How to modify an informative declaration using a web form (add, modify and delete records)

Once you have submitted an information return from its web form, you can access the "consolidated" return again and add records, modify them or delete existing ones, without needing to explicitly indicate that the return complements or replaces the previous ones. In the forms do not have the supplementary and substitute declaration boxes .

Note: The submission channels are exclusive; That is, if the first declaration was submitted using a web form, the rest of the actions on that declaration (registrations, deregistrations or modifications of records) must be carried out using the same means.

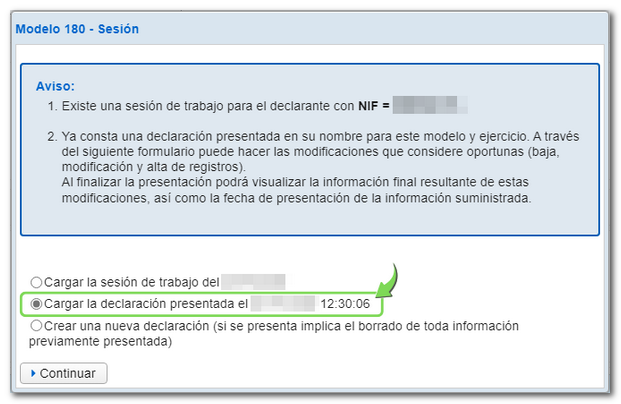

After indicating the NIF of the declarant, the options available in each case will be displayed.

- Load saved session: If you have already completed and saved data in a previous session

- Upload the submitted statement: If you have already filed the declaration and want to recover it to make changes

- Create a new declaration

Select the option "Upload the submitted declaration..." and you will retrieve the data for this declaration in the form.

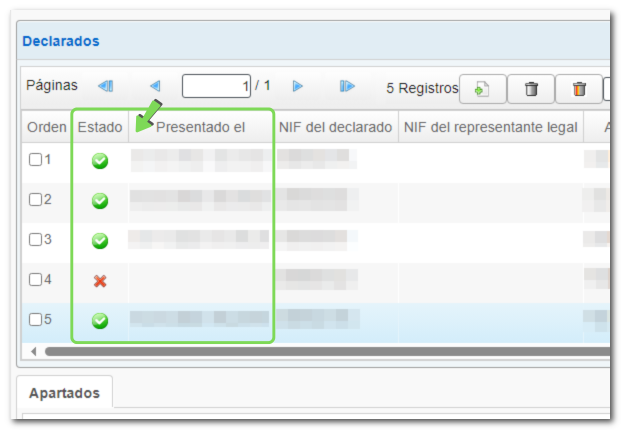

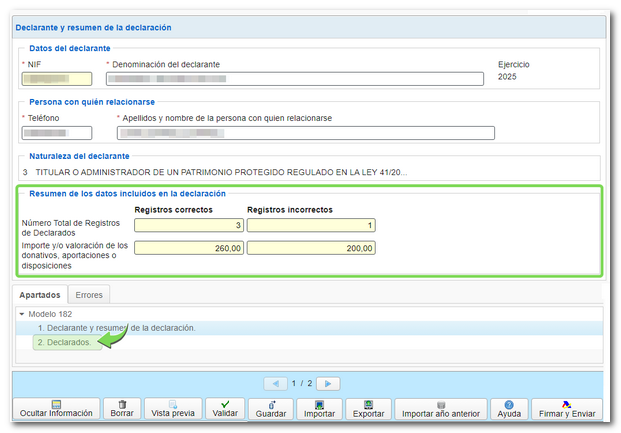

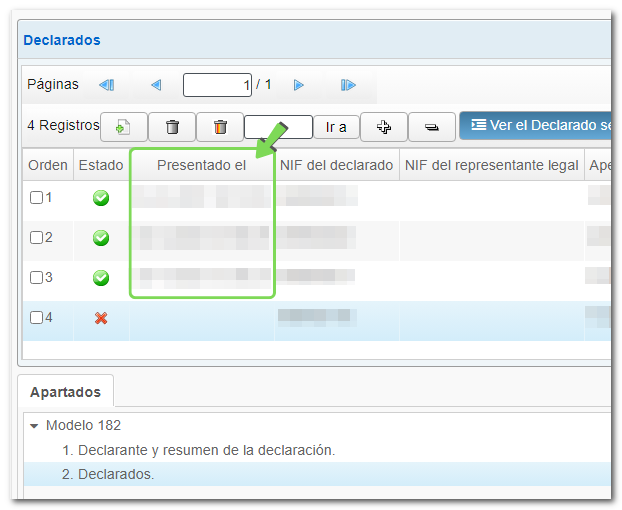

In the declaration summary you can check the total number of correct and incorrect records contained in the declaration. In the list of declared records you can check the date of submission of each record, the validation status (correct, incorrect or with warnings) and act on these consolidated records.

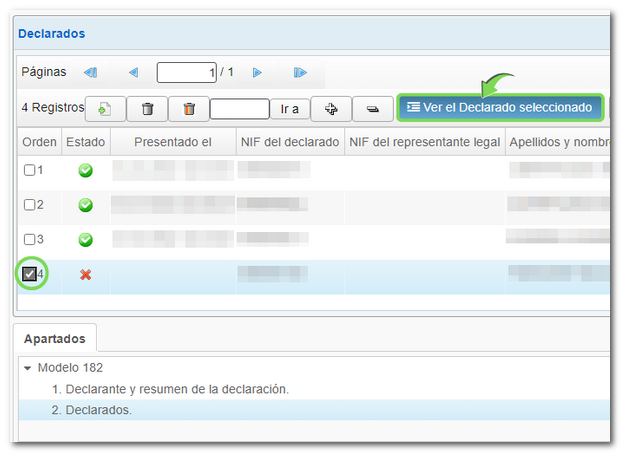

To modify the data of a declared taxpayer or recipient, double-click on the record or select it in the "Order" column and click "View the selected declared taxpayer" (or "View the selected recipient", depending on the declaration model).

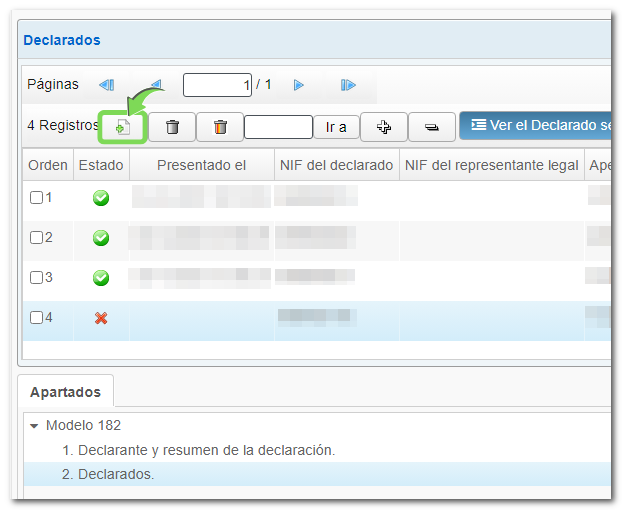

To register a new respondent, use the "New registration" button and complete the required data. When you return to the list, you will be able to verify the existence of the new records (these do not have a submission date).

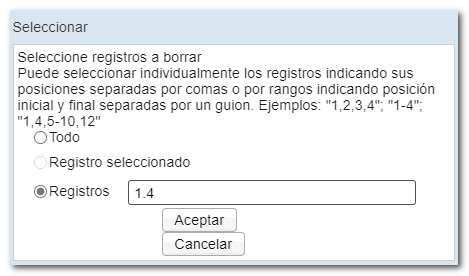

To delete a record, simply select it and use the individual "Delete selected record" option on the button bar. You also have the "Delete multiple records" button.

![]()

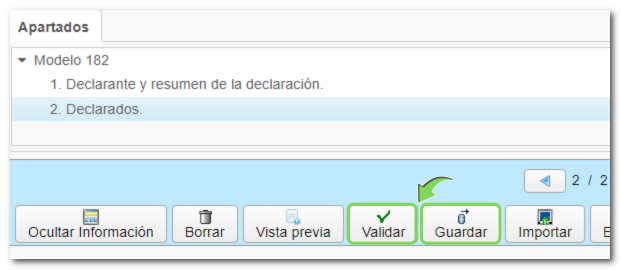

Before submitting, you can save the data to the server to retrieve it in a later session and "Validate" to detect possible errors or warnings.

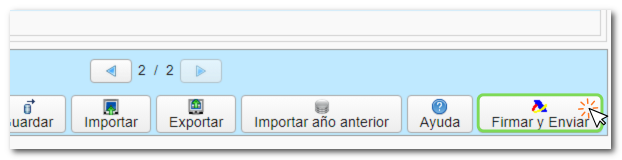

Press the "Sign and Send" button to start the presentation.

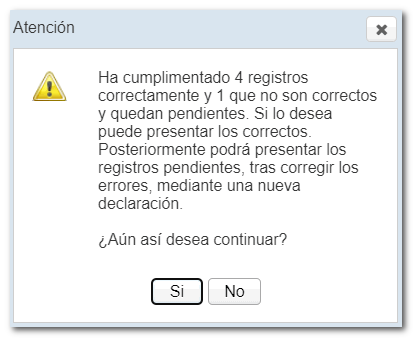

If incorrect records are detected, a window will be displayed warning of this and indicating the number of records to be submitted and those that will remain pending.

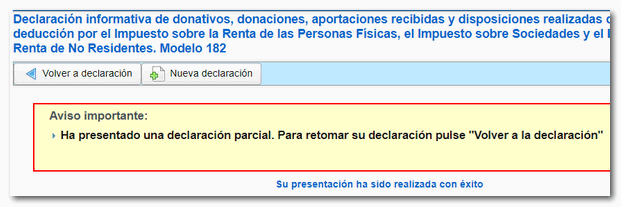

If the submission is successful, you will get the response page with the confirmation message, the Secure Verification Code ( CSV ) and the full copy of the declaration in PDF . Please note that the filing will be done with the correct records, even if incorrect records are detected and in this case it will be reported that a partial declaration has been filed.

If you access the saved session or declaration again, the declaration panel will retain all records, both correct and incorrect.