2022

Examples of messages sent through technological channels that impersonate the AEAT detected in 2022. Do not answer these messages, they are an attempt to commit fraud by impersonating the Tax Agency.

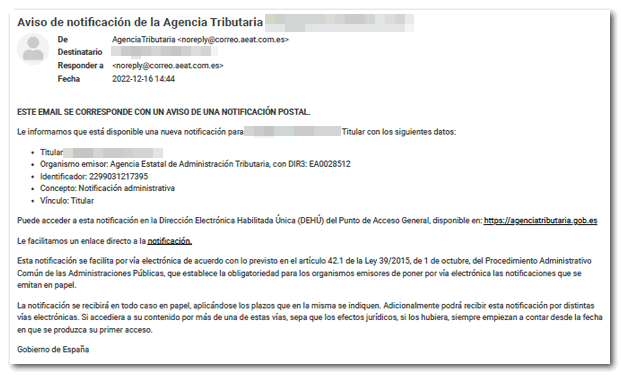

This is an example of sending a fake email message that impersonates the Tax Agency.

NOTICE: This email contains links that should not be accessed.

Text of the email:

THIS EMAIL CORRESPONDS TO A NOTICE OF A POSTAL NOTIFICATION.

We inform you that a new notification is available for xxx@xxxx.com Owner with the following data:

Owner xxx@xxxx.com

Issuing body: State Tax Administration Agency, with DIR3: EA0028512

Identifier: 2299031217395

Concept: Administrative notification

Bond: Owner

You can access this notification at the Single Enabled Electronic Address (DEHÚ) of the General Access Point, available at: https://agenciatributaria.gob.es

We provide you with a direct link to the notification.

This notification is provided electronically in accordance with the provisions of article 42.1 of Law 39/2015, of October 1, on the Common Administrative Procedure of Public Administrations, which establishes the obligation for issuing bodies to electronically submit notifications issued on paper.

In all cases, notification will be received in paper form, and the deadlines indicated therein will apply. Additionally, you may receive this notification through various electronic means. If you access your content through more than one of these means, please note that the legal effects, if any, always begin to run from the date of your first access.

Government of Spain

Do not answer these messages, they are an attempt to commit fraud by impersonating the Tax Agency.

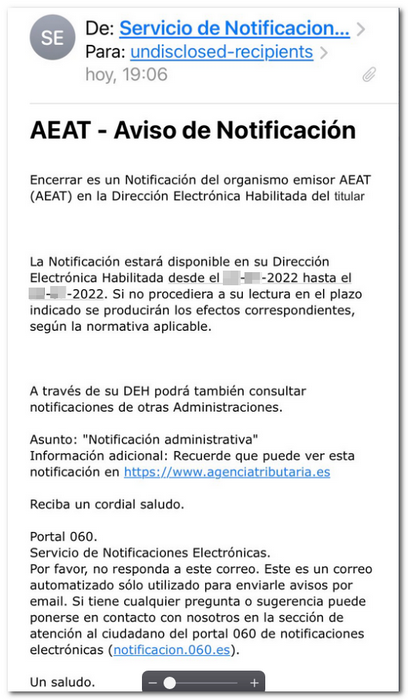

This is an example of sending a fake email message that impersonates the Tax Agency.

NOTIFICATION: This email comes with attached files containing VIRUSES and should not be opened.

Text of the email:

Enclosing is a Notification from the issuing body AEAT (AEAT) in the Authorized Electronic Address of the holder

The Notification will be from xx-xx-2022 to xx-xx-2022. If you do not read it within the indicated period, the corresponding effects will occur, according to the applicable regulations.

Through your DEH you can also consult notifications from other Administrations.

About: "Administrative notification"

Additional Information: Remember that you can see this notification at https://www.agenciatributaria.es

Best regards,

Portal 060.

Electronic Notification Service.

Please do not reply to this email. This is an automated email used only to send you email notifications. If you have any questions or suggestions, you can contact us in the citizen service section of the 060 electronic notification portal (notificacion.060.es)

All the best.

--

The information included in this email is PROFESSIONAL AND CONFIDENTIAL SECRET, and is for the exclusive use of the recipient mentioned above.

If you are not the intended recipient of the message or have received this communication in error, we inform you that any disclosure, distribution or reproduction of this communication is strictly prohibited. We ask that you notify us immediately and return the original message to the address mentioned above.

Thank you.

Do not answer these messages, they are an attempt to commit fraud by impersonating the Tax Agency.

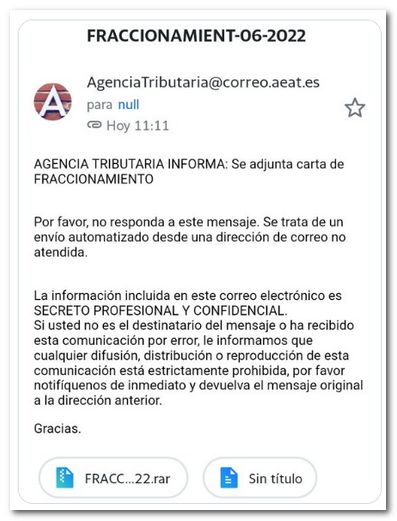

This is an example of sending a fake email message that impersonates the Tax Agency.

NOTIFICATION: This email comes with attached files containing VIRUSES and should not be opened.

Text of the email:

"Affair: FRACTIONATION 06-2022

TAX AGENCY REPORTS: Attached is the letter of FRACTIONATION

Please do not reply to this message. This is an automated email sent from an unattended email address.

The information included in this email is PROFESSIONAL SECRET AND CONFIDENTIAL. If you are not the intended recipient of the message or have received this communication in error, we inform you that any dissemination, distribution or reproduction of this communication is strictly prohibited, please notify us immediately and return the original message to the above address.

Thank you"

Do not answer these messages, they are an attempt to commit fraud by impersonating the Tax Agency.

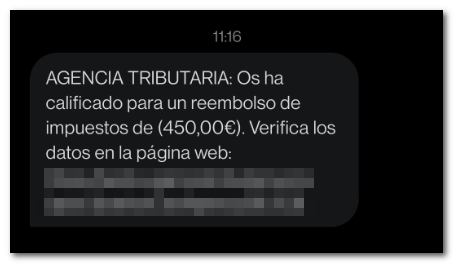

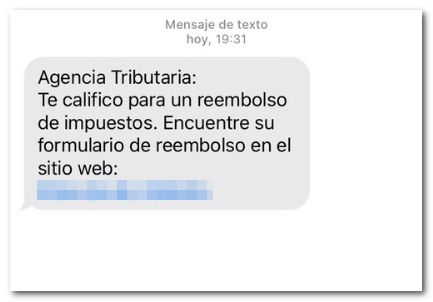

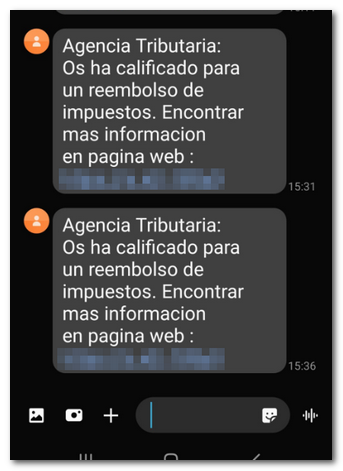

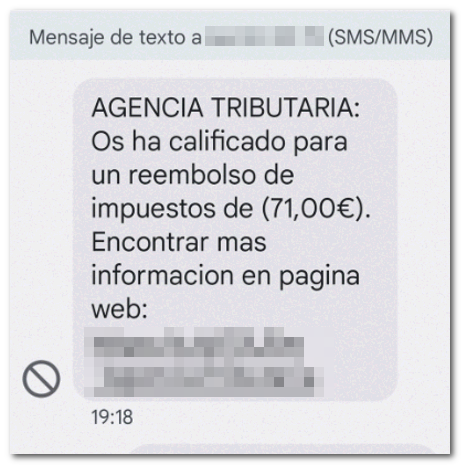

Over the past week, a mass sending of fraudulent SMS has been detected, with a very similar text and a link to a form, reporting an alleged tax refund.

Here are some examples:

"Tax agency: You have qualified for a tax refund..."

Please note that the Tax Agency never issues refunds to credit or debit cards, nor does it request confidential, financial or personal information, account numbers or card numbers, nor does it attach attachments with invoice information or other types of data.

Do not answer these messages, they are an attempt to commit fraud by impersonating the Tax Agency.

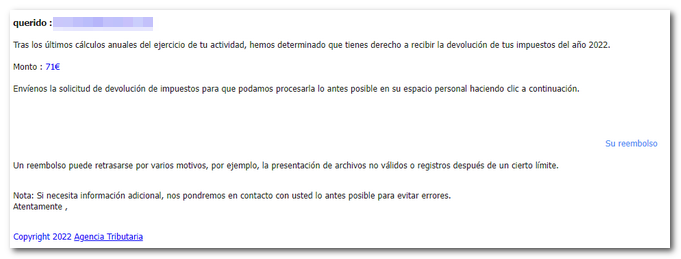

This is an example of sending a fake email message that impersonates the Tax Agency.

Text of the email:

darling:

Following the latest annual calculations for your business year, we have determined that you are entitled to receive a tax refund for 2022.

Amount: 71€

Please send us your tax refund request so we can process it as soon as possible in your personal space by clicking below.

A refund may be delayed for several reasons, for example, submission of invalid files or registrations after a certain limit.

Note: If you require additional information, we will contact you as soon as possible to avoid errors.

Sincerely,

Copyright 2022 Tax Agency

Do not answer these messages, they are an attempt to commit fraud by impersonating the Tax Agency.

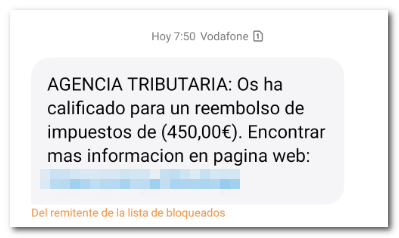

This is an example of sending SMS that impersonates the Tax Agency.

Text of message:

"Tax agency: You have qualified for a tax refund of (71 euros). Find more information on the website"

Do not answer these messages, they are an attempt to commit fraud by impersonating the Tax Agency.

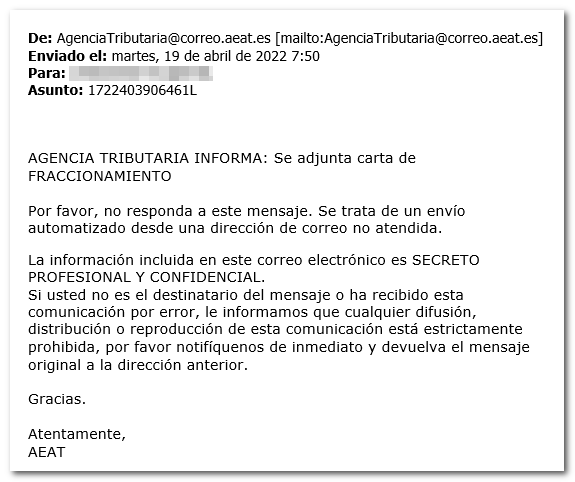

This is an example of sending a fake email message that impersonates the Tax Agency.

NOTIFICATION: This email comes with attached .rar files that contain VIRUSES and should not be opened.

Text of the email:

TAX AGENCY REPORTS: Attached is the letter of FRACTIONATION

Please do not reply to this message. This is an automated email sent from an unattended email address.

The information included in this email is PROFESSIONAL SECRET AND CONFIDENTIAL. If you are not the intended recipient of the message or have received this communication in error, we inform you that any dissemination, distribution or reproduction of this communication is strictly prohibited, please notify us immediately and return the original message to the above address.

Thank you.

Sincerely,

AEAT (Tax Agency)

Do not answer these messages, they are an attempt to commit fraud by impersonating the Tax Agency.

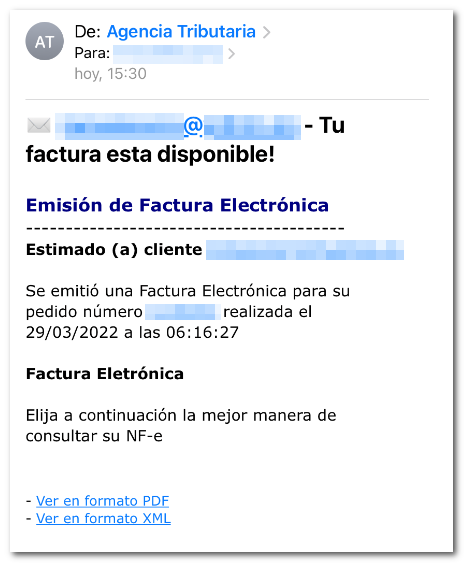

This is an example of sending a fake email message that impersonates the Tax Agency.

NOTIFICATION: This email comes with attached files in PDF and XML that contain VIRUSES and should not be opened.

Text of the email:

Electronic Invoice Issuance

Dear customer xxxxxx@xxxxxx

An Electronic Invoice was issued for your order number xxxxxxx made on 03/29/2022 at xx:xx:xx

Electronic Invoice

Choose below the best way to check your NF-e

- View in PDF format

- View in XML format

Do not answer these messages, they are an attempt to commit fraud by impersonating the Tax Agency.

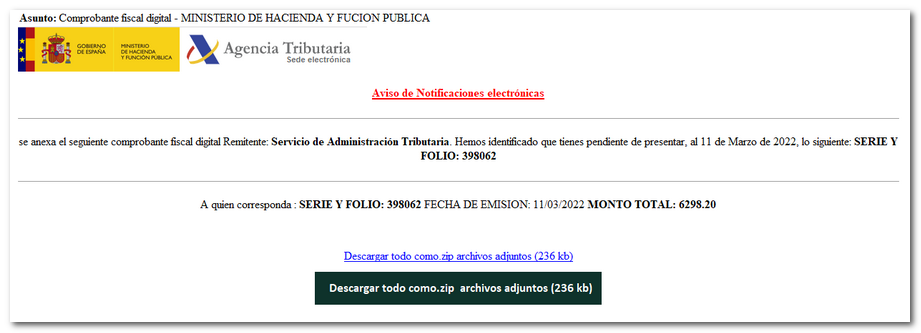

This is an example of sending a fake email message that impersonates the Tax Agency.

NOTIFICATION: This email comes with attached files containing VIRUSES and should not be opened.

Text of the email:

Notice of electronic notifications

The following digital tax receipt is attached. Sender: Service tax administration. We have identified that you are pending to present, as of March 11, 2022, the following, SERIES AND FOLIO 398062

To whom it may concern SERIES AND FOLIO 398062 DATE OF ISSUE 11/03/2022 TOTAL AMOUNT 6298.20

Download all as .zip attachments (236 kb)

Do not answer these messages, they are an attempt to commit fraud by impersonating the Tax Agency.

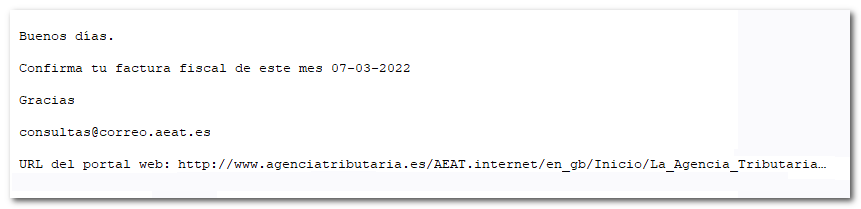

This is an example of sending a fake email message that impersonates the Tax Agency.

NOTIFICATION: This email comes with attached PDF files that contain VIRUSES and should not be opened.

Text of the email:

Good morning.

Confirm your tax invoice for this month 07-03-2022

Thank you.

consultas@correo.aeat.es

Web portal URL: http://www.agenciatributaria.es/AEAT.internet/en_gb/Inicio/La_Agencia_Tributaria...

Do not answer these messages, they are an attempt to commit fraud by impersonating the Tax Agency.

This is an example on Twitter of an attempt to impersonate the Tax Agency.

Account: Spanish Tax Agency

A fair recovery.

Spanish Tax Agency

@AgenciaEspana

Official Twitter account of the State Tax Administration Agency. Government of Spain. Madrid (Spain)

Joined January 2022

Tweet Text:

Official Press Release from the AEAT |22 January 2022|

As of January 25, 2022, it will be mandatory to install a complementary update to our "AEAT" application. For more information on how to install it

Link --------------

Please ignore these tweets, they are an attempt at fraud by impersonating the Tax Agency.