2021

Examples of messages sent through technological channels that impersonate the AEAT detected in 2021. Do not answer these messages, they are an attempt to commit fraud by impersonating the Tax Agency.

This is an example of sending a fake email message that impersonates the Tax Agency.

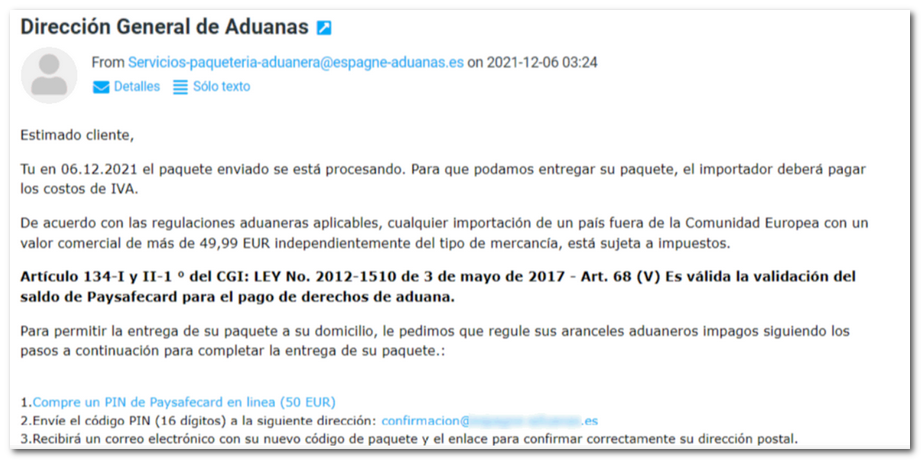

About: General Directorate of Customs

Text of the email:

Dear Customer,

Your package sent on 06.12.2021 is being processed. In order for us to deliver your package, the importer must pay VAT costs.

According to applicable customs regulations, any import from a country outside the European Community with a commercial value of more than EUR 49.99 regardless of the type of goods, is subject to tax.

Article 134.I and II.1 of the CGI: LAW No. 2012.1510 of May 3, 2017 - Art. 68 (V) Validation of the Paysafecard balance is valid for the payment of customs duties.

To enable delivery of your package to your home address, we ask that you settle your unpaid customs duties by following the steps below to complete the delivery of your package:

- Buy a Paysafecard PIN online (50 EUR)

- Send the PIN code (16 digits) to the following address confirmation@xxxxxx.es

- You will receive an email with your new package code and the link to correctly confirm your mailing address.

Greetings,

Customs Customer Service

Do not answer these messages, they are an attempt to commit fraud by impersonating the Tax Agency.

This is an example of sending a false message that impersonates the Tax Agency.

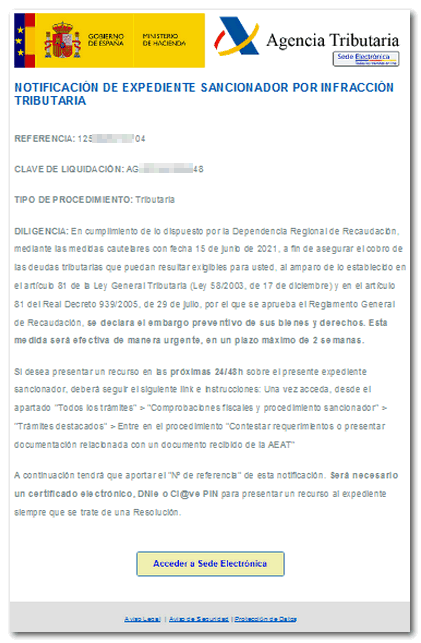

About: NOTIFICATION OF SANCTIONING PROCEEDINGS FOR TAX INFRINGEMENT

Text of message:

REFERENCE: ----------

SETTLEMENT KEY: ----------

TYPE OF PROCEDURE: Taxation

DILIGENCE: In compliance with the provisions of the Regional Collection Department, through the precautionary measures dated June 15, 2021, in order to ensure the collection of tax debts that may be payable by you, under the provisions of article 81 of the General Tax Law (Law 58/2003, of December 17) and in article 81 of Royal Decree 939/2005, of July 29, which approves the General Collection Regulations, the preventive seizure of your assets and rights is declared. This measure will be effective urgently, within a maximum period of 2 weeks.

If you wish to file an appeal in the next 24/48 hours regarding this sanctioning procedure, you must follow the following link and instructions: Once you access it from the section "All procedures" > "Tax checks and sanctioning procedure" > "Featured procedures" > Enter the procedure "Answer requests or submit documentation related to a document received from the AEAT"

You will then need to provide the "Reference Number" of this notification. An electronic certificate, DNIe or Cl@ve PIN will be required to submit an appeal to the file as long as it involves a resolution.

Access to Electronic Office

Do not answer these messages, they are an attempt to commit fraud by impersonating the Tax Agency.

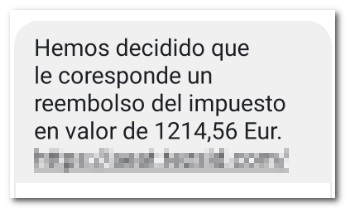

This is an example of a fake SMS message being sent impersonating the Tax Agency and which was received on July 7, 2021 with the following text:

"We have decided that you are entitled to a tax refund of 1214.56 EUR."

Do not answer these messages, they are an attempt to commit fraud by impersonating the Tax Agency.

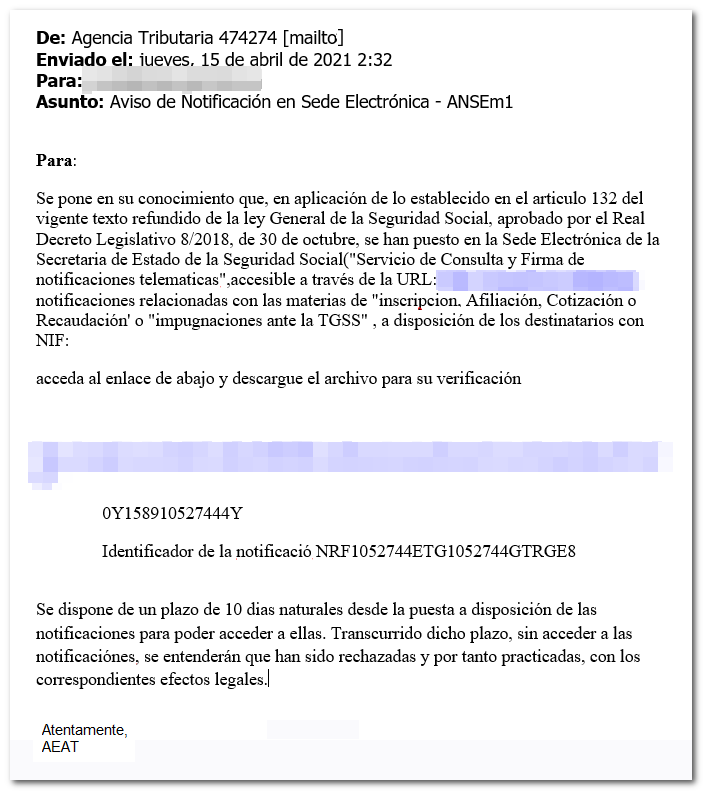

This is an example of sending a fake email message that impersonates the Tax Agency.

About: Electronic Notification Notice - ANSEm1

Text of message:

For:

Please be advised that, in accordance with the provisions of article 132 of the current consolidated text of the General Social Security Law, approved by Royal Legislative Decree 8/2018, of October 30, notifications related to the matters of "registration, affiliation, contribution or collection" or "challenges before the TGSS" have been made available to recipients with NIF:

Please access the link below and download the file for verification

http://

0Y158910527444Y

Notification identifier NRF1052744ETG1052744GTRGE8

You have a period of 10 calendar days from the date the notifications are made available to access them. After this period has elapsed, without accessing the notifications, they will be deemed to have been rejected and therefore carried out, with the corresponding legal effects.

Do not answer these messages, they are an attempt to commit fraud by impersonating the Tax Agency.

This is an example of sending a fake email message that impersonates the Tax Agency.

About: Legal and Financial Pending (last warning) - [id 184883525 ]

Text of the email:

IMPORTANT WARNING:

The following digital tax receipt is attached

Sender: Service tax administration.

We have identified that you are pending to present,

To whom it may concern:

Download all as .zip attachments (228kb)

Do not answer these messages, they are an attempt to commit fraud by impersonating the Tax Agency.

This is an example of sending a fake email message that impersonates the Tax Agency.

About: Errors in your Income Tax Return

Text of the email:

Dear Taxpayer,

Irregularities have been detected in your 2019 Income Tax return.

Attached to this message is your invoice with the due respect.

Failure to make payment on time may result in additional charges and fines.

DOWNLOAD INVOICE

Do not answer these messages, they are an attempt to commit fraud by impersonating the Tax Agency.

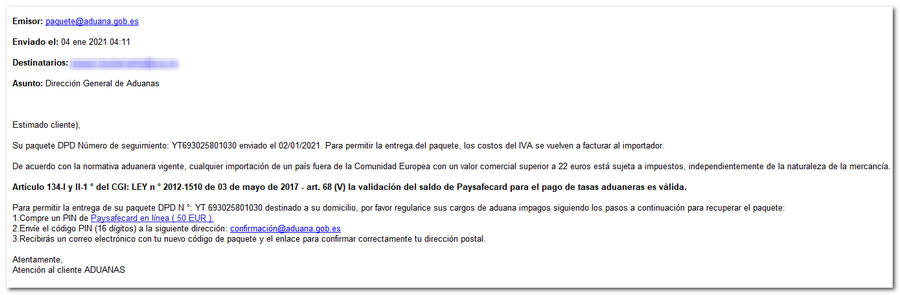

This is an example of sending a fake email message that impersonates the Tax Agency.

About: General Directorate of Customs

Text of the email:

Dear Customer).

Your DPD package Tracking Number: YT693025801030 SENT ON 01/02/2021. To enable delivery of the package, VAT costs are re-invoiced to the importer.

According to current customs regulations, any import from a country outside the European Community with a commercial value exceeding 22 euros is subject to tax, regardless of the nature of the goods.

Article 134.I and II.1 of the CGI: LAW No. 2012.1510 of May 3, 2017 - art. 68(V) the validation of the Paysafecard balance for the payment of customs fees is valid.

To allow delivery of your DPD package No. YT 693025801030 destined for your home, please regularize your unpaid customs charges by following the steps below to recover the package:

- Buy a Paysafecard PIN online (50 EUR)

- Send the PIN code (16 digits) to the following address confirmation@aduana.gob.es

- You will receive an email with your new package code and the link to correctly confirm your postal address.

Sincerely,

CUSTOMS Customer Service

Do not answer these messages, they are an attempt to commit fraud by impersonating the Tax Agency.

This is an example of sending a fake email message that impersonates the Tax Agency.

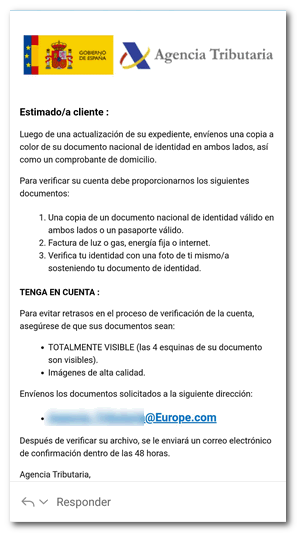

About: Updating your file

Text of the email:

Dear customer:

After updating your file, send us a color copy of your national identity document on both sides, as well as proof of address.

To verify your account you must provide us with the following documents:

- A copy of a valid national identity document on both sides or a valid passport.

- Electricity or gas bill, landline or internet.

- Verify your identity with a photo of yourself holding your ID.

KEEP IN MIND:

To avoid delays in the account verification process, please make sure your documents are:

- FULLY VISIBLE (all 4 corners of your document are visible)

- High quality images.

Please send us the requested documents to the following address:

- xxxxxxxxxxx@Europe.com

After your file is verified, a confirmation email will be sent to you within 48 hours.

Tax agency.

Do not answer these messages, they are an attempt to commit fraud by impersonating the Tax Agency.