Request for tax certificates from third parties by Public Administrations

Through this procedure, Public Administrations may request tax certificates from third parties for the processing of administrative procedures under their jurisdiction, provided that said direct transfer of tax information has the prior consent of the taxpayer or is provided for by law.

Prior to requesting certification, it must be verified that the requirements for carrying out this procedure are met. It is recommended to consult the information provided in the PDF "Protocol or procedure guide (PROTGEN)".

It will be necessary to identify yourself with a valid electronic certificate of a legal entity representative or a public employee certificate.

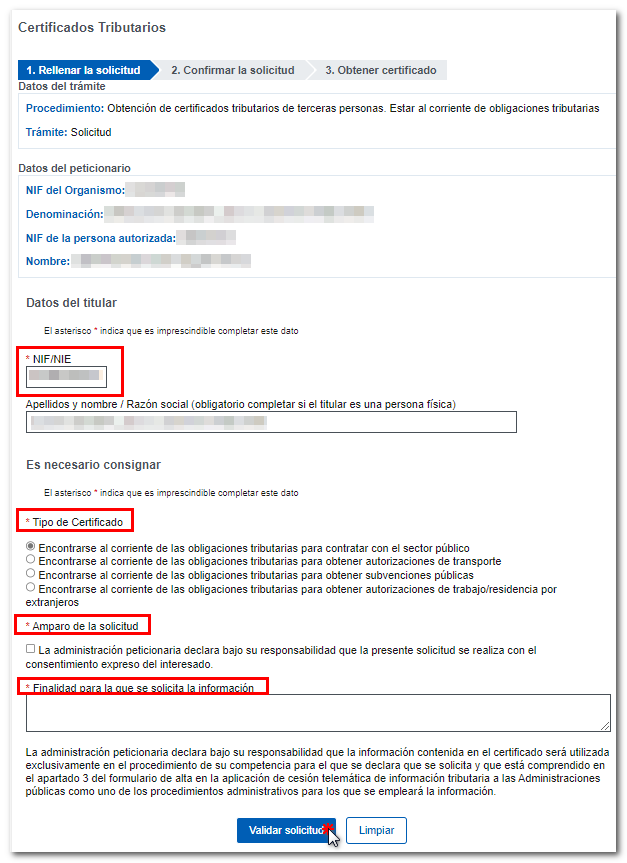

In the "1" tab. Fill out the application" to be completed:

- The NIF of the certification holder,

- Type of certificate (if applicable),

- "Request protection" box. By checking this box, you declare that the information is requested with the consent of the interested party.

- Purpose of the request.

Finally, you must click on "Validate request".

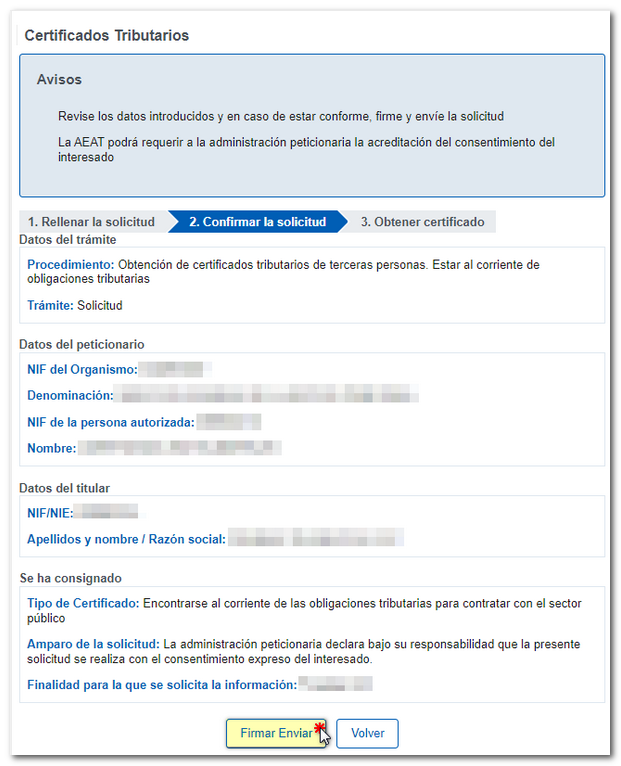

In the next tab "2. Confirm the request" check the data entered and if everything is correct click on "Sign and send".

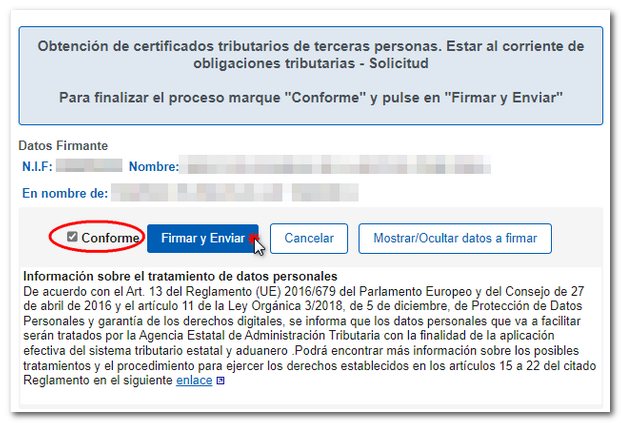

In the pop-up window, check the "I agree" box and click "Sign and Send."

You will be taken to the "3. "Get certified". In the case of certifications of PIT either IAE The certificate is obtained immediately, and you can open the PDF at the moment or save it to your computer by clicking "Download document".

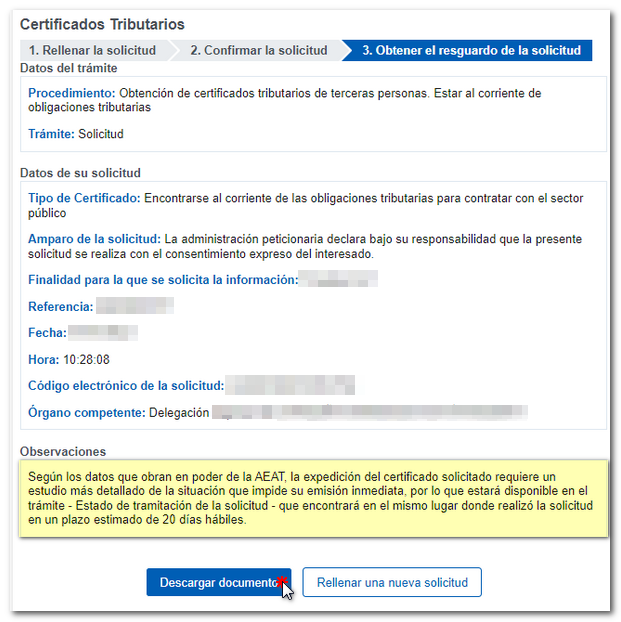

In the "3. "Get the request receipt" a message will be displayed specifying the waiting time and the method of collection; Otherwise, it is also generated immediately.