2020

Examples of messages sent through technological channels that impersonate the AEAT detected in 2020. Do not answer these messages, they are an attempt to commit fraud by impersonating the Tax Agency.

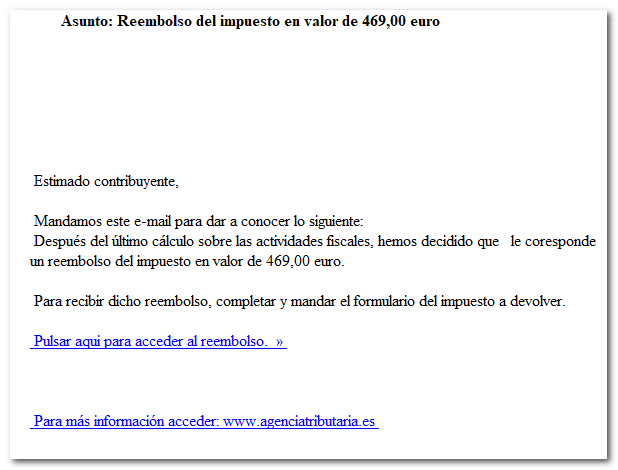

This is an example of sending a fake email message that impersonates the Tax Agency.

About: Refund of tax in the amount of 469.00 euros

Text of the email:

Dear Taxpayer,

We are sending this email to inform you of the following:

Following the final calculation of your taxable activities, we have decided that you are entitled to a tax refund of 469.00 Euro.

To receive the refund, complete and send the tax refund form.

Click here to access the refund >>

For more information access: www.agenciatributaria.es

Do not answer these messages, they are an attempt to commit fraud by impersonating the Tax Agency.

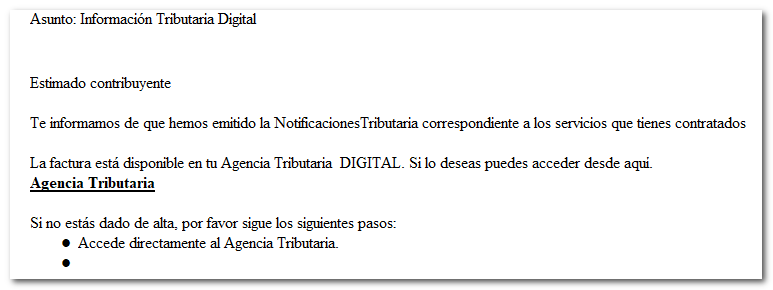

This is an example of sending a fake email message that impersonates the Tax Agency.

About: Digital Tax Information

Text of the email:

Dear Taxpayer

We inform you that we have issued the Tax Notifications corresponding to the services you have contracted.

The invoice is available in your DIGITAL Tax Agency. If you wish, you can access it from here.

Tax Agency

If you are not registered, please follow these steps:

- Go directly to the Tax Agency.

Do not answer these messages, they are an attempt to commit fraud by impersonating the Tax Agency.

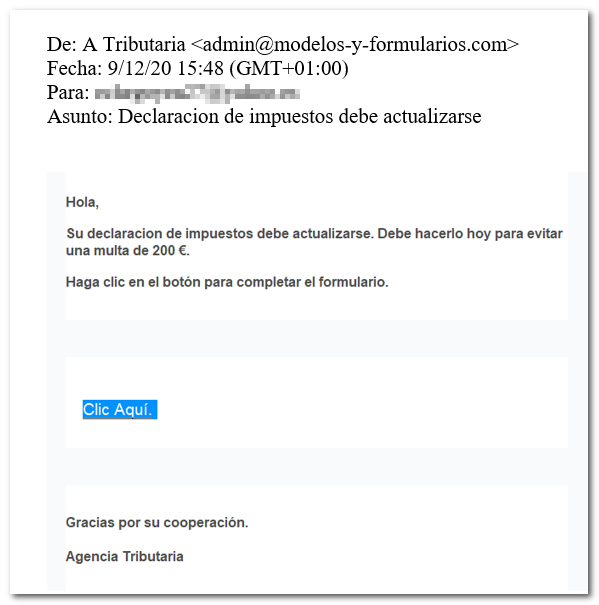

This is an example of sending a fake email message that impersonates the Tax Agency.

About: Tax return must be updated

Text of the email:

Hello,

Your tax return needs to be updated. You must do it today to avoid a €200 mule.

Click the button to complete the form

Click here.

Thanks for your cooperation.

Tax Agency

Do not answer these messages, they are an attempt to commit fraud by impersonating the Tax Agency.

This is an example of sending a fake email message that impersonates the Tax Agency.

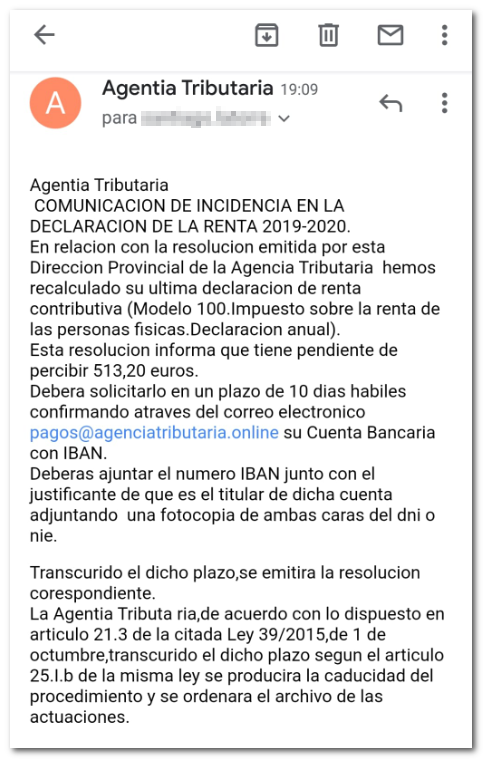

About: He has yet to receive 513.20 euros

Text of the email:

Tax Agency

NOTIFICATION OF INCIDENT IN THE 2019-2020 INCOME TAX RETURN.

In relation to the resolution issued by this Provincial Directorate of the Tax Agency, we have recalculated your last contributory income tax return (Form 100. Personal income tax. Annual declaration).

This resolution states that 513.20 euros are pending payment.

You must request it within 10 business days by confirming your bank account with IBAN via email to pagos@agenciatributaria.online.

You must attach the IBAN number along with proof that you are the owner of said account, attaching a photocopy of both sides of your ID or NIE.

After this period, the corresponding resolution will be issued.

The Tax Agency, in accordance with the provisions of article 21.3 of the aforementioned Law 39/2015, of October 1, after the aforementioned period according to article 25.lb of the same law has elapsed, the procedure will expire and the proceedings will be ordered to be archived.

Do not answer these messages, they are an attempt to commit fraud by impersonating the Tax Agency.

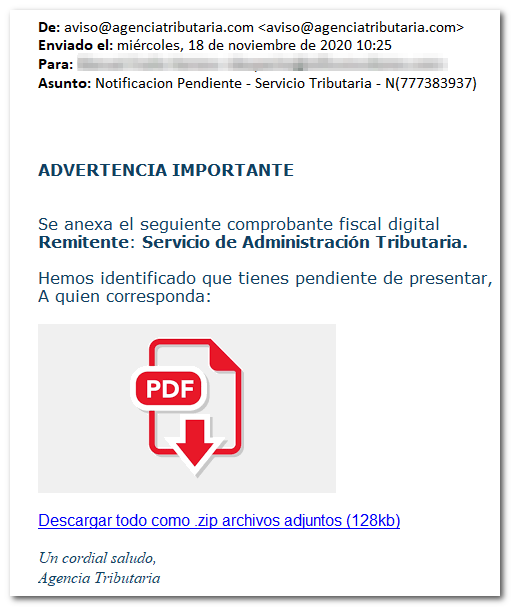

This is an example of sending a fake email message that impersonates the Tax Agency.

About: Pending Notification - Tax Service - N(777383937)

Text of message:

IMPORTANT WARNING

The following digital tax receipt is attached

Sender: Tax Administration Service.

We have identified that you are pending to present,

To whom it may concern:

Download all as .zip attachments (128kb)

A cordial greeting,

Tax Agency

Do not answer these messages, they are an attempt to commit fraud by impersonating the Tax Agency.

This is an example of sending a fake email message that impersonates the Tax Agency.

About: bank transfer receipt - [ id 467996391 ]

Text of message:

Download all as .zip attachments (128kb)

The following transfer receipt is attached

Sender: Financial Administration Service.

Income tax-related refund payment:

To whom it may concern

SERIES AND FOLIO: 215845

DATE OF ISSUE: 09/21/2020

TOTAL AMOUNT: 5987.20

Do not answer these messages, they are an attempt to commit fraud by impersonating the Tax Agency.

![Fraudulent email: bank transfer receipt - [id 467996391]](/static_files/AEAT/DIT/A3C/Phishing/Comprobante_transferencia/comprobante.png)

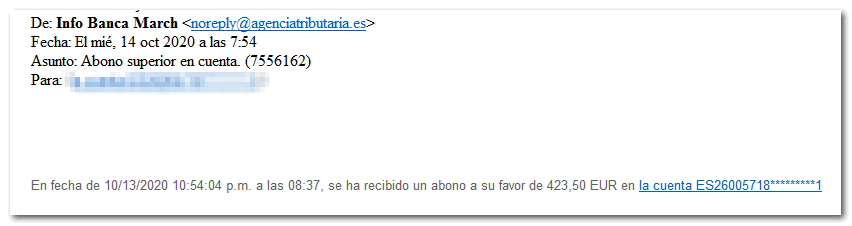

This is an example of sending a fake email message that impersonates the Tax Agency.

About: Top credit in account. (7556162)

Text of message:

On 10/13/2020 10:54:04 pm At 08:37, a credit in your favor of 423.50 EUR has been received in the account ES***********

Do not answer these messages, they are an attempt to commit fraud by impersonating the Tax Agency.

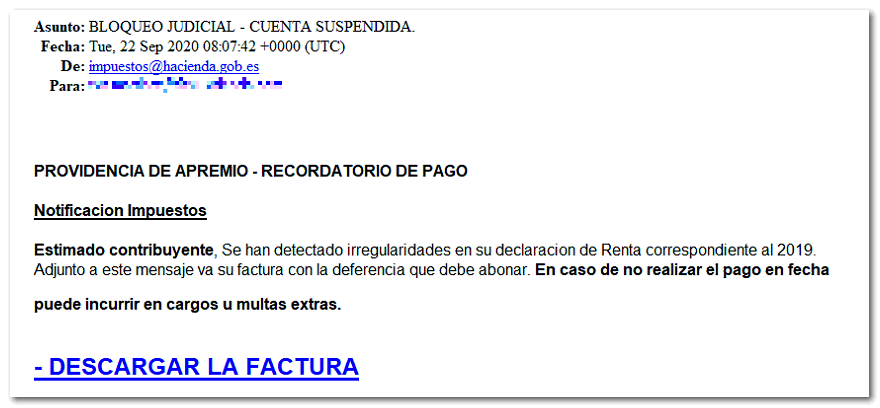

This is an example of sending a fake email message that impersonates the Tax Agency.

About: JUDICIAL BLOCK - ACCOUNT SUSPENDED.

Text of message:

DISTRIBUTION ORDER - PAYMENT REMINDER

Tax Notification

Dear taxpayer, Irregularities have been detected in your 2019 Income Tax return. Attached to this message is your invoice with the fee you must pay. Failure to make payment on time may result in additional charges or fines.

DOWNLOAD THE INVOICE

Do not answer these messages, they are an attempt to commit fraud by impersonating the Tax Agency.

This is an example of sending a fake email message that impersonates the Tax Agency.

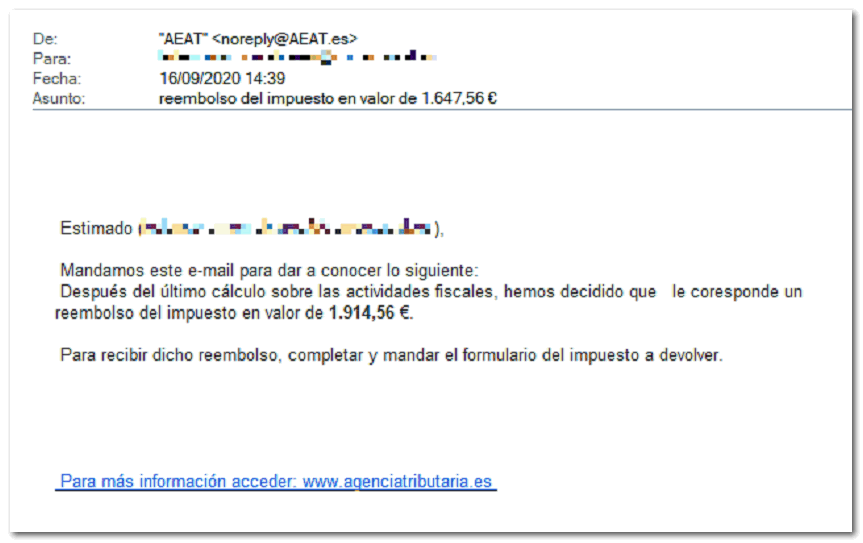

About: Tax refund in the amount of €1,647.56

Text of message: Dear... We are sending this email to inform you of the following:

After the latest calculation on tax activities, we have decided that you are entitled to a tax refund in the amount of €1,914.56.

To receive the refund, complete and send the tax refund form.

For more information access: www.agenciatributaria.es

Do not answer these messages, they are an attempt to commit fraud by impersonating the Tax Agency.

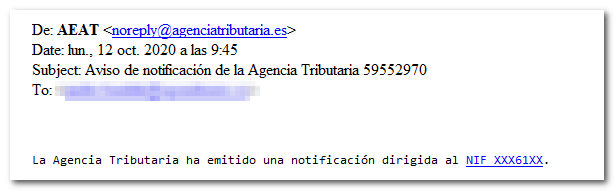

This is an example of a fake email message impersonating the Tax Agency received on September 9, 2020.

Subject "Tax Agency notification notice 59552970"

Text of the email: "The Tax Agency has issued a notification addressed to NIF XXX61XX ".

Do not answer these messages, they are an attempt to commit fraud by impersonating the Tax Agency.

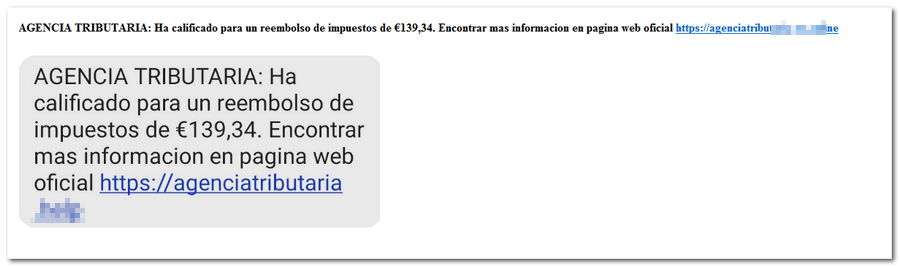

This is an example of a fake SMS message being sent impersonating the Tax Agency and which was received on September 6, 2020 with the following text:

"TAX AGENCY: You have qualified for a tax refund of €139.34. Find more information on the official website https://agenciatributaria...."

Do not answer these messages, they are an attempt to commit fraud by impersonating the Tax Agency.