Request for a generic tax certificate

Skip information indexRequest for a generic tax certificate

This option may be used by taxpayers who must carry out procedures with the Administration electronically, according to article 14.2 of Law 39/2015, and the rest of taxpayers through an electronic certificate/ DNI or Cl@ve .

If the procedure is carried out on behalf of a third party, it will be necessary for the applicant of the tax certification to be authorized in the specific procedure for consulting personal data.

Any certification may be requested as long as there is no specific one for obtaining the requested information.

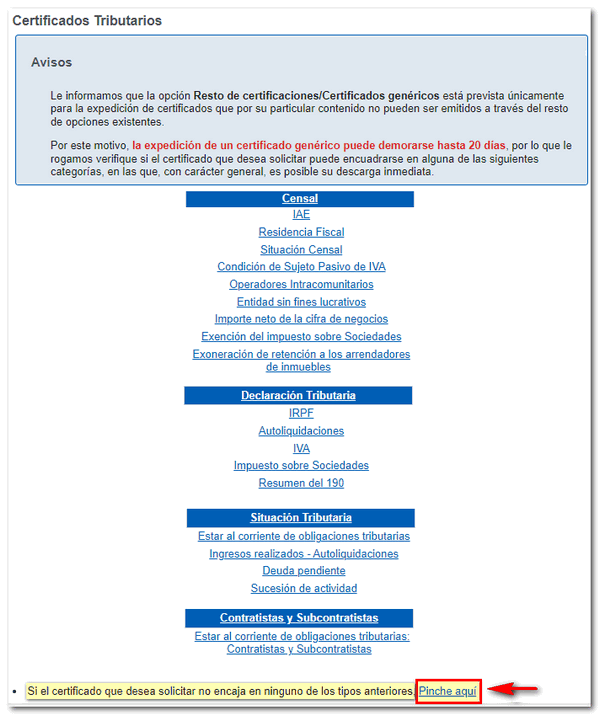

Therefore, before accessing the certification request, you must check that it is not included in the categories offered in the list. The certification, "Other certifications/Generic certificates", is intended solely for the issuance of certificates that, due to their particular content, cannot be issued through the other existing options. Please review the notice and if the certificate you wish to request does not fit into any of the types offered, click "Click here" at the bottom of the window.

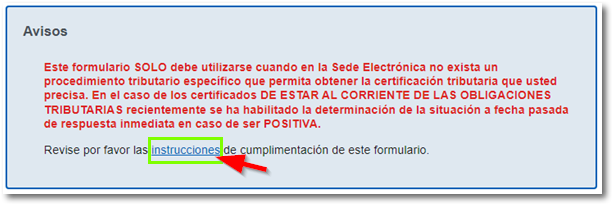

When accessing the form, the "Notices" section will appear at the top, from where the instructions can be downloaded.

The application for a generic certificate consists of 3 steps: Fill out the application, Confirm the application and Obtain the application receipt.