Pages that do not appear in WEB Societies

The liquidation of the corporate tax is contained in the boxes on pages 12, 13, 14 and 14 bis of form 200. From these boxes you can access the breakdown tables contained in other pages of the model.

In the form of the 200 model of WEB Companies, pages 15, 16, 16 bis, 17, 18, 18 bis, 19, 20 bis or 26 are only accessible from the pages indicated in the previous paragraph depending on the completion carried out, in addition, the content of all these pages varies depending on the box used to access them.

-

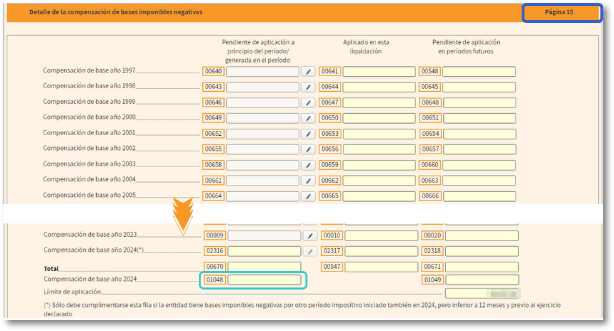

Page 15: In Companies there are two different pages 15

-

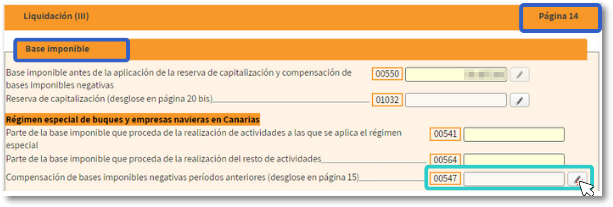

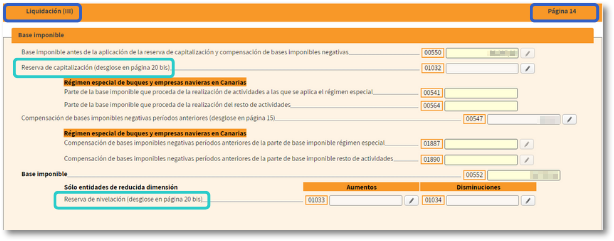

Offsetting negative tax bases of entities from previous periods: access from page 14 in the section (Settlement (III) - Taxable base). Entering the concept "Compensation of negative tax bases from previous periods (breakdown on page 15)" in box [00547].

NOTE: Box [01048] sometimes it returns an error.

-

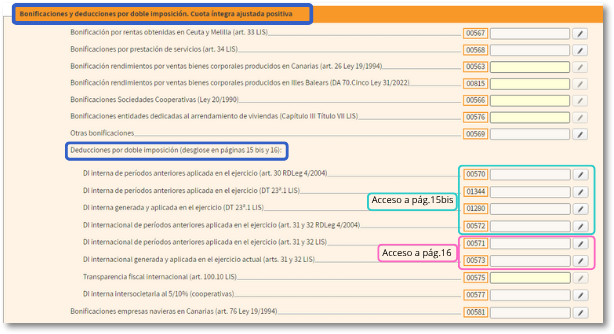

Bonuses and deductions for double taxation: access from page 14 in the section (Settlement (III) - Taxable base). Bonuses and deductions for double taxation. Positive adjusted gross share. See next point on Pages 15 bis and 16).

-

-

Pages 15 bis and 16: access from page 14 in the section (Settlement (III) - Taxable base) in "Bonuses and deductions for double taxation. Positive adjusted full quota (breakdown on pages 15 bis and 16)". Depending on the boxes you fill in, you can access the corresponding page.

NOTE: Page numbers will depend on the characters in the statement.

-

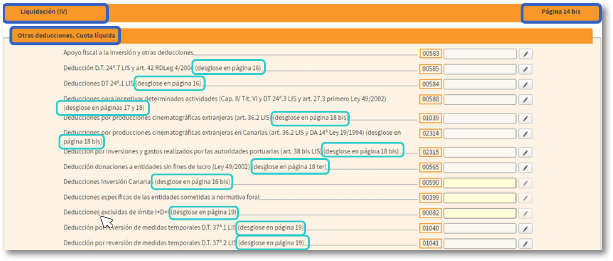

Pages 16, 16a, 17, 18, 18a, 18b and 19 (reinvestment in temporary measures): from the corresponding boxes on page 14 bis in the section "Settlement (IV)", "Other deductions. "Net share". These boxes are available or not depending on how the form is completed.

NOTE: To access page 19 (deductions excluded from the R&D&I limit) enter box 00082.

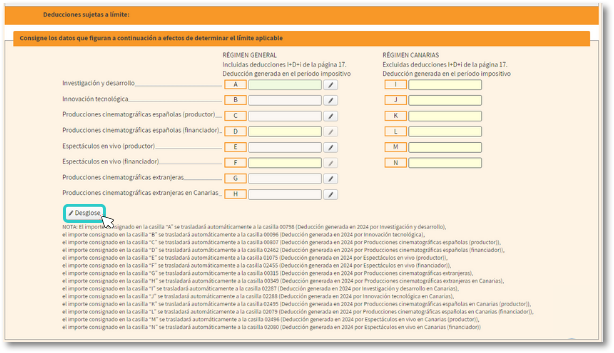

The box 00585 takes you to the breakdown of deductions subject to limits, where you will find the corresponding breakdown and information about them.

-

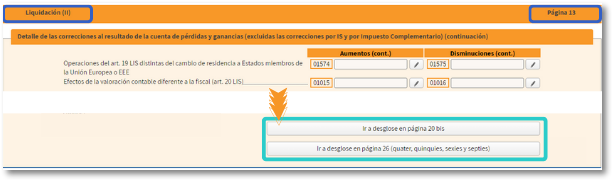

Pages 20 bis and 26: both are accessible from the buttons located at the bottom of page 13 of the section (Settlement II. Detail of corrections to the profit and loss account result (excluding IS correction) (cont.)).

-

Page 20a: accessible from the page 14 (Settlement (III) - Tax base), under the concepts "Capitalization Reserve" and "Leveling Reserve".

These are some examples of completion associated with a previous completion and the data entered in the declaration. The program informs you specifically about the associated pages.