Form 202. Instructions for tax periods beginning in 2023 and following

PAYMENT IN INSTALMENTS

CORPORATION TAX

NON-RESIDENT INCOME TAX (PERMANENT ESTABLISHMENTS AND ENTITIES

UNDER THE ATTRIBUTION REGIME OF INCOME ESTABLISHED ABROAD WITH PRESENCE IN SPANISH TERRITORY)

Instructions

Tax periods 2023 and later

Form 202 will be submitted exclusively online.

1) IDENTIFICATION

The identifying data of the declarant will be recorded: NIF and surnames and name or company name.

Entities that jointly pay taxes to the State and the Provincial Councils of the Basque Country and/or the Foral Community of Navarre, to which the corresponding regional regulations on Corporate Tax apply according to the provisions of the Economic Agreement with the Autonomous Community of the Basque Country or the Economic Agreement between the State and the Foral Community of Navarre, will also tick the box that corresponds to them from those listed at the bottom of this section and will complete the declaration form with the data that is compatible with their respective regional regulations in order to be able to enter into Common Territory the corresponding part of the regional fractional payment. These entities will record in their declarations the fields of identification, accrual, basis of the fractional payment (code 01, code 16 or code 19), volume of operations in Common Territory (%) (code 29) and the amount to be entered (code 03 or code 34).

2) ACCRUAL

Exercise : The four digits of the year in which the split payment is to be made must be entered in this box.

Period : The following code will be entered in this box, depending on the month in which the split payment is to be made: 1/P for payment to be made in the first twenty calendar days of the month of April, 2/P for the payment corresponding to the same period in the month of October and 3/P for the payment corresponding to the same period in the month of December.

Taxpayers subject to the regulations of the Navarra regional territory will mark 2P as the period code. Taxpayers subject to the regulations of the regional territory of Guipúzcoa, Vizcaya or Álava will mark 0A as the period code.

Tax period start date : The start date of the tax period will be entered in this box with six digits DD/MM/YY (D = day, M = month, Y = year).

C.N.A.E. main activity: The four-digit code for the National Classification of Activities will be entered

Economic that corresponds to the activity with the highest volume of operations.

3) ADDITIONAL DATA

The data declared in this section are linked to the fields to be completed in section 4 Settlement. In case of subsequent modification, check the content of said section.

Entity that applies the regime of Law 49/2002, of December 23 : This key will be used by entities that are subject to the special regime provided for in Law 49/2002, of December 23, which regulates the Tax Regime for Non-Profit Entities and tax incentives for patronage.

Entity that applies the regime of Law 11/2009, of October 26 : This key will be used by entities that are subject to the special regime provided for in Law 11/2009, of October 26, which regulates Listed Public Limited Companies for Investment in the Real Estate Market.

Venture capital entity that applies the special tax regime of art. 50 LIS : This key will be used by venture capital entities regulated by Law 22/2014, of November 12, exempt from the obligation to make the minimum fractional payment applicable to large companies.

Entity that applies the regime of shipping entities based on tonnage : This code will be used by entities that are subject to the special regime for shipping entities based on tonnage, provided for in Chapter XVI of Title VII of Law 27/2014, of November 28, on Corporate Tax (hereinafter LIS).

In the case of entities whose tax base is determined in part according to the objective estimation method and in part by applying the general tax regime (activities not included in the special regime), they will also mark in this section the key “other entities with the possibility of applying two tax rates” and enter 25/25N in the key “corporate tax rate for the current year”. In cases where the split payment is submitted directly (without using the form) due to space restrictions in the definition of the "Additional data - Corporate Tax rate for the current year" field, the value "25/25" must be entered instead of the value "25/25N".

Entities that meet the requirements of art. 101 LIS and apply the tax rate of art. 29.1, 1st paragraph LIS : This code will be used by entities that meet the requirements of article 101 of the LIS and in turn apply the general tax rate of 25%.

Net turnover for the twelve months prior to the start date of the tax period is greater than 6,000,000 euros : This box will be checked by entities that in the twelve months immediately prior to the date on which the tax period begins, have had a turnover greater than 6,000,000. In this way, they will be obliged to calculate the fractional payment in accordance with the provisions of article 40.3 of the LIS.

Fiscally protected cooperative : This key will be marked by entities that are considered fiscally protected, in accordance with the provisions of Law 20/1990, of December 19, on the Tax Regime of Cooperatives.

Check this box if ANY of the following circumstances apply :

-

Entity that applies the Reserve for investments in the Canary Islands or is entitled to the bonus of art. 26 Law 19/1994 : This box must be ticked for the purposes of taking into account the reduction of the tax base or the amount to be paid, as provided for in sections 1 and 2 of Additional Provision Five of the LIS, respectively, by entities that apply a reserve for investments or that are entitled to the bonus of art. 26 of Law 20/1994. For these purposes, the corresponding boxes in section 5, Additional information, must also be completed.

-

Entity that applies the ZEC regime :

This box shall be ticked for the purposes of determining the minimum amount to be paid as provided for in letter a) of section 1 of the Fourteenth Additional Provision of the LIS and for the purpose of not computing that part of the positive result that corresponds to the percentage indicated in article 44.4 of Law 19/1994 (unless the provisions of article 44.6 b) of Law 19/1994 apply), those entities that apply the regime of the Canary Islands Special Zone. For these purposes, the corresponding box in section 5, Additional information, must also be completed.

Taxpayers who have branches in the Canary Islands Special Zone of entities with tax residence in Spain that form part of a tax group that applies the tax consolidation regime, must separately declare the part of the tax base attributable to the branch in the Canary Islands Special Zone. Each of these entities must submit the advance payment of this tax in its corresponding form 202, all of this, without prejudice to form 222 that the dominant entity must submit for the part of the taxable base that is not taxed at the special rate and for which it will apply a special tax consolidation regime.

-

Entity that applies the Ceuta and Melilla bonus art. 33 LIS :

They will tick this box, in order to determine the minimum amount to be paid provided for in letter a) of section 1 of the Fourteenth Additional Provision of the LIS and with the aim of reducing from it 50% of that part of the positive result that corresponds to income that is entitled to the bonus provided for in article 33 of the LIS. For these purposes, the corresponding box in section 5, Additional information, must also be completed.

-

Entity with positive results from capital increase operations or equity by offsetting credits that are not included in the tax base by application of article 17.2 LIS :

This box will be checked by entities that have had positive results from capital increase operations or equity by offsetting credits that are not included in the tax base by application of article 17.2 of the LIS, in order to exclude said amounts from the minimum amount to be paid provided for in the Fourteenth Additional Provision of the LIS. For these purposes, the corresponding box in section 5, Additional information, must also be completed.

-

Partially exempt entity that applies the special tax regime Chap. XIV Title. VII LIS:

This box will be checked by partially exempt entities to which the special tax regime established in Chapter XIV of Title VII of the LIS applies, for the purposes of determining the minimum amount to be paid provided for in the Fourteenth Additional Provision of the LIS, since in these cases the positive result will be taken exclusively for non-exempt income. For these purposes, the corresponding box in section 5, Additional information, must also be completed.

-

Entity that applies the bonus of article 34 LIS :

This box will be checked by entities that apply the bonus for the provision of local public services provided for in article 34 of the LIS, for the purposes of determining the minimum amount to be paid provided for in the Fourteenth Additional Provision of the LIS, since in these cases the positive result will be taken exclusively for non-bonus income. For these purposes, the corresponding box in section 5, Additional information, must also be completed.

Other entities with the possibility of applying two tax rates : This code will be used by entities not included in the previous codes with the possibility of applying two types of tax.

Corporate Tax rate for the current year : The applicable tax rate(s) will be stated in the corporate tax return.

Entity with net turnover of the immediately preceding tax period less than 1 million euros : This key will be used by entities with a net turnover of less than 1 million euros in the immediately preceding tax period, to which the 23% tax rate applies in the corporate tax return.

Net amount of turnover in the twelve months preceding the start date of the tax period : This code will be entered in the corresponding section by entities with a net turnover of 10 million euros or more in the twelve months prior to the start date of the tax period.

4) SETTLEMENT

CORPORATION TAX PAYERS

Corporate Taxpayers will calculate the split payment as follows:

A) CALCULATION OF THE PARTIAL PAYMENT: MODALITY ARTICLE 40.2 LIS

KEY [01]. CALCULATION OF THE PARTIAL PAYMENT BASE.

-

In the case of entities that pay taxes exclusively to the State, the full amount of the last tax period whose regulatory declaration period expired on the 1st of the corresponding month of those indicated in the previous point will be taken as the basis for the split payment, less the deductions and bonuses as well as the withholdings and payments on account corresponding to that period, provided that said tax period was of annual duration.

-

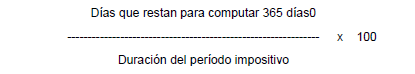

If the duration of the last base tax period was less than one year, the immediately preceding tax periods must be considered up to a minimum period of 365 days. In this case, the basis for the split payment will be determined by the algebraic sum of the installments of the tax periods considered.

If the period covered by the computed tax periods exceeds the minimum of 365 days, for the purposes of the aforementioned algebraic sum, the following percentage of the tax period's quota will be taken as the quota for the most remote tax period:

-

Spanish economic interest groups and temporary business associations registered in the special registry of the Ministry of Economy and Finance will take as the basis for the split payment the full quota corresponding to the part of the taxable base that corresponds to non-resident partners, reduced by the concepts mentioned in letter a) above that, in direct proportion to their percentage of participation, corresponds to the aforementioned partners.

The entities mentioned in the previous paragraph, therefore, are not obliged to make fractional payments when the percentage of participation in them corresponds, in its entirety, to partners or members resident in Spanish territory.

-

In the event of a merger, the basis for the fractional payments corresponding to the first tax period after the operation has been carried out will be determined by the algebraic sum of the bases that would have resulted in the transferring companies if the operation had not been carried out.

Otherwise, when there is no base tax period or this is the first since the transaction was carried out and lasts less than a year, the data from the immediately preceding tax periods of the transferring companies will be computed.

In an absorption operation and once it has been carried out, the base of the fractional payments of the acquiring company corresponding to the tax period in which it was carried out will be increased by the bases of the fractional payment of the transmitting companies that would have resulted if said operation had not been carried out. Otherwise, and as long as the base tax period does not cover a minimum period of 365 days for the company, once such operation has been carried out, the data from the immediately preceding tax periods of the transferring companies will also be computed.

- In the case of entities that must jointly pay taxes to the State and the Provincial Councils of the Basque Country and/or the Foral Community of Navarre, to determine the basis for the fractional payments that must be made, where applicable, to each of these Administrations, the proportion that, with respect to the total, represents the volume of operations carried out in each determined territory will be applied based on the proportion of the volume of operations carried out in each territory determined in the last tax return-settlement.

KEY [02]. RESULT OF THE PREVIOUS DECLARATION (EXCLUSIVELY IF THIS IS COMPLEMENTARY).

If this declaration is complementary to another one previously submitted for the same concept and period, the amount of the previously paid installment payment will be entered in this box. In this case, in section 6 Supplementary, the electronic code assigned to said declaration must be stated.

KEY [03]. TO ENTER.

It will be the result of applying the percentage of 18% to the amount calculated as the basis for the fractional payment (key [01]) in each of the periods of April, October or December.

In the event that this declaration is complementary to a previous one (see section 6 of these instructions), the amount calculated according to what is expressed in the previous paragraph must be subtracted from the amount of the fractional payment that was entered at the time (key [02]).

The amount to be entered must be expressed with two decimals. For this purpose, if necessary, the amount will be rounded up or down to the nearest cent. In the event that the last figure of the amount obtained as a result of applying the percentage to the base of the split payment is exactly half a cent, the rounding will be carried out to the next higher figure.

B) CALCULATION OF THE PARTIAL PAYMENT: MODALITY ARTICLE 40.3 LIS

This system is optional, except for the exceptions discussed below, and is applicable to those taxpayers who voluntarily decide to apply it. To this purpose, they must exercise the option in the corresponding census declaration during the month of February of the calendar year starting from which it is to take effect, provided that the tax period to which the said option refers coincides with the calendar year. Otherwise, the option must be exercised in the corresponding census declaration, during the period of two months from the beginning of said tax period or within the period between the beginning of said tax period and the end of the period to make the first fractional payment corresponding to the aforementioned tax period when this last period is less than two months.

Once the option has been made, the taxpayer will be bound to this split payment method for payments corresponding to the same tax period and subsequent ones, as long as its application is not waived through the corresponding census declaration, which must be made within the same time periods established in the previous paragraph.

Notwithstanding the above, in any case, taxpayers whose turnover in the twelve months prior to the start date of the tax period is greater than 6,000,000 euros, as well as taxpayers who have opted for the special tax regime established in Chapter XVI of Title VII of the LIS (taxation regime for shipping entities based on tonnage) are obliged to make the fractional payments using this system.

These latter taxpayers must take into account that the application of the modality established in article 40.3 of the LIS will be carried out on the taxable base calculated in accordance with the rules established in article 114 of the aforementioned Law and applying the percentage referred to in article 115 of the same legal text, without computing any deduction on the part of the quota derived from the part of the taxable base determined according to the provisions of article 116.

Spanish economic interest groups and temporary business associations registered in the special register of the Ministry of Economy and Finance will not be required to make split payments with respect to the part of the taxable base corresponding to partners resident in Spanish territory, nor will said taxable base form part of the split payment base. Therefore, the aforementioned entities are not obliged to make fractional payments when the percentage of participation in them corresponds, in its entirety, to partners or members resident in Spanish territory.

In the case of taxpayers who pay taxes jointly to the State and the Provincial Councils of the Basque Country and/or the Foral Community of Navarre, the basis for the split payment will be the proportional part that corresponds to each of these Administrations, taking into account the volume of operations carried out in each territory determined according to the volume of operations carried out in each territory according to the last tax return-settlement.

CALCULATION OF THE PARTIAL PAYMENT BASE.

Taxpayers who have chosen to make the split payment in accordance with the provisions of section 3 of article 40 of the LIS, will take as the basis of the split payment the part of the taxable base of the period of the first three (corresponding to 1/P), nine (corresponding to 2/P) or eleven months (corresponding to 3/P) of each calendar year, determined according to the rules of the Corporate Tax Law taking into account, where applicable, the limits for the compensation of negative tax bases from previous years.

Taxpayers whose tax period does not coincide with the calendar year will make the fractional payment on the part of the tax base corresponding to the days elapsed from the beginning of the tax period until the day before the beginning of each of the periods of payment of the fractional payment for the months of April, October and December, as applicable. In these cases, the instalment payment is on account of the payment for the tax period in progress on the day before the beginning of each of the above-mentioned payment periods.

KEY [04]. ACCOUNTING RESULT (AFTER INCOME TAX).

The result of the profit and loss account after Corporate Tax will be recorded in key [04].

KEYS [05] AND [06]. CORRECTION FOR CORPORATION TAX.

The amount corresponding to the increases in the result of the Profit and Loss account for Income Tax will be recorded in key [05] and the amount corresponding to the decreases in key [06].

KEY [37]. Reversal of 30% of the amount of amortization expenses. ACCOUNTING (ART. 7 LAW 16/2012).

The amount corresponding to the decreases due to the reversal of the adjustments made during the tax periods beginning in 2013 and 2014 by entities that are not considered small in size and that, as a result of the provisions of article 7 of Law 16/2012, of December 27, had to provide an increase to the result of the profit and loss account, will be recorded in key [37].

KEYS [07] AND [08]. OTHER CORRECTIONS TO ACCOUNTING RESULT, EXCEPT COMP. BI NEGATIVE E.G. ANT.

The amount corresponding to the total increases to the result of the Profit and Loss account, except for the correction for Corporate Tax and the adjustment for the limitation on tax-deductible amortizations, will be recorded in key [07], and the amount corresponding to the decreases will be recorded in key [08].

KEYS [38] AND [39]. TOTAL CORRECTIONS TO ACCOUNTING RESULT.

These are calculated amounts:

key 38 = key 05 + key 07

key 39 = key 06 + key 37 + key 08

KEY [13]. PRIOR TAXABLE BASE

It is a calculated amount: key 13 = key 04 + key 38 - key 39.

KEY [44]. CAPITALIZATION RESERVE REMAINING NOT APPLIED DUE TO INSUFFICIENT BASE.

Only taxpayers whose tax rate corresponds to that provided for in section 1 or 6 of article 29 of the Corporate Tax Law will enter this box, when the requirements provided for in section 1 of article 25 of the LIS are met, and provided that the entire 10% increase in equity could not be reduced in the Corporate Tax return (form 200), thus being able to apply the outstanding balance due to insufficient quota of amounts corresponding to previous years.

In this sense, the reduction in the tax base of a given tax period relative to the capitalisation reserve corresponds to 10% of the increase in equity, for which determination it is essential that the financial year has closed. This means that the application of the capitalisation reserve cannot be taken into account when determining the tax base applicable to the fractional payments, since the tax period will not have concluded and the year-end closing will not have taken place, it will not have been possible to determine the possible increase in equity that would determine the reduction of the tax base. This can only be determined in the declaration for the corresponding tax period which, in accordance with article 124.1 of the LIS, must be submitted within 25 calendar days following the 6 months after the conclusion of the tax period.

Consequently, in the case of split payments, a reduction for this concept (capitalisation reserve) may not appear in the part of the tax base from which such split payments are determined. On the other hand, a reduction for the capitalisation reserve may appear, but corresponding to the amounts pending application of the reduction from previous years, which is what will appear in this box, as a remainder of the capitalisation reserve not applied due to insufficient base.

KEY [14]. COMPENSATION OF NEGATIVE TAX BASES FROM PREVIOUS PERIODS.

The amount of negative bases from previous periods that are subject to offset for the purposes of this declaration will be recorded. It takes the value zero if box 13 – box 44 is negative or zero, except if an amount has been indicated in the box part integrated into the tax base for removal or waiting operations.

The offsetting of negative tax bases from previous periods is limited to 70% of the tax base prior to the application of the capitalization reserve established in article 25 of the LIS and its offsetting.

In any case, negative tax bases can be offset during the tax period up to an amount of 1 million euros. The limitation on the offsetting of negative tax bases indicated in the previous paragraph will not apply to the amount of income corresponding to reductions and deductions resulting from an agreement with the taxpayer's creditors. The negative tax bases to be offset with said income will not be taken into consideration with respect to the 1-million-euro value referred to above.

KEYS [45] AND [46]. LEVELING RESERVE (art. 105 LIS) (only entities that meet the requirements of art. 101 LIS and apply the tax rate of art. 29.1, 1st paragraph LIS).

The equalisation reserve is a tax incentive applicable to small entities (those whose turnover in the immediately preceding tax period is less than 10 million euros). In this regard, the amount corresponding to the levelling reserve is not included in the corrections to the accounting result. Following the corrections to the accounting result, a prior tax base is obtained, on which the compensation of negative tax bases would be applied, and the tax base is obtained, on which, where applicable, the levelling reserve would be applied, which must be taken into account for the purposes of fractional payments, as indicated in section 5 of article 105 of the LIS and which may reduce or add to that tax base. Thus, and provided that the requirements set out in article 105 are met, the positive tax base (provided that it does not exceed the amount of 1 million euros) may be reduced by up to 10 percent of its amount. In the event of a reduction in the tax base, a reserve must be created against the positive results of the year for the amount of said reduction. Thus, the reduction amount must be included in the key [46] .

These amounts will be added to the tax base of the tax periods that end in the 5 years immediately following the end of the tax period in which said reduction is made, if the taxpayer has a negative tax base and up to the amount thereof. The addition amount must be included in key [45] .

PREVIOUS RESULT.

B1 GENERAL CASE (ENTITIES WITH SINGLE PERCENTAGE).

KEYS [16], [17] AND [18].

The amount will be calculated automatically based on the data entered in the declaration.

For example:

Key [16] = key [13] – key [44] - key [14] + key [45] – key [46], which cannot be negative.

Key [17] = 19/20 x tax rate indicated in the tax rate box, all rounded up, provided that the entity's turnover in the twelve months prior to the date on which the tax period begins is at least 10 million euros.

Key [17] = 5⁄7 × tax rate indicated in the tax rate box, all rounded down to the previous unit, provided that the entity's turnover in the twelve months prior to the date on which the tax period begins is less than 10 million euros.

Special case: If you check the key “Entity that applies the regime of shipping entities based on tonnage” the Key [17] must be, in any case, 25.

KEY [47]. ART. ENDOWMENTS 11.12 OF THE LIS (DA 7 LAW 20/1990) (ONLY COOPERATIVES).

The provision provided for in section 12 of article 11 of the Corporate Tax Law (which regulates its integration into the tax base in accordance with the provisions of the LIS, with a limit of 70% of the positive tax base prior to its integration, the application of the capitalisation reserve established in article 25 and the offsetting of negative tax bases), will refer to the positive integral quota without taking into account its integration or the offsetting of negative quotas. Thus, for cooperative societies, it will be applied after applying the tax rate, and it will be necessary to convert the amount to a quota, depending on the corresponding tax rate.

Cooperative societies that apply this limit will carry out the positive or negative adjustment that arises from it in this key and will not make any corrections to the accounting result prior to determining the tax base.

KEY [40]. COMPENSATION OF NEGATIVE QUOTAS FROM PREVIOUS PERIODS (ONLY COOPERATIVES).

Cooperatives that are not tax protected will fill in this box for any negative amounts to be offset from previous periods.

The offset of negative quotas from previous periods is limited to 70% of the full quota prior to offset.

In any case, full amounts will be offset in the tax period by the amount resulting from multiplying 1 million euros by the average tax rate of the entity.

The limitation on the compensation of negative quotas indicated in the previous paragraph will not apply to the amount of income corresponding to reductions and waiting periods resulting from an agreement with creditors not related to the taxpayer. For these purposes, it must be taken into account whether the income corresponds to cooperative or extra-cooperative results.

KEYS [48] AND [49]. LEVELING RESERVE (art. 105 LIS) CONVERTED INTO QUOTAS (only entities that meet the requirements of art. 101 LIS and apply the tax rate of art. 29.1, 1st paragraph LIS).

The equalisation reserve is a tax incentive applicable to small entities (those whose turnover in the immediately preceding tax period is less than 10 million euros). In this regard, the amount corresponding to the levelling reserve is not included in the corrections to the accounting result. Following the corrections to the accounting result, a prior tax base is obtained, on which the compensation of negative tax bases would be applied, and the tax base is obtained, on which, where applicable, the levelling reserve would be applied, which must be taken into account for the purposes of fractional payments, as indicated in section 5 of article 105 of the LIS and which may reduce or add to that tax base.

Thus, and provided that the requirements set out in article 105 are met, the positive tax base (provided that it does not exceed the amount of 1 million euros) may be reduced by up to 10 percent of its amount. In the event of a reduction in the tax base, a reserve must be created against the positive results of the year for the amount of said reduction. The reduction amount, converted into installments by applying the applicable tax rate, must be included in the code [49] .

These amounts will be added to the tax base of the tax periods that end in the 5 years immediately following the end of the tax period in which said reduction is made, if the taxpayer has a negative tax base and up to the amount thereof. The additional amount, converted into installments by applying the applicable tax rate, must be included in key [48] .

KEYS [18]

Key [18] will be = [(key[16] x key[17]) /100] + key[47] – key[40] + key[48] – key[49]

B2 SPECIFIC CASES (COMPANIES WITH MORE THAN ONE PERCENTAGE).

KEYS [20] AND [23].

In key [20] the amount of the fractional payment base to which the lowest tax rate of the two indicated in the tax rate key is applicable will be recorded, rounded down to the previous unit.

In the case of shipping entities that apply the special regime based on tonnage, whose tax base is determined in part according to the objective estimation method and in part by applying the general tax regime (activities not included in the special regime), they will include in this box the base of the fractional payment that corresponds to the activities of the entity that are taxed under the general regime.

In key [23] the amount of the fractional payment base to which the highest tax rate of the two indicated in the tax rate key is applicable will be recorded.

In the case of shipping entities that apply the special regime based on tonnage, whose tax base is determined in part according to the objective estimation method and in part by applying the general tax regime (activities not included in the special regime), they will include in this box the base of the fractional payment that corresponds to the activity of the entity that pays taxes under the special regime.

Key [23] will be = key [19] - key [20]

KEYS [19], [21], [22], [24] AND [25].

The amount will be calculated automatically based on the data entered in the declaration.

For example:

Key [19] will be equal to key [13] - key [44] - key [14] + key [45] - key [46], without being negative.

Key [21] = 19/20 × tax rate indicated in the tax rate box, all rounded up, provided that the entity's turnover in the twelve months prior to the date on which the tax period begins is at least 10 million euros.

Key [21] = 5/7 × tax rate indicated in the tax rate box, all rounded down to the previous unit, provided that the entity's turnover in the twelve months prior to the date on which the tax period begins is less than 10 million euros.

Key [22] will be = (key [20] × key [21])⁄100

Key [24] = 19/20 × tax rate indicated in the tax rate box, all rounded up, provided that the entity's turnover in the twelve months prior to the date on which the tax period begins is at least 10 million euros.

In the case of shipping entities that apply the special regime based on tonnage, the tax rate applicable to the base of the fractional payment corresponding to the activity that is taxed under the special regime will be 25%.

Key [24] = 5/7 × tax rate indicated in the tax rate box, all rounded down to the previous unit, provided that the entity's turnover in the twelve months prior to the date on which the tax period begins is less than 10 million euros.

In the case of shipping entities that apply the special regime based on tonnage, the tax rate applicable to the base of the fractional payment corresponding to the activity that is taxed under the special regime will be 25%.

Key [25] = (key [23] × key [24])⁄ 100.

KEY [42]. COMPENSATION OF NEGATIVE QUOTAS FROM PREVIOUS PERIODS (ONLY COOPERATIVES).

Tax-protected cooperatives will fill in this box for any negative amounts to be offset from previous periods.

The offset of negative quotas from previous periods is limited to 70 percent of the full quota prior to offset.

In any case, full amounts will be offset in the tax period by the amount resulting from multiplying 1 million euros by the average tax rate of the entity.

The limitation on the compensation of negative quotas indicated in the previous paragraph will not apply to the amount of income corresponding to reductions and waiting periods resulting from an agreement with creditors not related to the taxpayer. For these purposes, it must be taken into account whether the income corresponds to cooperative or extra-cooperative results.

KEYS [51] AND [52]. LEVELING RESERVE (art. 105 LIS) (only entities that meet the requirements of art. 101 LIS and apply the tax rate of art. 29.1, 1st paragraph LIS).

The equalisation reserve is a tax incentive applicable to small entities (those whose turnover in the immediately preceding tax period is less than 10 million euros). In this regard, the amount corresponding to the levelling reserve is not included in the corrections to the accounting result. Following the corrections to the accounting result, a prior tax base is obtained, on which the compensation of negative tax bases would be applied, and the tax base is obtained, on which, where applicable, the levelling reserve would be applied, which must be taken into account for the purposes of fractional payments, as indicated in section 5 of article 105 of the LIS and which may reduce or add to that tax base. Thus, and provided that the requirements set out in article 105 are met, the positive tax base (provided that it does not exceed the amount of 1 million euros) may be reduced by up to 10 percent of its amount. In the event of a reduction in the tax base, a reserve must be created against the positive results of the year for the amount of said reduction. Thus, the reduction amount must be included in the key [52].

These amounts will be added to the tax base of the tax periods that end in the 5 years immediately following the end of the tax period in which said reduction is made, if the taxpayer has a negative tax base and up to the amount thereof. The addition amount must be included in key [51].

These codes will be used by cooperative societies that, where applicable, meet the requirements to apply this tax incentive.

KEY [26]

Key [26] = key [22] + key [25] + key [50] – key [42] + key [51] – key [52].

CALCULATION OF THE RESULT AND THE AMOUNT TO BE ENTERED.

KEY [27]. BONUSES CORRESPONDING TO THE COMPUTATIONAL PERIOD (TOTAL).

The total amount of the bonuses of Chapter III of Title VI of the LIS and other bonuses that are applicable to the taxpayer in the corresponding period will be recorded.

KEY [28]. WITHHOLDINGS AND INCOME ON ACCOUNT MADE ON THE INCOME OF THE COMPUTATIONAL PERIOD (TOTAL).

The total amount of withholdings and payments on account made to the taxpayer on the income of the computed period will be recorded.

KEY [29]. VOLUME OF OPERATIONS IN COMMON TERRITORY (%).

The percentage figure corresponding to the State's taxation will be recorded according to the proportion of the volume of operations carried out in the Common Territory determined in the last tax declaration-settlement.

KEY [30]. PARTIAL PAYMENTS FROM PREVIOUS PERIODS IN COMMON TERRITORY (TOTAL).

The total amount of the fractional payments made previously in common territory corresponding to the same tax period will be recorded.

KEY [31]. RESULT OF THE PREVIOUS DECLARATION (EXCLUSIVELY IF THIS IS COMPLEMENTARY).

If this declaration is complementary to another one previously submitted for the same concept and period, the amount of the previously paid installment payment will be entered in this box. In this case, in section 6 Supplementary, the electronic code assigned to said declaration must be stated.

KEY [32]. RESULT.

It is a calculated amount.

Key[32] = ([key[18] (or key[26]) – key[27]- key[28] ] × key[29]/100 ) – key[30] – key[31].

KEY [33]. MINIMUM AMOUNT TO ENTER (ONLY FOR COMPANIES WITH CN EQUAL TO OR GREATER THAN 10 MILLION €)

In accordance with the Fourteenth Additional Provision of Law 27/2014, of November 27, on Corporate Tax, as amended by article 71 of Law 6/2018, of July 3, on the General State Budget for 2018 and article 4 of Law 8/2018, of November 5, the amount to be paid may not be less, in any case, than 23% (25% for taxpayers to whom the tax rate provided for in the first paragraph of section 6 of article 29 of this Law applies) of the positive result of the profit and loss account for the year of the first 3, 9 or 11 months of each calendar year or, for taxpayers whose tax period does not coincide with the calendar year, of the year elapsed from the beginning of the tax period until the day before the beginning of each period of payment of the fractional payment, determined in accordance with the Commercial Code and others. development accounting regulations, reduced exclusively by the fractional payments made previously, corresponding to the same tax period.

This positive result will exclude the amount corresponding to income derived from debt reduction or waiting operations resulting from an agreement between the taxpayer's creditors, including in said result that part of its amount that is integrated into the taxable base of the tax period.

The amount of the positive result resulting from capital increase operations or equity by offsetting credits that is not included in the tax base by application of article 17.2 of Law 27/2014, of November 27, on Corporate Tax, will also be excluded.

In the case of partially exempt entities to which the special tax regime established in Chapter XIV of Title VII of Law 27/2014, of November 27, on Corporate Income Tax applies, the positive result will be taken exclusively as that corresponding to non-exempt income. In the case of entities to which the bonus established in article 34 of Law 27/2014, of November 27, on Corporate Tax is applicable, the positive result will be taken exclusively from non-bonus income.

In the case of entities that apply the Reserve for investments in the Canary Islands, the amount of the reserve for investments in the Canary Islands that is expected to be made in accordance with the provisions of section 1 Additional Provision Five of the LIS will be excluded from the aforementioned positive result.

In the case of entities entitled to the bonus provided for in Article 26 of Law 19/1994, 50% of the total amount corresponding to the income that is entitled to said bonus will be excluded from the aforementioned positive result.

If the entities apply the bonus provided for in article 33 LIS, which regulates the Bonus for income obtained in Ceuta and Melilla, 50% of that part of the positive result that corresponds to income that is entitled to it will be excluded from the aforementioned positive result.

In the case of entities that apply the tax regime of the Canary Islands Special Zone regulated in Title V of Law 19/1994, the part of the taxable base of the entity of the Canary Islands Special Zone that, for the purposes of applying the special tax rate, derives from operations carried out materially and effectively within the geographical area of the Canary Islands Special Zone, which results from applying the percentage indicated in article 44 of Law 19/1994, will not be computed for the purposes of the minimum fractional payment, unless the provisions of letter b) of section 6 of said article are applied, in which case the positive result to be computed will be reduced by the amount resulting from applying the provisions of that letter.

This minimum amount to be paid will not apply to the entities referred to in sections 3, 4 and 5 of article 29 of Law 27/2014, of November 27, on Corporate Tax, nor to those referred to in Law 11/2009, of October 26, which regulates Listed Public Limited Companies for Investment in the Real Estate Market, nor to venture capital entities regulated by Law 22/2014, of November 12.

The minimum amount to be paid by shipping companies under a special regime based on tonnage will also not apply. However, for those entities whose tax base is determined in part according to the objective estimation method and in part by applying the general tax regime (activities not included in the special regime), the declarant must include in box 33 (minimum to be paid) the amount that, where applicable, corresponds to the activities included in the general regime, since these activities are not excluded from the minimum fractional payment. This information must be entered directly by the taxpayer, and calculated in accordance with the provisions of the Fourteenth Additional Provision of Law 27/2014, of November 27, on Corporate Tax.

KEY [34]. AMOUNT TO ENTER

Key [34] = The largest of keys [32] or [33].

NON-RESIDENT INCOME TAX TAXPAYERS

Taxpayers of the Non-Resident Income Tax who obtain income through a permanent establishment will calculate the fractional payments in the same terms as taxpayers of the Corporate Tax, but taking into account the peculiarities derived from their status as taxpayers of the aforementioned Non-Resident Income Tax (article 23.1 of the consolidated text of the LIRNR).

Entities under the income attribution regime established abroad with a presence in Spanish territory must make fractional payments under the same terms as taxpayers of this Tax with a permanent establishment in Spain, for the amount corresponding to the part of income attributable to non-resident members. When the payment is made in installments in accordance with the provisions of article 40.3 of the LIS, the taxable base will be calculated in accordance with the provisions of chapter V of the Non-Resident Income Tax Law (article 18 of Royal Decree 1776/2004, of July 30).

5) ADDITIONAL INFORMATION

Taxpayers whose net turnover in the twelve months prior to the start of the tax period is at least ten million euros must submit the annex for communication of additional data to the declaration. For these purposes, they will mark the key “communication of additional data to the declaration” indicating the company reference number (NRS) corresponding to said communication.

Amount excluded for debt reduction or waiting operations: For the purposes of the minimum split payment calculated from the positive result of the profit and loss account for the first 3, 9 or 11 months of the year, determined in accordance with the Commercial Code and other accounting regulations, the amount of the positive result corresponding to income derived from debt relief or waiting operations resulting from a creditors' agreement of the taxpayer will be filled in in this key.

Part included in the tax base for debt relief or waiting operations: For the purposes of the minimum split payment calculated from the positive result of the profit and loss account for the first 3, 9 or 11 months of the year, determined in accordance with the Commercial Code and other accounting regulations, the amount of the part included in the tax base for debt reduction or waiting operations resulting from a creditors' agreement of the taxpayer will be completed in this code.

Part integrated into the tax base at the quota level for debt reduction or waiting operations (cooperatives only): For the purposes of determining the limits for offsetting negative quotas from previous periods, cooperatives will also include in this code the amount of the part integrated into the tax base at the quota level for debt reduction or waiting operations resulting from a creditors' agreement of the taxpayer.

Income from reversal of impairment losses that are included in the tax base: In accordance with the criteria contained in the consultation of the General Directorate of Taxes V0155-17, it must be understood that the reversal of the deterioration regulated in section 3 of the sixteenth transitional provision of the LIS occurs on the last day of the tax period, so, as a general rule, it should not be taken into account for the purposes of calculating the fractional payments by the method provided for in section 3 of article 40 of the LIS.

Amount corresponding to the reserve for investments in the Canary Islands: For the purposes of the minimum installment payment calculated from the positive result of the profit and loss account for the first 3, 9 or 11 months of the year, determined in accordance with the Commercial Code and other accounting regulations, the amount of the reserve for investments in the Canary Islands that is expected to be made will be filled in in this code.

Amount corresponding to the bonus provided for in art. 26 of Law 19/1994: For the purposes of the minimum split payment calculated from the positive result of the profit and loss account for the first 3, 9 or 11 months of the year, determined in accordance with the Commercial Code and other accounting regulations, the amount of the bonus provided for in art. 26 of Law 19/1994 shall be entered in this code. This amount will be 50% of the full quota corresponding to the income referred to in this provision.

Amount not included in the calculation due to the application of the ZEC tax regime: For the purposes of the minimum split payment calculated from the positive result of the profit and loss account for the first 3, 9 or 11 months of the year, determined in accordance with the Commercial Code and other accounting regulations, entities that apply the tax regime of the Canary Islands Special Zone, regulated in Title V of Law 19/1994, shall complete in this key the reduction of the part of the positive result that corresponds to the percentage indicated in article 44.4 of Law 19/1994, unless the provisions of article 44.6 b) of Law 19/1994 are to be applied, in which case the applicable reduction to be included in this key will be the amount resulting from applying the provisions in that letter.

Amount of the reduction corresponding to the income that is entitled to the bonus provided for in art. 33 LIS: For the purposes of the minimum split payment calculated from the positive result of the profit and loss account for the first 3, 9 or 11 months of the year, determined in accordance with the Commercial Code and other accounting regulations, 50 percent of the part of the positive result that corresponds to income that is entitled to the bonus for income obtained in Ceuta or Melilla provided for in article 33 of the Corporate Tax Law shall be filled in in this key.

Amount excluded for capital increase operations or equity by offsetting credits that are not included in the tax base by application of art. 17.2 LIS: For the purposes of the minimum split payment calculated from the positive result of the profit and loss account for the first 3, 9 or 11 months of the year, determined in accordance with the Commercial Code and other accounting regulations, the amount of the positive result resulting from capital increase operations or equity by offsetting credits that are not included in the tax base by application of article 17.2 of the Corporate Tax Law shall be filled in in this key.

Amount of exempt income of entities that apply the special tax regime of Chapter XIV of Title VII of the LIS: For the purposes of the minimum split payment calculated from the positive result of the profit and loss account for the first 3, 9 or 11 months of the year, determined in accordance with the Commercial Code and other accounting regulations, partially exempt entities to which the special tax regime established in Chapter XIV of Title VII of the Corporate Income Tax Law applies will complete the amount of exempt income in this code.

Amount of the bonus provided for in art. 34 LIS: For the purposes of the minimum split payment calculated from the positive result of the profit and loss account for the first 3, 9 or 11 months of the year, determined in accordance with the Commercial Code and other accounting regulations, the amount of the subsidized income for the provision of local public services established in article 34 of the Corporate Tax Law will be filled in in this code.

6) SUPPLEMENTARY DECLARATION

If this declaration is complementary to another previously submitted for the same concept and period, the electronic code of said previous declaration must be included. In this case, in codes [02] or [31], as the case may be, the amount of the split payment entered for the previously submitted declaration will be recorded.

7) NEGATIVE

This box will be checked if no payment is to be made in installments during the corresponding period.

8) INCOME

In the case of a declaration to be entered, the method of payment will be stated. If the payment is made by direct debit, the corresponding International Bank Account Number (IBAN) must be duly completed.

However, corporate tax payers who are covered by the tax current account system will make the split payments in accordance with the provisions of Section 6 of Chapter II of Title IV of the General Regulations on tax management and inspection actions and procedures and development of common rules for tax application procedures, approved by Royal Decree 1065/2007, of July 27.

FILING PERIOD

The split payment must be made during the first twenty calendar days of the months of April (1/P), October (2/P) and December (3/P) of each calendar year. Any deadlines that fall on a Saturday or non-working day will be deemed to be transferred to the next immediately following business day.

The submission of form 202 will be mandatory for those taxpayers whose net turnover for the twelve months prior to the start date of the tax period exceeds 6,000,000 euros, even in cases where, in accordance with the provisions of the regulations governing instalment payments on account of Corporation Tax or Income Tax for Non-Residents, no payment must be made as instalment payments of the aforementioned taxes in the corresponding period.

For the rest of entities, in cases where, in accordance with the regulations governing the partial payments on account of the Corporate Tax or the Income Tax for Non-Residents, no payment must be made as a partial payment of the aforementioned taxes in the corresponding period, the presentation of form 202 will not be mandatory.

In no case will Spanish economic interest groups and temporary business associations covered by the special regime of Chapter II of Title VII of the Corporate Income Tax Law, in which the percentage of participation in them, in its entirety, corresponds to partners or members resident in Spanish territory, be required to submit the model.

Entities that, in accordance with articles 29.4 and 5 of said Law, pay taxes at a rate of 1% and 0% will not be required to make the aforementioned split payment or submit the corresponding declaration.

All amounts must be expressed in euros, with the whole number followed by two decimal places.

ANNEX II (PART 2)

COMMUNICATION OF ADDITIONAL DATA TO THE DECLARATION.

Declarants who have had a net turnover of at least ten million euros in the twelve months prior to the date on which the tax periods begin will be required to submit this annex.

To make this communication, a form has been enabled in model 202 that will allow the declarant to communicate the additional data requested, which will be accessed from the split payment form itself. The steps to follow will be the following:

-

The presenter starts the submission process and opens the Model 202 form.

-

In this case, form 202, in section 5 (Additional information), includes a box to mark with an X that you want to communicate the additional data requested. This enables a button to open the form, which is filled out, signed and sent. As a result, the window with the form is closed and the NRS (Company Reference Number) corresponding to the submitted annex is incorporated into model 202.

-

The presenter completes form 202, signs it and sends it, obtaining proof of submission.

DETAIL OF CORRECTIONS TO THE ACCOUNTING RESULT, EXCLUDING CORRECTION FOR INCOME TAX

COMPANIES (3)

The amount of the corrections will be recorded in the profit and loss account result detailed in the boxes listed in this section. The remaining corrections not included in the previous boxes will be grouped in the “Other corrections to the accounting result” box.

The total net corrections (excluding corrections for Corporate Tax and for art. 7 Law 16/2012) must be equal to the sum of the previous corrections (total increases - total decreases), as well as the difference between the keys [07] and [08] of self-assessment 202.

LIMITATION ON DEDUCTIBILITY OF FINANCIAL EXPENSES (4)

The requested data will be entered for the purpose of calculating the amount of deductible net financial expenses, limited to 30 percent of the operating profit for the year or 1 million euros if the previous amount is less than this amount. If the entity's tax period were to last less than a year, the amount of this limitation would be the result of multiplying 1 million euros by the proportion between the duration of the tax period and the year.

Thus, key i has a maximum amount of 30% of (i1 – i2 – i3 – i4 + i5) with a minimum of one million euros (or the existing proportion if the tax period is less than a year). If the taxpayer has filled in the box relating to the addition due to the limit of operating profit not applied in the previous five years (key j) and the sum of keys h + l + m which refer to the sum of net financial expenses of the current year is greater than or equal to one million euros, the greater of the two amounts will be recorded in key j (if both results are negative, zero will be recorded):

-

(key (i1 – i2 – i3 – i4 + i5) x 0.30, or

-

1,000,000 - j

If, on the other hand, the sum of keys h + l + m that refer to the sum of net financial expenses for the current year is less than one million euros, the highest of the two amounts will be recorded in key j (if both results are negative, zero will be recorded):

-

(key (i1 – i2 – i3 – i4 + i5) x 0.30, or

-

Amount resulting from the sum of h + l + m.

ADDITIONAL INFORMATION (5)

This section shall be completed in cases where the tax base is insufficient to offset negative tax bases pending from previous periods.