2024

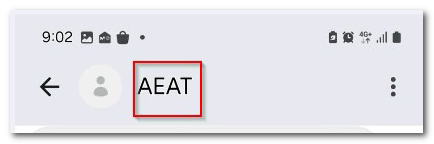

Examples of messages sent through technological channels that impersonate the AEAT detected in 2024. Do not answer these messages, they are an attempt to commit fraud by impersonating the Tax Agency.

A campaign of fake SMS (smishing) has been detected, which aims to impersonate the Tax Agency through "spoofing". This technique, called "spoofing," makes the illegitimate message appear to come from the same number used by the legitimate organization.

We recommend that, if you have any suspicions, you go directly to the Tax Agency website to carry out the appropriate checks, avoiding the links that may be included in these messages.

NOTIFICATION: These SMS arrive via the same phone number used by the organization to communicate with users, and even appear in the same thread or conversation as previous messages the user has received from the organization that are legitimate, thereby deceiving the recipient as they appear to be part of an authentic conversation.

TEXT AND DYNAMICS:

The SMS appear in the AEAT thread after other legitimate messages sent by the AEAT , which generates trust in the victim.

An example of a fraudulent SMS :

Tax agency: Notification

Notification Number Address 438/2024 Addressed to you. https[…]agencla.com

Other messages may be of the following type:

«The tax agency has issued a notification addressed to you: https[…]agenclatrlbutarla.com»

Do not respond to these emails, messages or calls, they are an attempt at fraud by impersonating the Tax Agency.

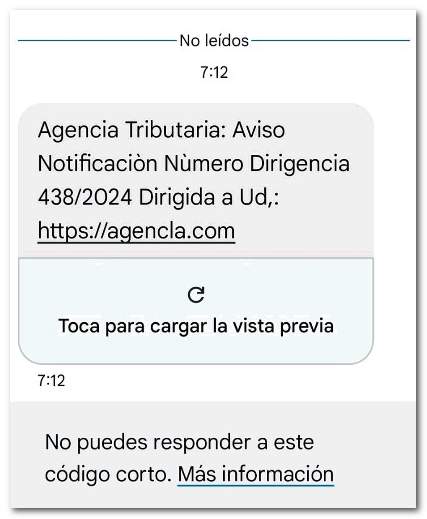

A campaign of fake SMS (smishing) accompanied by phone calls (social engineering) that impersonate the Tax Agency has been detected. We recommend that, if you have any suspicions, you go directly to the Tax Agency website to carry out the appropriate checks, avoiding the links that may be included in these messages.

NOTIFICATION: In these SMS Bank card details are requested and, if the link is enabled, the victim receives a call inviting them to make transfers from their own bank account with the argument of proceeding with a refund from the "Refund requests" campaign. PIT 2020-2023 by pensioners who made contributions to mutual funds" using a new method.

TEXT AND DYNAMICS:

"TAX AGENCY. Tax refund of (263€). Find your refund form at the link: https://itsssl.com//zk1NZ"

When you click on the link, the following form appears with the letterhead of the Tax Agency and the coat of arms of Spain from a domain that does not belong to the Tax Agency:

"Electronic Refund" "Please enter your details correctly"

Payment Method

Select Credit or Debit

Cardholder Name

Expiration date: month and year

Security Code»

And a "ratification" document appears where a photo of the DNI is requested. If this step is not completed, the victim receives a phone call from Spain, posing as an official from the Tax Agency, who gives instructions to the victim to make payments from their account to the attacker's account.

Do not respond to these emails, messages or calls, they are an attempt at fraud by impersonating the Tax Agency.

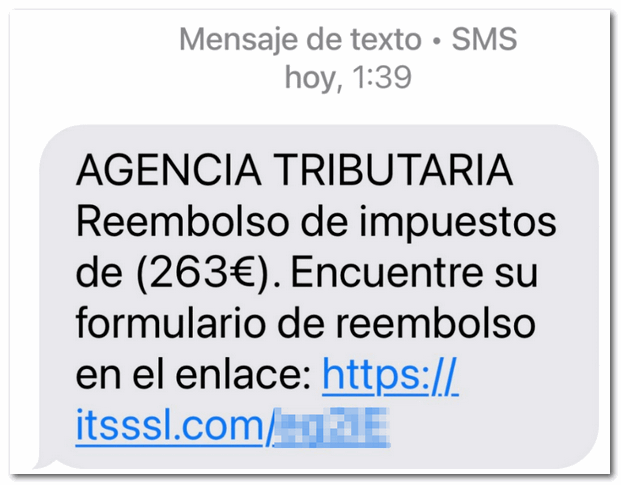

A campaign of fake SMS has been detected impersonating the Tax Agency, demanding payment for exceeding the regulated Bizum limit. We recommend that, if you have any suspicions, you go directly to the Tax Agency website to carry out the appropriate checks, avoiding the links that may be included in these messages.

NOTICE: This SMS is accompanied by a link that should not be accessed.

Text of SMS :

TAX AGENCY: The TAX OFFICE requires you to pay 48.64 EUR. Check out the following link: http://agencia.tributarias.digital/es

The link leads to a fake website urging people to make a payment to avoid penalties.

Do not respond to these emails, they are an attempt at fraud by impersonating the Tax Agency.

A campaign of fake emails impersonating the Tax Agency has been detected. We recommend that, if you have any suspicions, you go directly to the Tax Agency website to carry out the appropriate checks, avoiding the links that may be included in these emails.

NOTICE: This email is accompanied by a link that should not be accessed.

Email text:

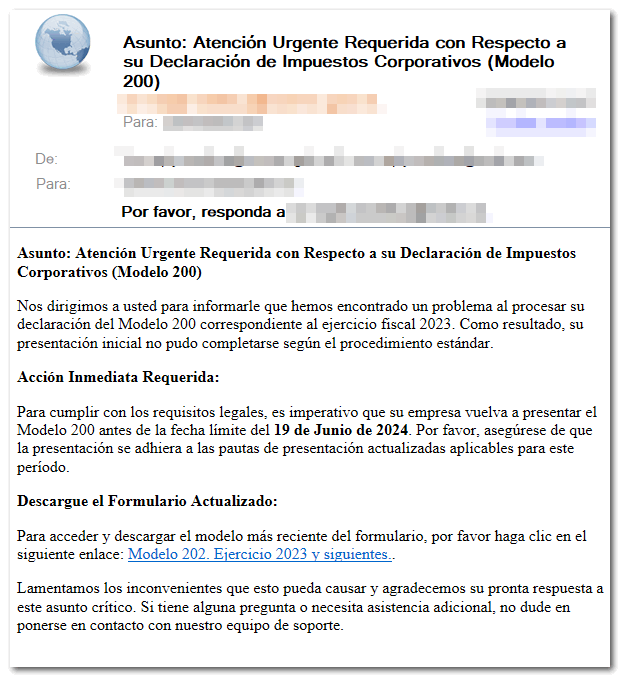

About: Urgent Attention Required Regarding Your Corporate Tax Return (Form 200)

We are writing to inform you that we have encountered a problem when processing your Form 200 declaration for the 2023 tax year. As a result, your initial submission could not be completed according to standard procedure.

Immediate Action Required:

To comply with legal requirements, it is imperative that your company re-submit Form 200 before the deadline of June 19, 2024 . Please ensure that your submission adheres to the updated submission guidelines applicable for this period.

Download the Updated Form:

To access and download the most recent model of the form, please click on the following link: Form 202. Exercise 2023 and following..

We regret any inconvenience this may cause and appreciate your prompt response to this critical matter. If you have any questions or need additional assistance, please feel free to contact our support team.

Do not respond to these emails, they are an attempt at fraud by impersonating the Tax Agency.

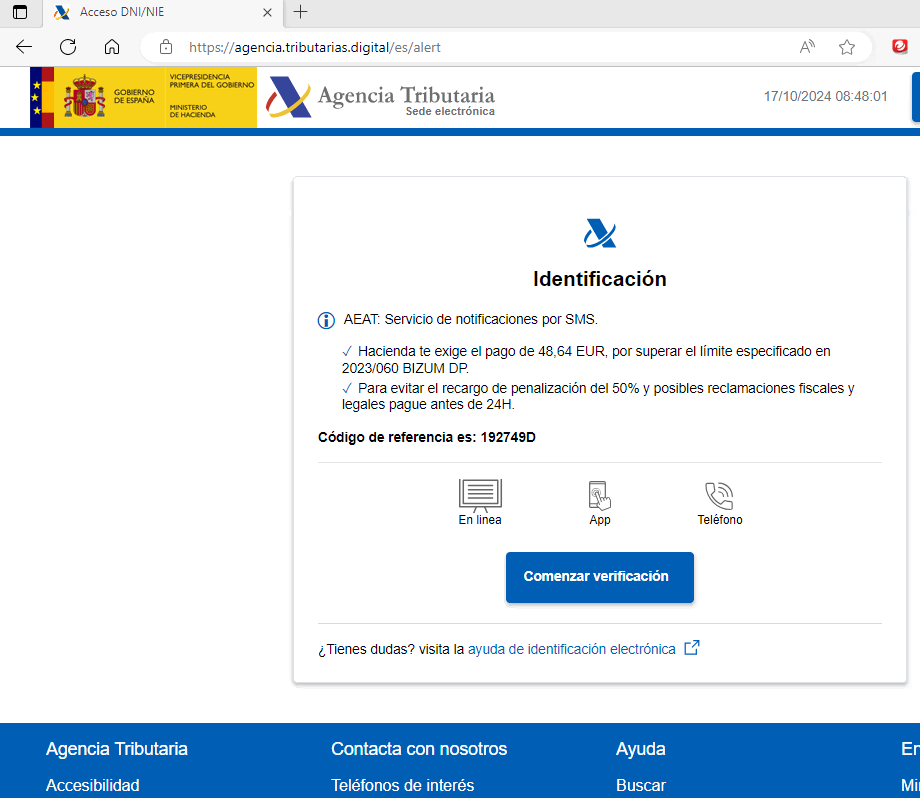

Several fake SMS campaigns impersonating the Tax Agency have been detected. We recommend that, if you have any suspicions, you go directly to the Tax Agency website to carry out the appropriate checks, avoiding the links that may be included in these SMS.

NOTICE: This SMS is accompanied by a link that should not be accessed.

SMS text:

Tax Agency Headquarters: Payment of your 2023 IRPF tax refund has been ordered. See details: hxxps://xxx-es.xxxx/hacienda

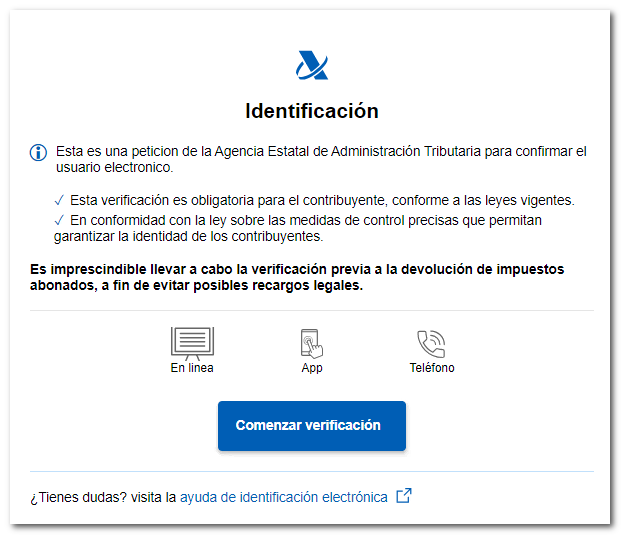

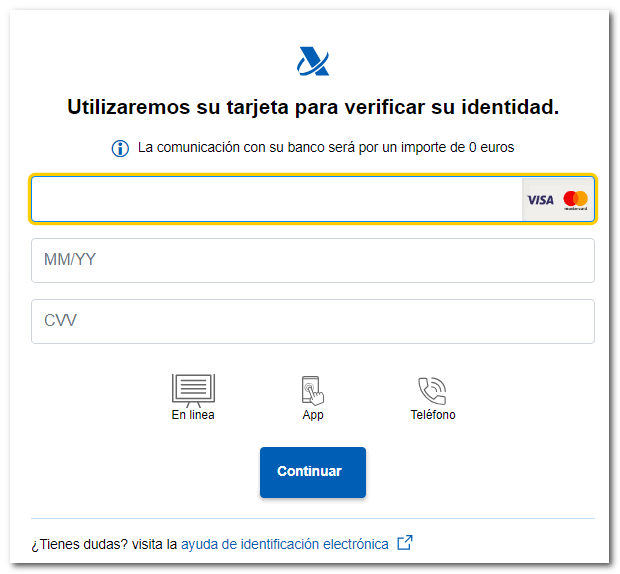

The link takes you to a fake page that impersonates the image of the Tax Agency and where it asks you to begin the verification.

Fake page

If you click on "Start verification" a form is displayed that should NOT fill out under any circumstances, it is an attempt at fraud.

Do not pay attention to these messages, they are an attempt at fraud by impersonating the Tax Agency.

Several fake SMS campaigns impersonating the Tax Agency have been detected. We recommend that, if you have any suspicions, you go directly to the Tax Agency website to carry out the appropriate checks, avoiding the links that may be included in these SMS.

NOTICE: This SMS is accompanied by a link that should not be accessed.

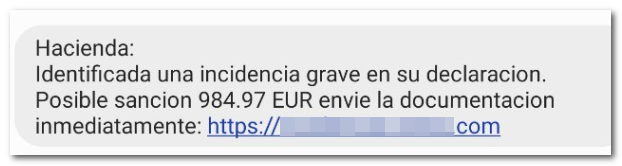

SMS text:

Tax authorities:

A serious incident has been identified in your statement. Possible fine 984.97 EUR please send documentation immediately: https://xxxxxxxxxx-xxxxx.com

Do not answer these messages, they are an attempt to commit fraud by impersonating the Tax Agency.

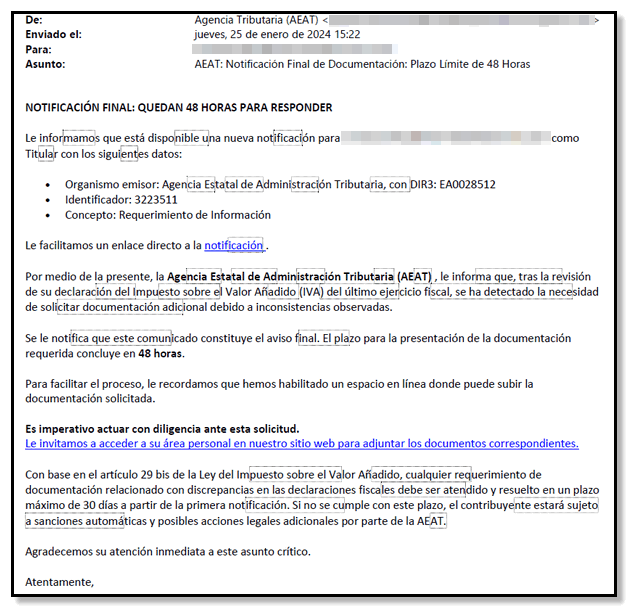

Several fake email campaigns have been detected that impersonate the Tax Agency with the intention of stealing users' access credentials. We recommend that, if you have any suspicions, you go directly to the Tax Agency website to carry out the appropriate checks, avoiding the links that may be included in these emails.

NOTICE: This email contains links that should not be accessed.

Text of the email:

About: AEAT: Final Documentation Notification: 48 Hour Deadline

FINAL NOTIFICATION: 48 HOURS LEFT TO RESPOND

We inform you that a new notification is available for xxx@xxxxxx as Owner with the following data:

Issuing body: State Tax Administration Agency, with DIR3: EA0028512

Identifier: 3223511

Concept: Request for information

We provide you with a direct link to the notification.

The State Tax Administration Agency (AEAT) hereby informs you that, after reviewing your Value Added Tax (VAT) declaration for the last fiscal year, the need to request additional documentation has been detected due to to observed inconsistencies.

You are hereby notified that this notice constitutes final notice. The deadline for submitting the required documentation ends in 48 hours.

To facilitate the process, we remind you that we have enabled an online space where you can upload the requested documentation.

It is imperative to act diligently on this request.

We invite you to access your personal area on our website to attach the relevant documents.

Pursuant to Article 29 bis of the Value Added Tax Law, any request for documentation related to discrepancies in tax returns must be addressed and resolved within a maximum period of 30 days from the first notification. If this deadline is not met, the taxpayer will be subject to automatic sanctions and possible additional legal actions by the AEAT.

We appreciate your immediate attention to this critical matter.

Sincerely,

State Tax Administration Agency (AEAT)

NOTE: This is an automatic message generated by the system. Please do not reply to this email. If you need assistance, please visit our website or contact our customer service.

LEGAL WARNING: This email may contain confidential information. If you are not the intended recipient, please notify the sender and delete this message from your system. Any disclosure, distribution or copying of this email without the corresponding authorization is prohibited. Thank you.

This email was sent from a notification-only address that cannot accept incoming email.

Copyright 2024 Tax Agency

Do not answer these messages, they are an attempt to commit fraud by impersonating the Tax Agency.

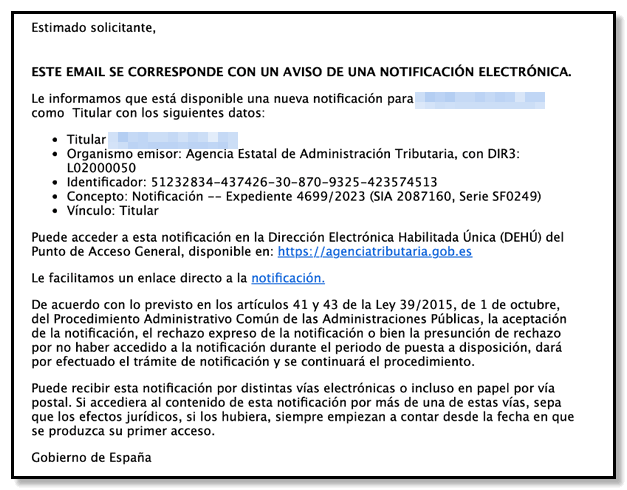

Several fake email campaigns have been detected that impersonate the Tax Agency with the intention of stealing users' access credentials. We recommend that, if you have any suspicions, you go directly to the Tax Agency website to carry out the appropriate checks, avoiding the links that may be included in these emails.

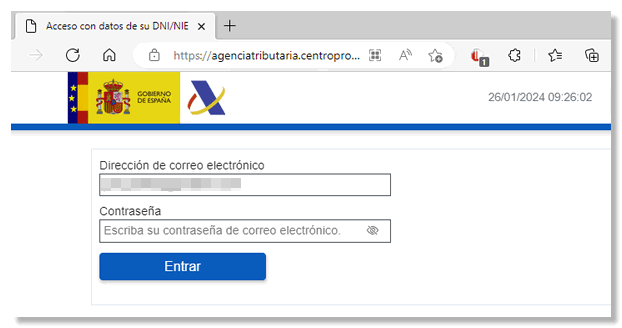

NOTICE: This email is accompanied by links that should not be accessed as they lead to a supposed Tax Agency page that requests an email address and password.

Text of the email:

About: New AEAT notification alert

THIS EMAIL CORRESPONDS TO AN ELECTRONIC NOTIFICATION NOTICE.

We inform you that a new notification is available for XXXXX as Holder with the following data:

Headline: XXXXX

Issuing body: State Tax Administration Agency, with DIR3: L02000050

Identifier: 51232834-437426-30-870-9325-423574513

Concept: Notification -- File 4699/2023 (SIA 2087160, Series SF0249)

Link: Owner

You can access this notification at the Single Enabled Electronic Address (DEHÚ) of the General Access Point, available at: https://agenciatributaria.gob.es

We provide you with a direct link to the notification.

In accordance with the provisions of articles 41 and 43 of Law 39/2015, of October 1, on the Common Administrative Procedure of Public Administrations, the acceptance of the notification, the express rejection of the notification or the presumption of rejection due to not having accessed the notification during the period of availability, will consider the notification process to be carried out and the procedure will continue.

You may receive this notification via various electronic means or even in paper form by mail. If you access the content of this notice through more than one of these means, please note that the legal effects, if any, always begin to run from the date of your first access.

Government of Spain

Do not answer these messages, they are an attempt to commit fraud by impersonating the Tax Agency.