Ways of submitting informative tax returns

There are 2 ways to submit Informative Declarations:

Submission via web form

For most Informative Declarations, you have web forms that allow you to complete and submit the declaration from the procedure available on the Electronic Office.

This submission method is valid for declarations that do not exceed 40,000 records.

Web forms consist of different sections to complete (Declarant, recipients / declared / operations, etc.) and have a series of functionalities that allow importing, exporting, obtaining a preview and submitting the declaration, among others.

Submission by file ( TGVI online)

It is a direct submission by file, which has been previously obtained through external applications or other means and which must conform to the published registry design.

The system TGVI The online system extends to all information return models for the 2025 fiscal year, with advantages such as immediate validation of the information submitted and the possibility of partial submission of correct records.

This system will be mandatory for tax returns containing more than 40,000 records, but will allow any file regardless of its size.

We remind you that in the 2019 fiscal year the submission of pre-declaration by SMS for models 190, 347 and 390 was eliminated. If you do not have a valid identification system, we recommend that you consult the help available to obtain an electronic certificate and register at Cl@ve .

Depending on the type of declarant, electronic submission can be done with an electronic certificate or DNIe and with Cl@ve . In those models that allow submission using Cl@ve for individuals, this form of access to direct submission by file will also be permitted.

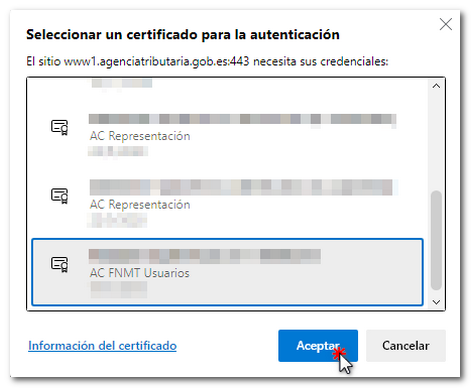

Electronic submission with certificate or DNIe

This identification method can be used by all presenters who have a recognized electronic certificate, accepted by the State Tax Administration Agency according to the regulations in force at any given time or their eDNI with valid certificates and correctly configured.

Submission with an electronic certificate will be mandatory for legal entities in general, persons or entities attached to the Central Delegation of Large Taxpayers or to any of the Large Business Management Units of the Special Delegations of the AEATPublic Limited Companies, Limited Liability Companies and Public Administrations.

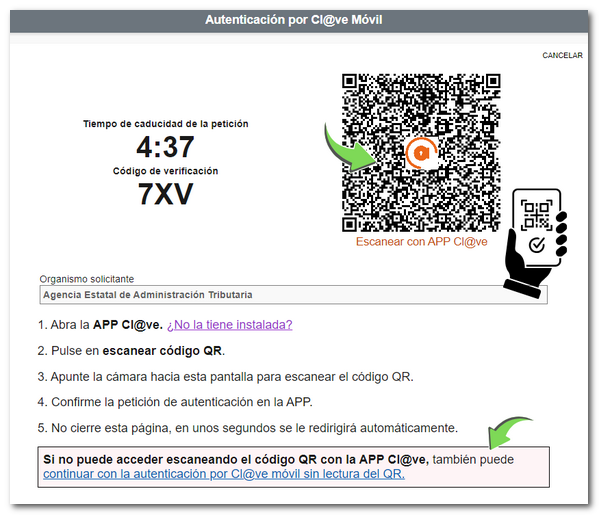

Electronic submission with Cl@ve

Natural persons acting on their own behalf or with power of attorney and who are not required to use an electronic certificate may use Cl@ve in those models in which this identification system is accepted.

Click on "Cl@ve Mobile Cl@ve", authentication will be enabled via QR code (to scan the QR code with the APP Cl@ve) and the option to continue without QR code scanning, by entering the ID card / NIE and the requested contrast data or requesting the sending of a SMS with the 6-digit PIN code.

For more information about the new filing methods for the 2025 tax year, you can consult the 2025 Informative Declarations Campaign portal.