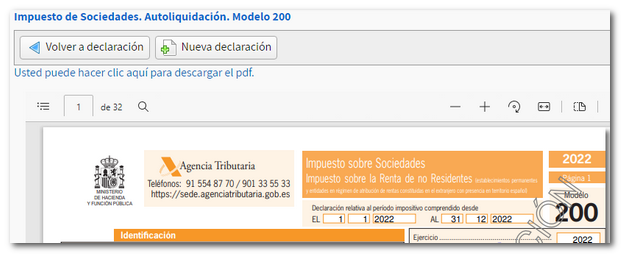

Exercise 2022

Skip information indexWEB Companies 2022 on behalf of third parties

The "Declaration processing service (WEB Companies) 2022" allows the electronic preparation and submission of form 200. Access is common both to act on one's own behalf and to act on behalf of third parties (social collaborator or agent).

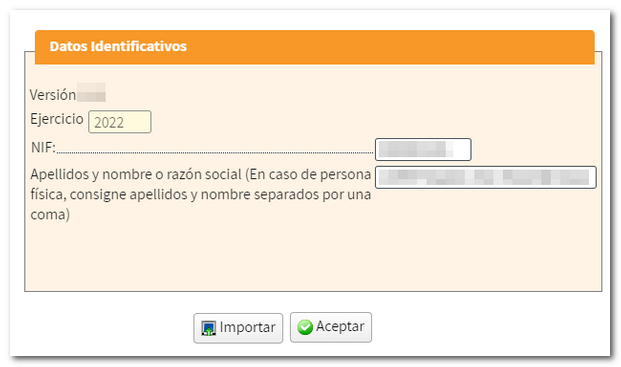

Once the electronic certificate has been selected, the window "Identification Data" is displayed, in which you must enter the NIF , company name or the surnames and first name, separated by a comma, of the declarant.

Then press "Accept" to access form 200 and complete the declaration. If you already have a model 200 file that follows the registration design published on the WEB for the 2022 fiscal year, press "Import" and select the file.

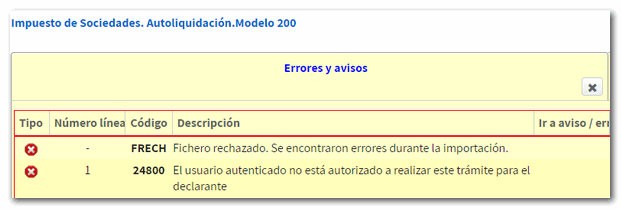

At this point, the application will validate whether the certificate holder is authorized to act on behalf of the named declarant. If he or she is not a social collaborator and is not authorized by the holder, the error message "The authenticated user is not authorized to carry out this procedure for the declarant" will be obtained, preventing access to the form or the import of the file.

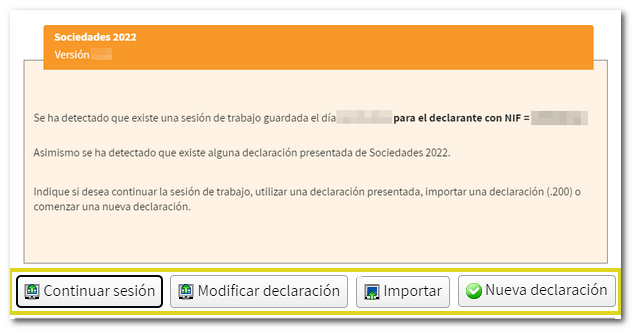

After clicking "OK", the following options may appear:

-

"Continue session" : If the collaborator or representative has previously saved a session for the NIF declarant, they can click "Continue session" to recover the data and continue working with the declaration. It is not necessary to select any file since the last declaration is saved on the server.

-

"Modify declaration" : If it is detected that there is already a declaration submitted for that NIF it is directed to the declaration characters page and retrieves the declaration submitted for the purpose of submitting a supplementary declaration.

-

"New statement" : if you want to start a declaration from scratch for that NIF .

-

"Import" : allows you to import a file of model 200 (same function as the "Import" button in the previous window). The Import button in this second window only appears if you access it on your own behalf or with a power of attorney. Social partners must use the "Import" button in the previous "Identification data" window.

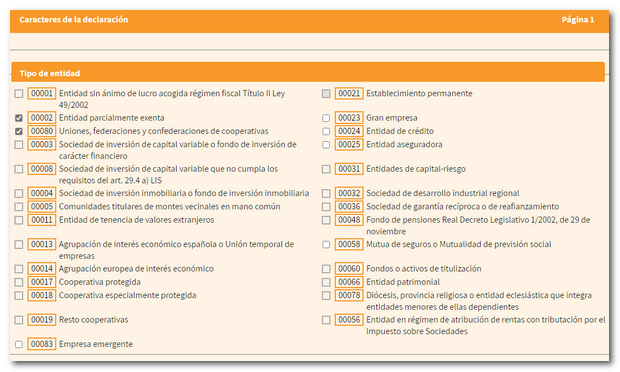

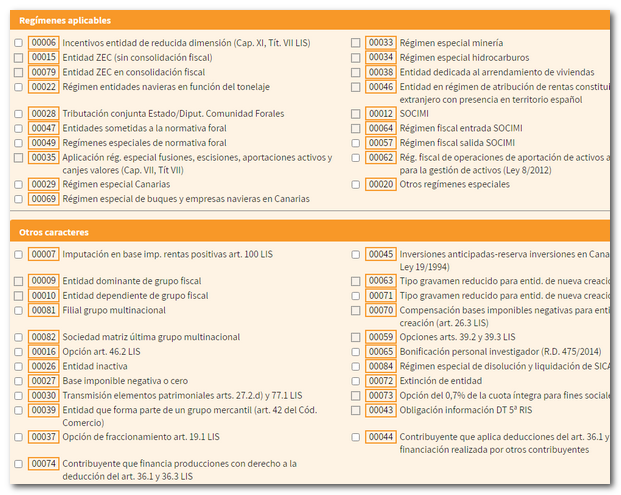

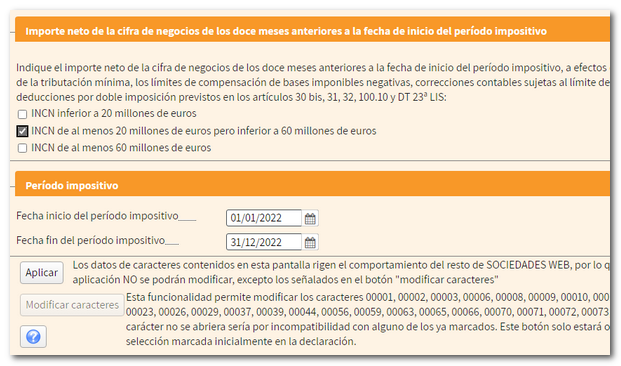

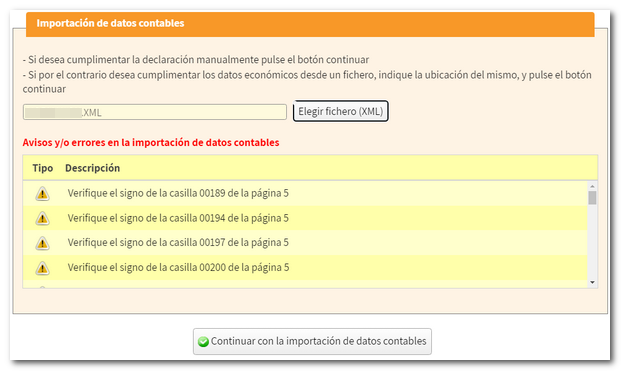

When generating a new declaration, you access the "Declaration Characters" page. Select the appropriate options in the sections "Type of entity", "Applicable regimes", "Other characteristics", "Tax period" and as a new feature in the section "Net turnover..." since it will determine the application of the Minimum Taxation ; press "Apply".

The selected characters will condition the rest of the declaration. Once applied, they cannot be modified in a general manner. However, you will have the button "Modify characters" with which you can modify some of them (those indicated in the adjacent text).

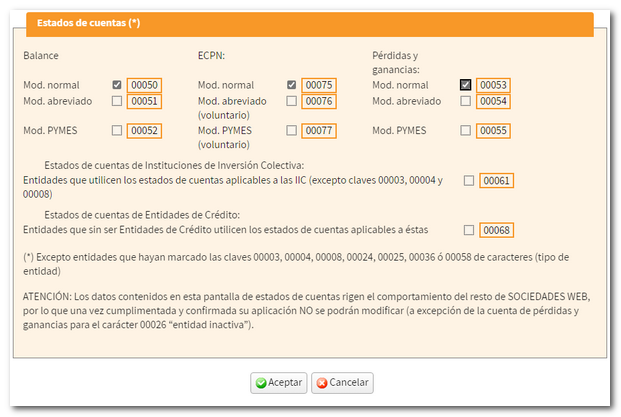

Next, for certain entities, information will be requested on Account statements .

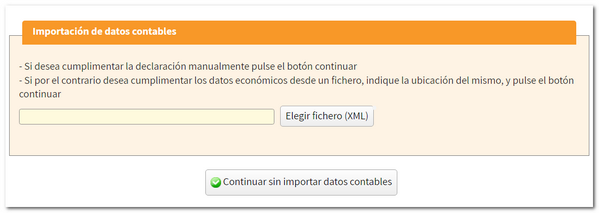

Before accessing the declaration, a new window allows you to import a XML file to incorporate accounting data. Press the button "Choose file ( XML )" to choose the file or "Continue without importing accounting data" to continue filling out the declaration.

If you import a XML file with accounting data, if it does not contain errors and the data it contains is compatible with that established in the character and account status register when registering the declaration, the "Continue with the import of accounting data" button will be displayed.

Please note that this import is optional and automatic for information relating to the balance sheet, the profit and loss account and the statement of changes in equity. It may be carried out for entities subject to the accounting standards of the Bank of Spain, insurance entities, collective investment institutions, mutual guarantee companies, and those not subject to specific regulations.

You will then access the first page "Declaration characters" and the button "Modify characters" will be activated at the bottom, with which only the characters indicated in the attached list can be modified.

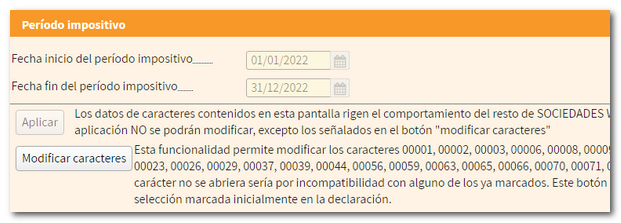

At the top, the button bar will appear with the different WEB Companies functionalities.

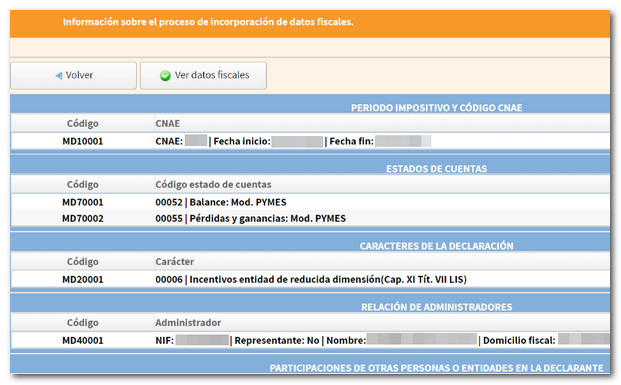

If the holder is a legal entity and the tax period coincides with the calendar year (01-01-2022 to 31-12-2022), the tax data will be automatically transferred to form 200. For authorized users only, this access is not available for social collaboration. Press "Tax data" to check the tax data that has been transferred to the declaration.

To consult the tax data of the owner that appear in the Tax Agency, press the button "View tax data" .

To locate the different pages of the declaration you can use the button "Sections" on the top bar or the arrows to navigate between its pages.

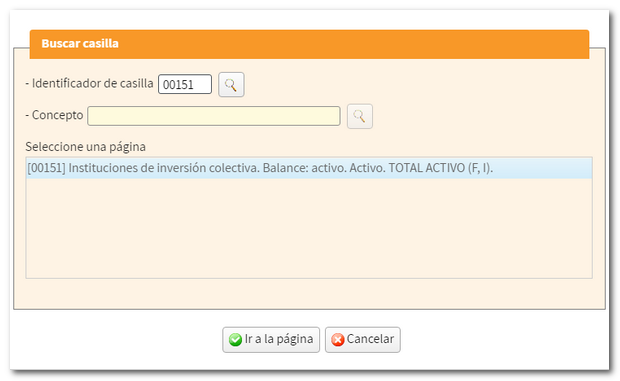

You can also search for specific boxes by their identification number or by concept.

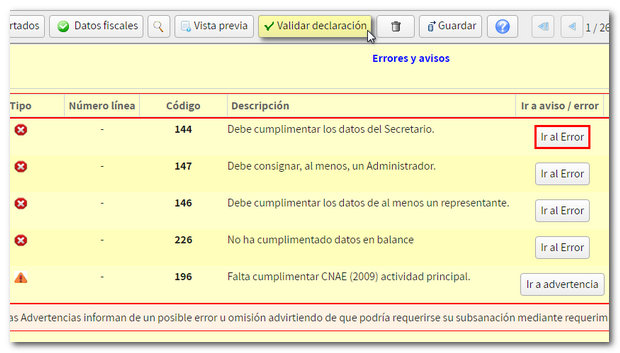

While completing the declaration you can check if it passes the validations using the button "Validate declaration" . Notices, warnings and detected errors will be displayed. Errors must be corrected before the return can be submitted, while warnings and notices allow the return to continue, although it is advisable to review them. To facilitate correction, a button will be displayed next to the description that leads directly to the corresponding box or section.

The message "There are no errors" with a green check indicates that the declaration is correct and can be submitted.

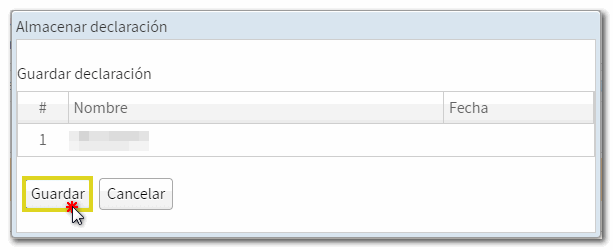

It is recommended to save data periodically with the "Save" button. It is not validated for errors so it can be used at any time. The declaration is stored on the AEAT servers and can be retrieved using the "Continue" button when accessing Sociedades WEB again.

You can also generate a declaration file adjusted to the registration layout and valid for submission from the option "Export" that will be displayed after clicking "Submit declaration" in declarations that involve an income or a refund. Therefore, it is required that the validation is correct, and you can also choose the location where you will save the .200 file that is generated.

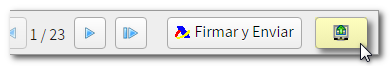

If the declaration does not have an income/refund document, the export button will appear directly in the top button bar, in the form of an icon. In this case, instead of the button "Submit declaration" the option "Sign and send" will be displayed on the same button bar.

In addition, Sociedades WEB allows you to obtain a "Preview" of the declaration in PDF so you can review the data on paper, taking into account that it cannot be used for presentation, as indicated by the printed watermark.

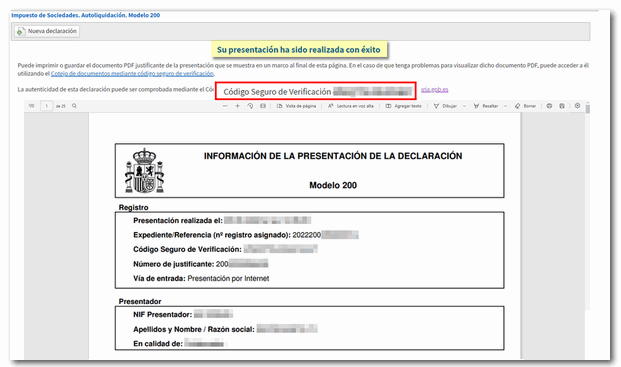

Finally, press "Sign and send" if there is no income/refund document" or "Submit declaration" to review the bank details and select the type of declaration. To finish the submission, click "Sign and Send." If everything is correct, the response sheet will open with the message "Your submission has been successfully completed" and an embedded PDF containing a first page with the submission information (registration entry number, Secure Verification Code, receipt number, day and time of submission and the submitter's details) and, on the subsequent pages, the complete copy of the declaration.