Forms of presentation and payment of model 210

1. PAPER PRESENTATION WITHOUT ELECTRONIC CERTIFICATE.

Beforehand, you must complete the form available on the Tax Agency website in the “Pre-declaration” section, in the “Model 210” subsection. Accruals 2018 and subsequent years. Form for submission (pre-declaration)”:

1.1 PAYMENT FROM SPAIN BY DEPOSIT

You can make the presentation and payment by paying at a bank located in Spain that is a collaborating entity of the Tax Agency in the collection of taxes.

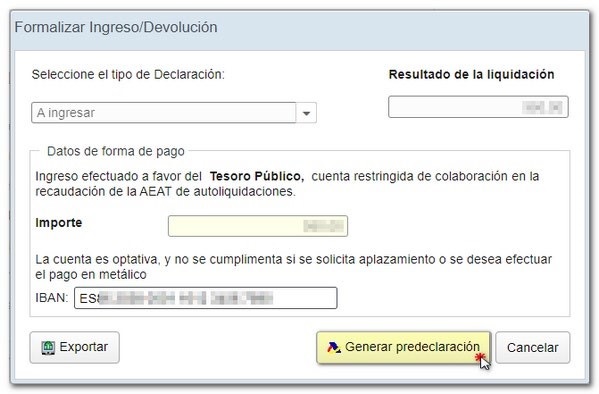

You can optionally indicate the IBAN account number from which the payment will be made; This field must be left blank if you are going to request a deferral or pay in cash. Finally, click "Generate pre-declaration".

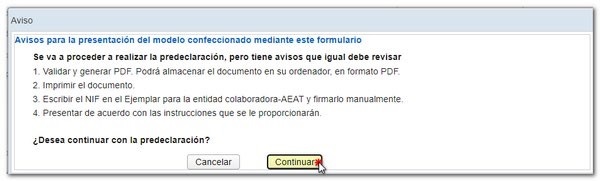

Before obtaining the PDF, a notice will be displayed with the procedure to be followed to make the pre-declaration submission effective.

The PDF will be generated with the submission instructions, the "Copy for the taxpayer/representative" or "Copy for the jointly liable party/withholder" and a copy of the Income or Refund Document for the Collaborating Entity or Administration.

For security reasons, after printing the document, you must write the NIF on all copies of the Income or Refund Document and sign it manually. We recommend that you carefully read the instructions included in the pre-declaration regarding the places of submission, the method of payment and the additional documentation.

When documentation must be attached, it will be placed in the general return envelope or in an ordinary envelope and, once the concept “NON-RESIDENT INCOME TAX” and the proof number of the income document that appears in the self-assessment have been stated on it, the envelope may be left at the collaborating entity that will send it to the Tax Agency, or it may be presented, in person or by certified mail, at the competent Delegation of the Tax Agency or Administrations dependent on it, or at the Central Delegation of Large Taxpayers or in the corresponding Large Company Management Units, as regards those made by taxpayers assigned to them.

1.2 PAYMENT FROM ABROAD BY TRANSFER (from 1/6/22 for accrual year 2018 and following).

The applicable regulations are article 14 of Order EHA/3316/2010, of December 17, which approves self-assessment forms 210, 211 and 213 of the IRNR, which is modified, with effect from June 1, 2022, by Final Provision 1.3 of Order HFP/915/2021, of September 1. Therefore, for self-assessments submitted from June 1, 2022, a new procedure is established. The most notable new feature in relation to the previous procedure is that transfers are made to an account owned by the AEAT that has been opened by the collaborating entities that adhere to this procedure, instead of being made to the bank account opened, until then, at the Bank of Spain.

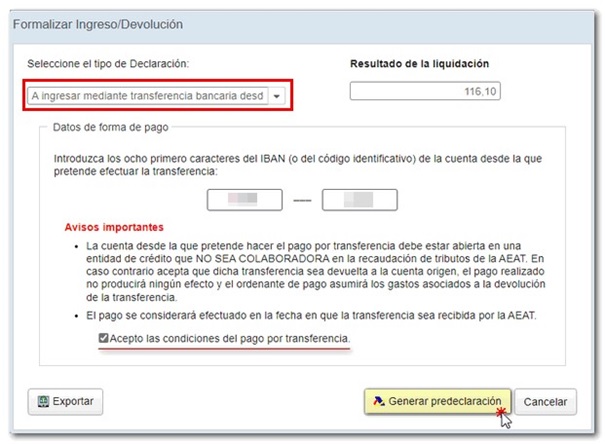

Therefore, from 1/6/22 for the accrual year 2018 and subsequent years, in the case of payment by transfer from a bank account opened in a NON-COLLABORATING Credit Institution, when formalizing the payment, you must choose the payment method "Deposit by transfer from abroad" and it will be necessary to indicate the first 8 characters of the IBAN from which you intend to make the payment and check the box "I accept the conditions of payment by transfer". Finally, click "Generate pre-declaration".

When generating the pre-declaration, the system provides the taxpayer with the identification data of the AEAT account opened in a collaborating entity to which the transfer must be made and a payment identifier that must be used in the “concept” field of the transfer. The validity of the payment identifier will expire within thirty calendar days from the date it was obtained.

It is essential that the “concept” field of the transfer contains ONLY AND EXCLUSIVELY the payment identifier mentioned in the previous paragraph, since, otherwise, the transfer could be returned to its original account, without producing any liberating effect before the AEAT.

Once the form has been validated, a document adjusted to model 210 is generated.

The collaborating entity must compare the data provided by the AEAT with the information appearing in the transfer received.

The payment date will be the date of the payment into the corresponding AEAT account provided that the payment details have been validated.

Once the above requirements have been met, you can obtain proof of payment from the Electronic Office.

The documentation that, where applicable, must be attached must be sent, together with the copy for the collaborating entity/Administration of the payment/refund document, in an ordinary envelope addressed to the National Tax Management Office. The envelope will contain the self-assessment model number (model 210), as well as the name and address of said body (Tax Agency). Department of Tax Management. National Tax Management Office. IRNR model 210; C/ Lérida 32-34 [General Registry] 28020-Madrid).

If you wish, you can expand the information by consulting the “Non-resident taxation manual” in the section “Presentation in paper format” the point dedicated to “Presentation from abroad” and specifically, “Special procedure for the presentation, from abroad, of self-assessments 210 with a result to be paid, made by the taxpayer, without an electronic certificate”, through the following link:

Tax Agency: Forms of presentation of model 210

2. ONLINE SUBMISSION WITH ELECTRONIC CERTIFICATE

Beforehand, you must complete the form available on the Tax Agency website in the “Presentations” section, in the “Model 210” subsection. Accruals 2018 and subsequent years. Presentation":

2.1 IN-PERSON OR TELEMATIC PAYMENT IN SPANISH COLLABORATING ENTITIES

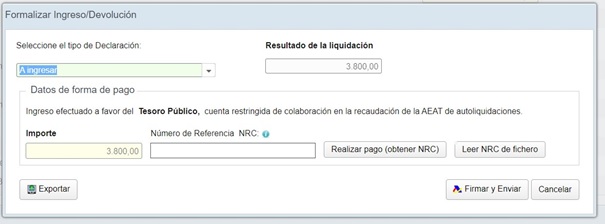

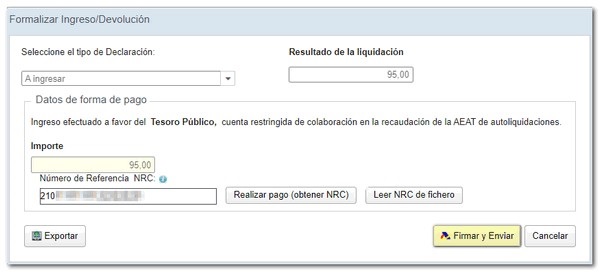

Before submitting the self-assessment, you must establish communication with a bank that collaborates in the collection process, electronically or by visiting their offices, to make the payment and obtain a NRC (Complete Reference Number), which you must also include when submitting the self-assessment.

Tax returns and self-assessments required by tax regulations that result in a payment due, and for which direct debit has not been selected as a form of payment, need an NRC (Complete Reference Number) to be correctly received by the Tax Agency: code generated to identify the tax income generated.

The Electronic Office offers the possibility of obtaining an NRC through its payment gateway by direct debit, card or Bizum. The "Make Payment (Get NRC)" button that will be enabled in the form or program for filing the declaration must be used when selecting the payment method that involves a payment, whether partial or total.

To make the payment it is necessary to have a certificate or electronic ID.

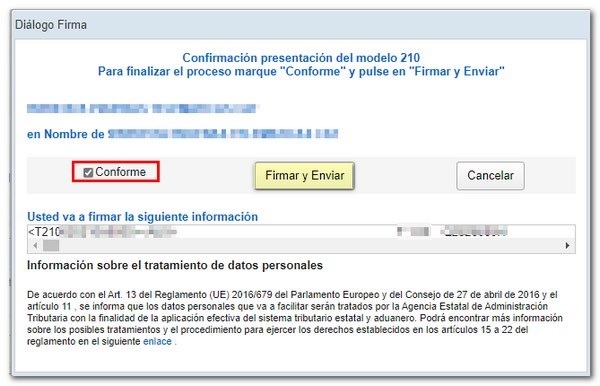

To continue with the submission, click " Sign & Submit ".

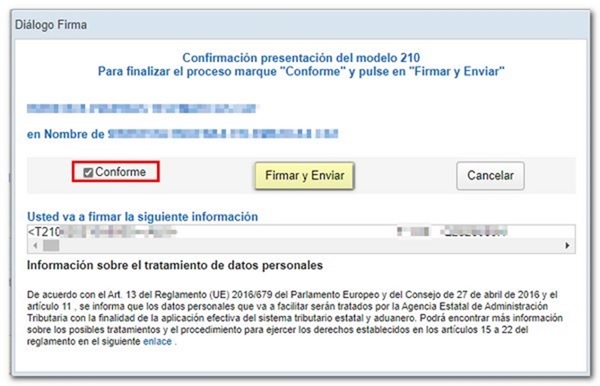

The program will request confirmation of the submission. If it is correct, check the "I agree" box and click "Sign and Send."

The result of a successful submission will be a response page with the text "Your submission has been successfully completed" with an embedded PDF containing a first page with the submission information (registration entry number, Secure Verification Code, receipt number, day and time of submission and the submitter's details) and, on subsequent pages, the complete copy of the declaration.

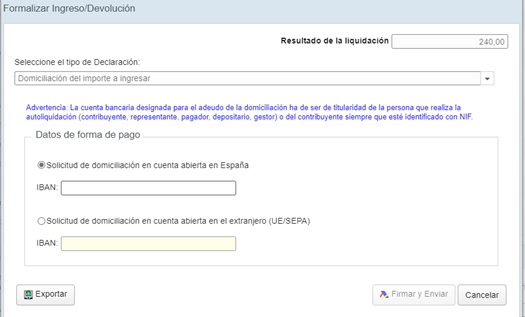

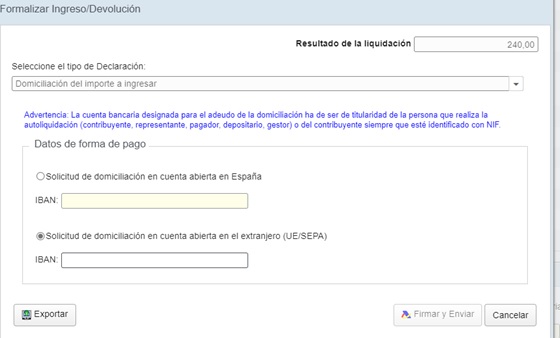

2.2 PAYMENT BY DIRECT DEBIT

With the exception of self-assessments corresponding to income derived from the transfer of real estate, in the case of electronic submission, the payment of debts resulting from self-assessments 210 may be domiciled, within the following periods:

-

In general: from April 1st to 15th, July, October or January. In the case of annual grouping of income, accrued since 2024, from leased or subleased properties, from January 1 to 15 of the year following the accrual.

-

In the case of imputed income from urban properties, income type 02: from January 1st to December 23rd.

-

From November 30, 2021 a split in the direct debit account is allowed. In any case, even when the self-assessment is transmitted by a social collaborator, the account designated for the direct debit must necessarily be owned by the person who makes the self-assessment (in any of its forms: taxpayer, representative or jointly liable party) or the taxpayer.

2.2.1. IN OPEN ACCOUNT IN SPAIN

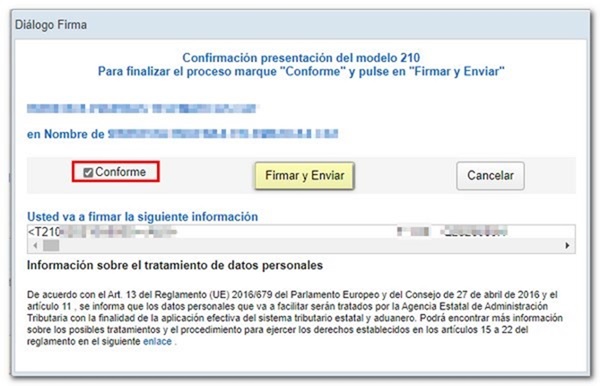

To continue with the submission, click " Sign & Submit ".

The program will request confirmation of the submission. If it is correct, check the "I agree" box and click "Sign and Send."

The result of a successful submission will be a response page with the text "Your submission has been successfully completed" with an embedded PDF containing a first page with the submission information (registration entry number, Secure Verification Code, receipt number, day and time of submission and the submitter's details) and, on subsequent pages, the complete copy of the declaration.

2.2.2. ON AN OPEN ACCOUNT ABROAD (EU/SEPA)

From February 1, 2024 direct debits can be ordered from accounts opened in non-collaborating entities of the SEPA Zone (the SEPA Zone is made up of the following thirty-six countries: the twenty-seven Member States of the European Union, Iceland, Liechtenstein, Norway, Andorra, Monaco, San Marino, Switzerland, the United Kingdom and the Vatican City State).

According to the procedure, even if the account into which the person obliged to pay is opened in a non-collaborating entity, the effective management of the direct debit will be carried out through a credit institution that is collaborating. This provides a solution for all those cases in which those who wish to pay their debts to the State Tax Authority domiciled and do not have an account open in Spain.

During the course of electronic submission of the self-assessment, the electronic signature of the debit mandate will be required. By this mandate, the owner of the direct debit account data authorizes:

-

To the State Tax Administration Agency to send debit instructions to the entity in which the account designated by it to debit the direct debit amount is located.

-

To the entity in which the direct debit account is opened for making direct debits, following the instructions received for this purpose from the State Tax Administration Agency.

The designation of the collaborating entity in charge of managing each direct debit in accounts opened in non-collaborating entities within the SEPA Zone, in the event that there is more than one participating entity, will be carried out by the party liable for payment, at the time of submitting the electronic self-assessment.

The party liable for payment will be charged all commissions and bank charges that the State Tax Administration Agency must pay to the participating collaborating entities for carrying out the necessary banking procedures in the procedure. If there are several entities participating in the direct debit process, the entity you wish to use can be selected in the payment component. The commission charged by the entities will be reported at all times (currently no commission is charged by the only participating entity).

When the entity in which the account of the person obliged to pay is opened charges the account for an amount less than the sum of the direct debit debt and the amount of the commissions/expenses passed on to the obliged party, the participating collaborating entity will proceed to refund the full amount received.

Once the payment has been received correctly, the person obliged to pay may obtain the corresponding proof of payment from the electronic office of the State Tax Administration Agency.

In any case, the date on which the direct debit amount is debited shall be stated on said receipt as the payment date, unless the right to a refund under article 48.2 of Royal Decree-Law 19/2018, of November 23, on payment services and other urgent financial measures, is exercised within the period referred to in article 49.1 of the same regulatory text.

To continue with the submission, click " Sign & Submit ". The program will request confirmation of the submission. If it is correct, check the "I agree" box and click "Sign and Send."

The result of a successful submission will be a response page with the text "Your submission has been successfully completed" with an embedded PDF containing a first page with the submission information (registration entry number, Secure Verification Code, receipt number, day and time of submission and the submitter's details) and, on subsequent pages, the complete copy of the declaration.

And the following mention is added to the presentation receipt:

DOMICILIATION OF THE AMOUNT TO BE PAID

Payment will be made directly to an account in a non-collaborating entity in the SEPA Zone.

2.3 PAYMENT BY TRANSFER FROM ABROAD (for accrual year 2019 and subsequent years).

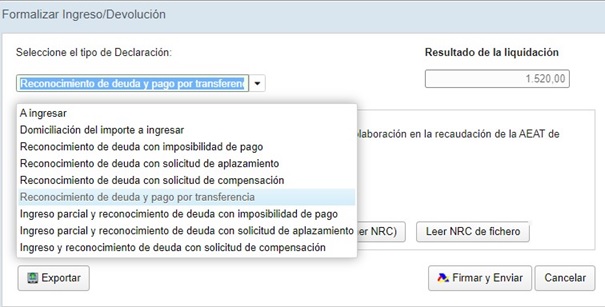

When you submit the self-assessment electronically, you must choose the payment method " Acknowledgement of debt and payment by transfer ".

The AEAT recovers the data from the previous electronic submission of the self-assessment except for the one referring to the IBAN/code (or, where applicable, BIC/SWIFT) of the account from which the transfer is to be made, which must be completed by the interested party.

The system will indicate the IBAN of the destination account and generate a Payment Identifier (with a validity period of 30 calendar days).

In the transfer from the source account to the destination account, the “Transfer Concept” field will include ONLY AND EXCLUSIVELY the Payment Identifier, without recording any other additional data.

Transfers, which must be made in euros, are made to an “AEAT Transfer Account” that will be opened by the collaborating entities that adhere to this procedure, taking into account that the source account cannot be an account opened in a collaborating entity.

Collaborating entities must compare the information from the AEAT with the transfers received and incorporate the transaction data into their systems for subsequent sending to the AEAT. In addition, once the income received has been identified, the amount must be entered into the corresponding restricted account.

If it is not possible to identify the data of the received transfer, or if the Payment Identifier does not appear in the “Transfer Concept” field or is incomplete or inaccurate or its validity period has expired, or if the payment is made in a currency other than the euro, the transfer will be returned to the issuer, with the sender being responsible for any costs and commissions that may arise.

For tax collection purposes, the payment to the Treasury is considered to occur on the date of payment into one of the restricted accounts, provided that the data of the transfer received has been correctly validated.

Proof of payment: A proof of payment can be obtained from the Tax Agency's electronic office when the collaborating entity has confirmed receipt of the transfer to the AEAT and the amount has been paid into the corresponding restricted account. To do so, the person obliged to pay must correctly identify himself and indicate the Payment Identifier.

If you wish, you can expand the information by consulting the “Non-resident taxation manual” in the section “Telematic submission via the Internet” the point dedicated to “Self-assessments 210 to be paid. Procedure for payment of self-assessments by transfer from abroad by persons without an account in a collaborating entity”, through the following link: