holder until the date on which a copy of the aforementioned documentation is obtained. To determine what is meant by "succession", it is necessary to refer to the specific legislation in this area in each jurisdiction governing the transmission or inheritance of rights and obligations in the event of death (such as the rules on universal succession).

You can access these Comments through the section “ Additional information on the CRS in the OECD ” which is available on the OECD Electronic Office.

In short, the financial accounts of deceased clients must be included in Form 289 if the requirements described above are not met.

The information must be declared in the currency in which the account is denominated, and the currency used must be identified.

If a financial account is denominated in more than one currency, the financial institution may choose to report the information in only one of them, and must identify the currency used (See Comment 23 of Section I of the OECD Common Reporting Standard).

However, if this option is not exercised, in these cases of multi-currency accounts, the financial institution could declare the information in the different currencies in which the balances or other amounts of the account are denominated, so that it will present as many records as there are different currencies for that account.