FAQs

The month of February.

From the tax return for 2018, to be filed in 2019, the filing date will be February.

No, they are excluded from this obligation.

It will be provided in general broken down quarterly , except for the one related to:

-

to the amounts received in cash, which will continue to be supplied on an annual basis.

-

to the amounts declared by taxpayers who carry out operations to which the special cash basis regime of Law 37/1992, of December 28, on Value Added Tax is applicable, and the entities to which Law 49/1960, of July 21, on horizontal property, is applicable, which are required to provide all the information that they are required to relate in their annual declaration, on an annual calculation basis.

-

to the amounts declared by taxpayers who are recipients of operations included in the special cash-based regime, who will be required to provide the information corresponding to these operations on an annual basis.

No.

Regarding the information corresponding to the 2016 fiscal year and previous years, taxpayers registered with REDEME were not required to submit Form 347 as they were required to submit Form 340.

Regarding the information corresponding to fiscal year 2017 and following years , taxable persons registered with REDEME are not required to present form 347, since they are required to keep their VAT registration books through the electronic headquarters of the AEAT. (they are included in the SII)

A taxable person who ceases to be in REDEME with effect from July 1, 2017, and, furthermore, as of this date, does not incur any other circumstance to be included in the obligation to keep the VAT Record Books through the electronic headquarters of The AEAT (not included in the SII), will have the following formal obligations regarding the 2017 financial year:

- Regarding the first half of 2017, you are required to submit Form 340.

- Regarding the second half of 2017, you may be required to submit Form 347, in accordance with the provisions of Articles 31 to 35 of Royal Decree 1065/2007, of July 27. The calculation of the amounts of this obligation, generally 3,005.06 euros, must be computed with respect to the entire fiscal year. Therefore, all operations that do not fully coincide with those already declared in Form 340 must be included in Form 347. (In the event that Form 340 has related transactions with a third party that have only taken place during the period in which said declarations were submitted, they will not have to be related in Form 347.)

In these cases the exemption from Form 390 does not apply.

The operations will be deemed to have occurred in the period in which the registration of the invoice serving as proof must be made.

-

The invoices issued must include notes at the time of liquidation and payment of the tax corresponding to said operations.

-

Invoices received must be recorded in the order in which they are received and within the settlement period in which their deduction is to be made.

However, the operations to which the special cash basis regime is applicable will also be recorded in the calendar year corresponding to the moment of total or partial accrual in accordance with the special accrual rule of this special regime.

Yes. In the event that the invoice is received by the client and is registered in a quarterly period different from that in which it was issued by the supplier, differences will arise.

Example: Company X sold to Y for an amount of 10,000 euros on March 20, 2014. Company Y received the invoice on April 30 and recorded it in the book of invoices received on that date.

In 347 X the indicated operation must be included, with the key “B”, in the box corresponding to the 1st Quarter and in 347 Y it will be included, with the key “A” in the box corresponding to the 2nd Quarter.

These changing circumstances must be reflected in the calendar quarter in which they occurred, provided that the result of these changes, together with the rest of the operations carried out with the same person or entity in the calendar year, exceeds the figure of 3,005.06 euros.

Example 1: In January 2014, entity X (not a large company) sold to Y for an amount of 4,000 euros. After 6 months, X has not received this amount, so he/she takes the relevant steps to modify the tax base in the last quarter of 2014. How do you declare these operations in 347? You do not need to file Form 347 because the annual amount of the transactions, in absolute value, is less than 3,005.06 euros:

Annual amount of operations = 0 = Sale (4000) – Modif. BI (-4.000)

Example 2: In December 2013, entity X sold to Y for an amount of 20,000 euros. In the first quarter of 2014, entity X receives a return of goods from a previous sale worth €4,000. How do you declare these operations in 347? In this case, you must declare the operations in 347 since it is taken into account that the absolute value of the operations carried out in the same calendar year exceeds 3,005.06 euros.

Fiscal year 2013: Key “B”.

Annual amount of operations = 20,000 euros

Amount 1T=0

2T Amount=0

Amount 3T=0

Amount 4T=20,000

Fiscal year 2014: Key “B”

Annual amount of operations = - 4,000

Amount 1T= - 4,000

2T Amount=0

Amount 3T=0

4T Amount=0

Yes. As long as the annual amount of the operations exceeds €3,005.06, in its absolute value (without sign). This amount will be stated in the tax return with a minus sign.

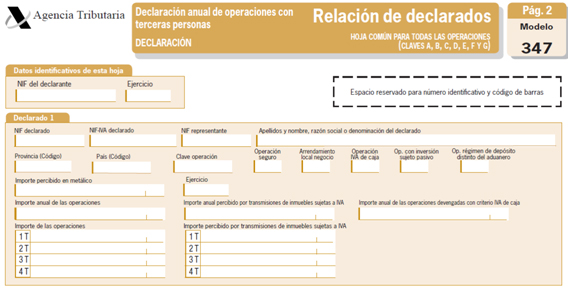

They must be declared in the same registry as the rest of operations, but separately in the boxes corresponding to the quarterly and annual amounts received from operations corresponding to transfers of real estate subject to VAT .

On the other hand, in the boxes corresponding to Annual amount of operations and Quarterly amount of operations the amount of the operations will be recorded, including the transfers of real estate, but excluding the amounts of insurance operations (insurance entities) and leases, which must be recorded in a separate register.

Taxpayers subject to the special cash-basis regime must report transactions subject to the special cash-basis regime in accordance with the general accrual rule and also in accordance with the special accrual rule specific to the special regime.

Furthermore, all information that they are required to provide in the declaration must be provided on an annual basis.

Example:Supplier X applies to the new cash VAT regime in 2014. In February 2014, it issues 1 invoice to company X for an amount of 4,000 euros. In November 2014, Company X pays 2,500 euros, leaving 1,500 euros pending to be paid in fiscal year 2015. How does supplier X declare these operations in 347?

In 2014:

“Operation key” = “B”.

“Cash VAT operation”.

“Annual amount of operations” = 4,000 euros.

“Annual amount of operations accrued with cash VAT criteria” = 2,500.

In 2015:

“Operation key” = “B”.

“Cash VAT operation”.

“Annual amount of operations” = 0 euros.

“Annual amount of operations accrued with cash VAT criteria” = 1,500.

The taxpayers who are recipients of the operations included in the

special cash basis regime must report them in accordance with the general accrual rule and also in accordance with the special accrual rule specific to the special regime.

Furthermore, information relating to these operations included in the special cash basis regime must be provided on an annual basis.

Example:Businessman X is a tenant of a business premises from company Z, which has adopted the special cash basis regime in 2014. The annual rent for the 2014 financial year amounts to 10,000 euros, which is paid in full by businessman X in the same financial year 2014. How does businessman X declare these operations in 347?

In 2014:

“Operation key” = “A”.

“Cash VAT operation” and “Local business lease”

“Annual amount of operations” = 10,000 euros.

“Annual amount of operations accrued with cash VAT criteria” = 10,000 euros.

Starting in 2014, entities to which Law 49/1960 of 21 July on horizontal property applies must also report in their annual Declaration of transactions with third parties the general acquisitions of goods or services that they make outside of their business or professional activities, even if they do not carry out activities of this nature.

These entities must report all their operations on an annual basis.

Example: The community of owners H does not carry out any business or professional activity. During 2014, renovations were carried out in the common areas for an amount of 20,000 euros. In addition, fuel costs for the 2014 financial year amount to 40,000 euros. How should these operations be reported in the Declaration?

Fiscal year 2014:

For reform operations, the following Declaration must be submitted:

“Operation key” = “D”.

“Annual amount of operations” = 20,000 euros.

Fuel costs do not need to be reported, since they are excluded from the obligation to report electricity, water and fuel supply operations provided that their destination is community use and consumption. Also excluded are operations derived from insurance whose object is the insurance of assets and rights related to common areas and elements.