How to modify an informative declaration using a file (supplementary and substitute declarations)

If you have submitted an information return using a file and need to make changes to it, you must do so using the same submission method (using a file).

After submitting the original declaration, the remaining declarations will be complementary or substitute.

Supplementary tax return

A supplementary return will be filed only to add records to the original return . You can submit as many supplementary declarations as necessary. In the file you must include your own identification number (not used in any other previous submission), the complementary mark and the identification number of the previous declaration, which has not been cancelled.

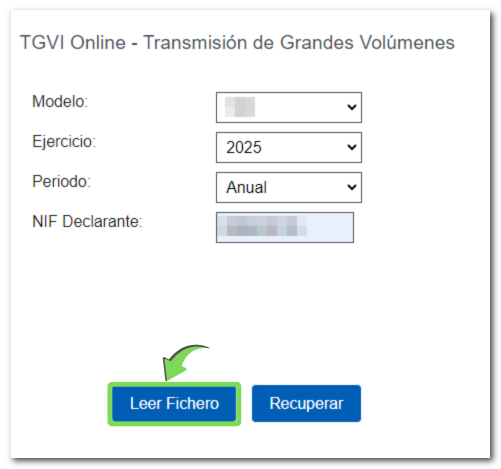

Provide the NIF of the declarant and click "Select the file to validate" to choose the file with the supplementary declaration.

The file must conform to the record layout and meet the specifications for a supplemental declaration. For example, for model 190:

- Positions 108-120: Identification number of the new supplementary declaration

- Position 121: Supplementary declaration mark (C)

- Positions 123-135: Identification number of the original declaration that it complements, which must be different from that of the original declaration (13 positions)

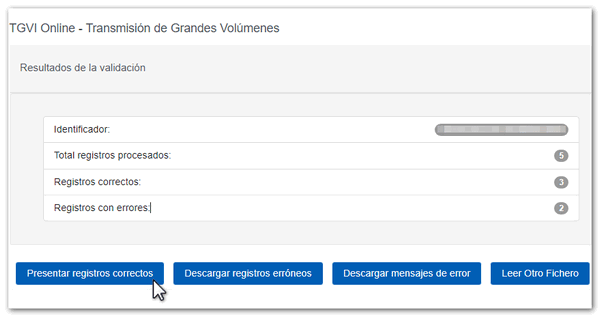

After reading the file, the validation result is obtained. Click the "Submit correct records" button.

If the submission is done correctly, you will get the response page with the receipt in PDF , which includes the supplementary declaration mark, in addition to the identification number of the previous declaration.

Substitute tax return

The purpose of a substitute declaration is to cancel and completely replace a previous declaration for the same fiscal year and period. You can file as many substitute returns as necessary.

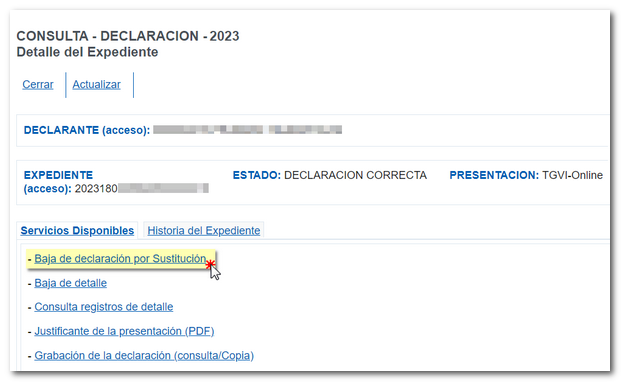

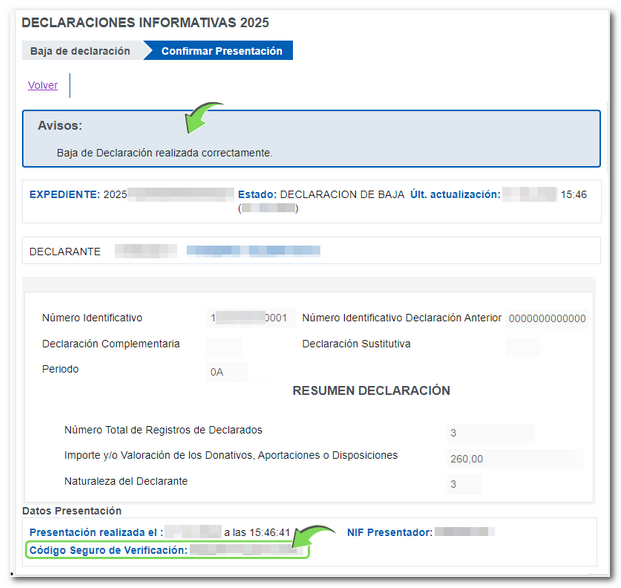

To file a substitute declaration, it is essential to first cancel the declaration it replaces using the "Cancellation of declaration by replacement" service, within "Consultation and cancellation of declarations".

Please note that when you delete a statement, it will no longer be accessible. It is important to keep the identification number of the declaration you wish to cancel, as it must be included in the file for the replacement declaration that you will submit later.

As with filing a supplementary declaration, access the presentation using the corresponding model file and select the declaration file.

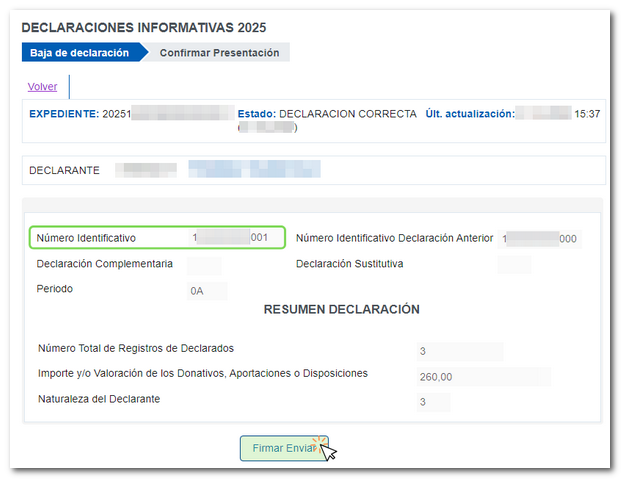

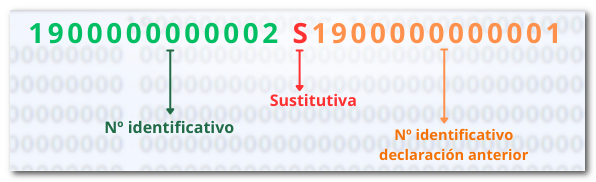

The file must conform to the record layout and meet the specifications for a substitute declaration. For example, for model 190:

- Positions 108-120: Proof number of the new declaration

- Position 122: Substitute declaration mark (S)

- Positions 123-135: Identification number of the original declaration cancelled (13 positions).

The result of the presentation of this declaration generates the receipt in PDF with the replacement declaration mark and the identification number of the previous declaration.

Note: When filing a supplementary return, the result will be that both the records of the original return and the supplementary return are submitted. Whereas if a substitute declaration is submitted, after cancelling the original declaration, the records that remain valid are only those of the substitute declaration.