2025

Examples of messages sent through technological channels impersonating the AEAT were detected in 2025. Do not answer these messages, they are an attempt to commit fraud by impersonating the Tax Agency.

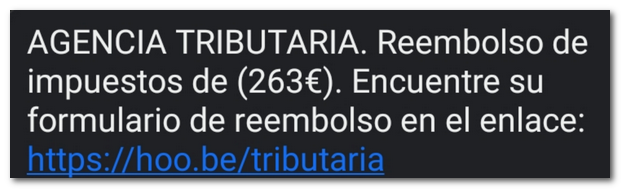

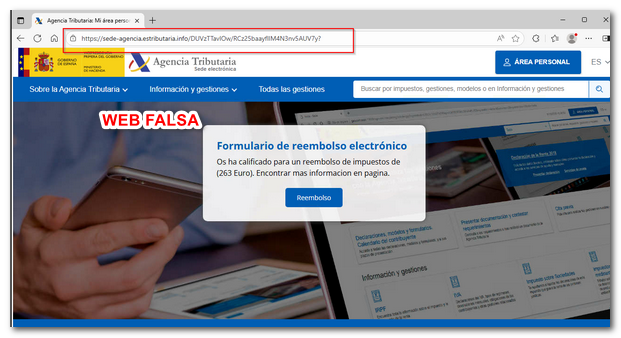

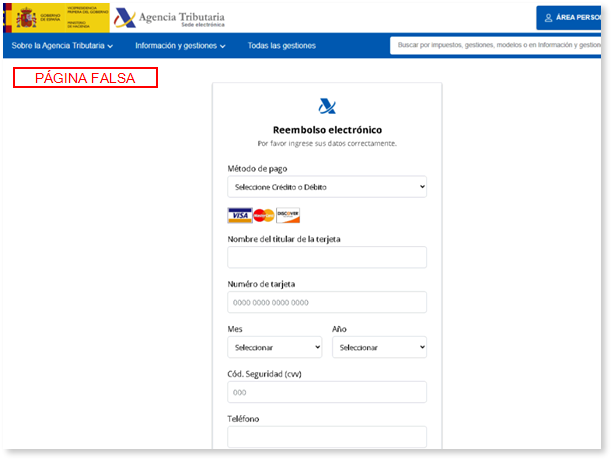

A campaign has been detected SMS fraudulent scams that include a link to a website that impersonates the Tax Agency's website, with a link to a refund form that requests bank card details.

Text of SMS :

TAX AGENCY. Tax refund of (263€). Find your refund form at the link: https://hoo.be/tributaria

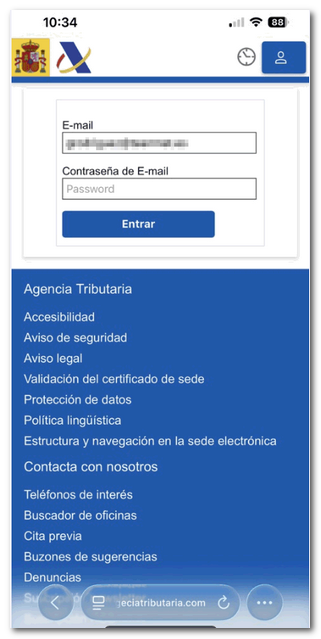

NOTIFICATION: This email includes a link that leads to a website that impersonates the Tax Agency's electronic office and requests the taxpayer's data.

Remember that the The Tax Agency never requests confidential, financial or personal information, account numbers or card numbers by email, nor does it attach attachments with invoice information or other types of data.. If you have any questions, please go directly to the Electronic Office and check if you have any pending communications or notifications; Do not use links contained in emails.

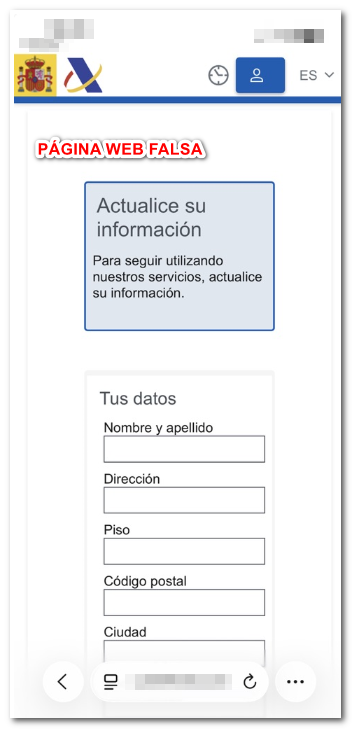

A new phishing campaign has been detected impersonating the Spanish Tax Agency, directing users to a form on a fake website, requesting that taxpayer information be updated and requiring numerous personal details, including the IBAN from the bank account.

Do not respond to messages from suspicious senders requesting personal information. The Tax Agency never requests confidential, financial, or personal information, account numbers, or credit card numbers from taxpayers via email, nor does it attach attachments containing invoice information or other types of data.

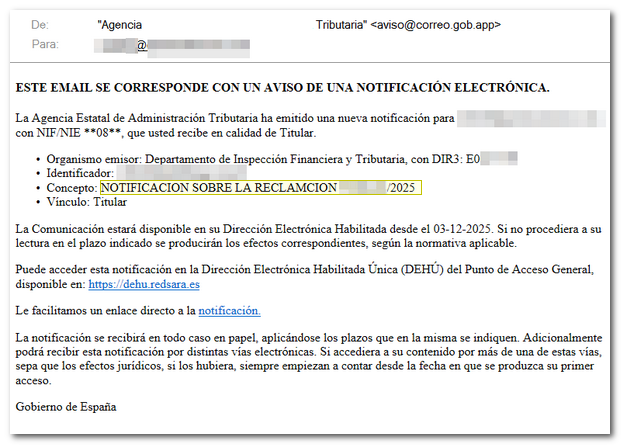

A fraudulent email campaign has been detected impersonating the Tax Agency and indicating that there is an electronic notification pending attention.

Text of the email:

Of: "Tax Agency"<aviso@correo.gob.app>

For: xxxxx@xxxxxx.xxx

THIS EMAIL CORRESPONDS TO AN ELECTRONIC NOTIFICATION NOTICE.

The State Tax Administration Agency has issued a new notification to xxxxx@xxxxxx.xxx with NIF/NIE **08**, which you receive as the Holder.

- Issuing body: Department of Financial and Tax Inspection, with DIR3: E0XXXXXX

- Identifier: xxxxxxxxxxxxxxxxxxxxxxxx

- Concept: NOTIFICATION REGARDING CLAIM XX/XXXX/2025

- Bond: Owner

The Communication will be available at your Enabled Electronic Address from 03-12-2025. If you do not read it within the indicated period, the corresponding effects will occur, according to the applicable regulations.

You can access this notification at the Single Enabled Electronic Address (DEHU) of the General Access Point, available at: https://dehu.redsara.es

We provide you with a direct link to the notification.

In all cases, notification will be received in paper form, and the deadlines indicated therein will apply. Additionally, you may receive this notification through various electronic means. If you access your content through more than one of these means, please note that the legal effects, if any, always begin to run from the date of your first access.

Government of Spain

The email contains links that, when clicked, redirect to the fake domain. agenciatributari[.]com where a form is displayed. The purpose of this form is to capture the user's credentials.

Remember that the Tax Agency never requests confidential, financial, or personal information, such as account or card numbers, by email, or attaches invoice information or other types of data. If you have any questions, please go directly to the Electronic Office and check if you have any pending communications or notifications; Do not use links contained in emails.

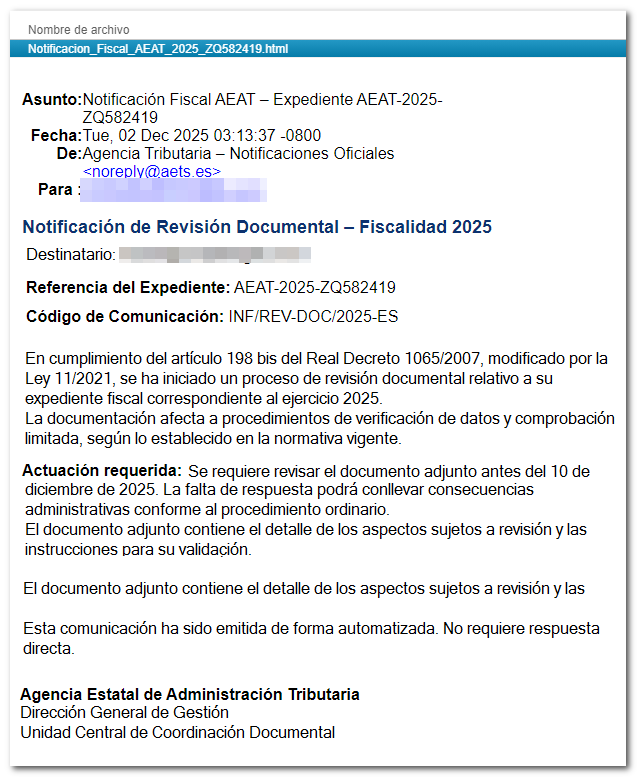

A fraudulent email campaign impersonating the Spanish Tax Agency has been detected, originating from the following FAKE email account: noreply@aets.es

Similar emails have been detected with changes to the text and/or the .html file name, but with the common denominator of the spoofed sending account noreply@aets.es

Text of the email:

Document Review Notification – Taxation 2025

Addressee: xxxxxx@xxxxxx.com

File Reference: AEAT-2025-ZQ582419

Communication Code: INF/REV-DOC/2025-ES

In compliance with article 198 bis of Royal Decree 1065/2007, modified by Law 11/2021, a documentary review process has been initiated relating to your tax file corresponding to the year 2025.

The documentation relates to data verification and limited verification procedures, as established in current regulations.

Action required: The attached document must be reviewed before December 10, 2025. Failure to respond may result in administrative consequences in accordance with the ordinary procedure.

The attached document contains details of the aspects subject to review and instructions for their validation.

This communication has been issued automatically. It does not require a direct answer.

State Revenue Office

General Directorate of Management

Central Unit for Document Coordination

Remember that the Tax Agency never requests confidential, financial, or personal information, such as account or card numbers, by email, or attaches invoice information or other types of data. If you have any questions, please go directly to the Electronic Office and check if you have any pending communications or notifications; Do not use links contained in emails.

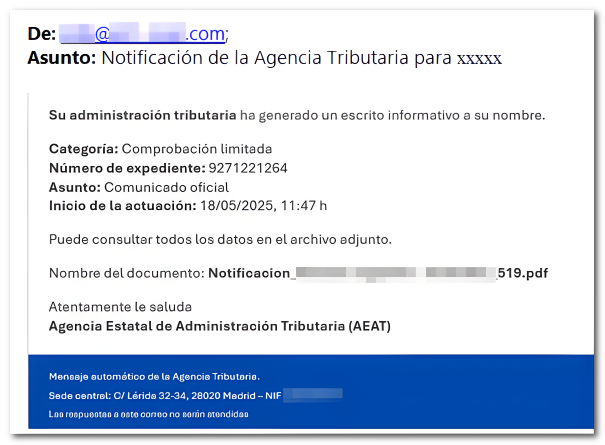

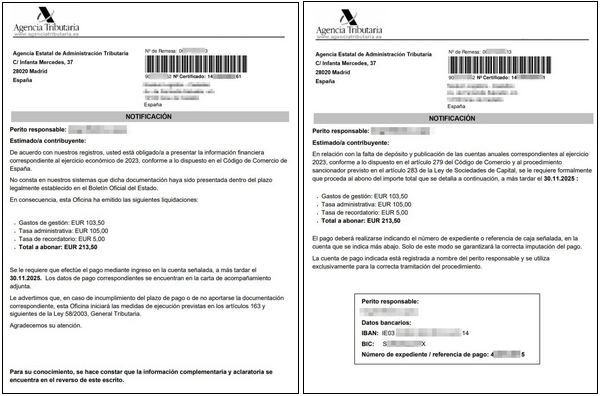

A fraudulent email campaign has been detected impersonating the Tax Agency and urging recipients to make a deposit into a bank account using a document PDF fake.

Email text:

Of: xxxx@xxxx.com

About: Tax Agency notification for xxxx

Your tax administration has generated an informational document in your name.

Category: Limited verification

File number: 9271221264

About: Official statement

Start of the performance: 18/05/2025, 11:47 h

You can find all the data in the attached file.

Document name: Notification_xxxxxxxx-xxxx,519.pdf

Yours sincerely

Agencia Estatal de Administración Tributaria (AEAT)

The email contains an attachment containing a fake document that impersonates a notification from the AEATwhich is also personalized with the recipient's details and where a pending payment is requested, and the details of the "expert" and the IBAN in each document.

Remember that the Tax Agency never requests confidential, financial, or personal information, such as account or card numbers, by email, or attaches invoice information or other types of data. If you have any questions, please go directly to the Electronic Office and check if you have any pending communications or notifications; Do not use links contained in emails.

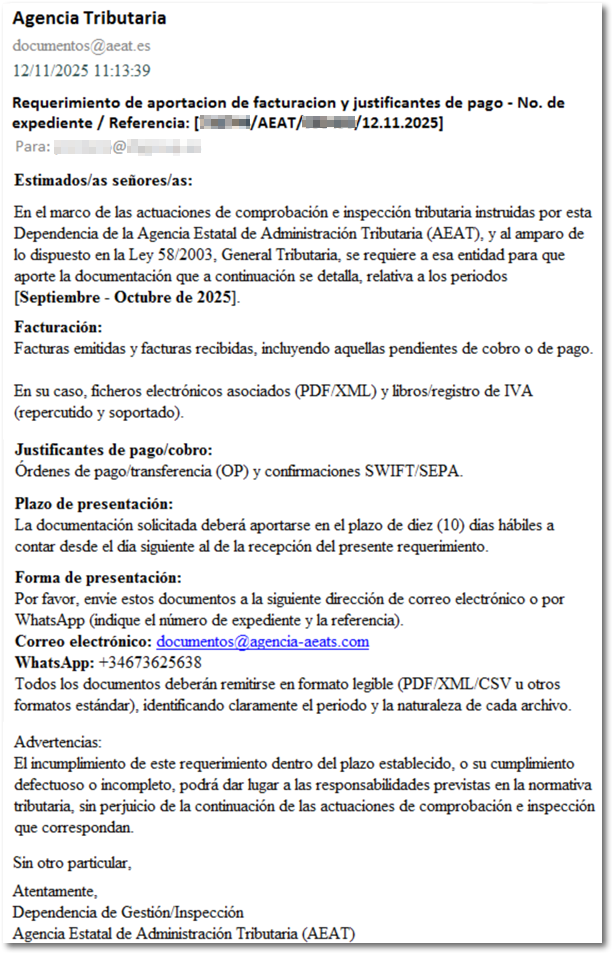

A fraudulent email campaign has been detected impersonating the Tax Agency from the following FAKE email account, documentos@aeat.es, in which the sending of financial documentation by email or WhatsApp account is urged (both accounts are not from the AEAT).

Email text:

About: Request for submission of invoices and proof of payment - No. file number / Reference: [XXXXXX/AEAT/XXXXXX/12.11.2025]

For: XXXXXXXX@XXXXXXXXX

Dear Sir/Madam:

Within the framework of the tax verification and inspection proceedings initiated by this Department of the State Tax Administration Agency (AEAT), and pursuant to the provisions of Law 58/2003, General Tax Law, this entity is required to provide the documentation detailed below, relating to the periods [September - October 2025].

Billing:

Invoices issued and invoices received, including those pending collection or payment.

In your case, associated electronic files (PDF/XML) and VAT books/register (charged and incurred).

Proof of payment/collection:

Payment/transfer orders (OP) and SWIFT/SEPA confirmations.

Deadlines:

The requested documentation must be provided within ten (10) business days from the day following receipt of this request.

Way of filing:

Please send these documents to the following email address or via WhatsApp (please indicate the file number and reference).

Email: documents@aeats-agency.com

WhatsApp: +34673625638

All documents must be submitted in a legible format (PDF/XML/CSV or other standard formats), clearly identifying the period and nature of each file.

Warnings:

Failure to comply with this requirement within the established period, or its defective or incomplete compliance, may give rise to the liabilities provided for in the tax regulations, without prejudice to the continuation of the corresponding verification and inspection procedures.

Without further ado,

Sincerely,

Management/Inspection Unit

Agencia Estatal de Administración Tributaria (AEAT)

Remember that the Tax Agency never requests confidential, financial, or personal information, such as account or card numbers, by email, or attaches invoice information or other types of data. If you have any questions, please go directly to the Electronic Office and check if you have any pending communications or notifications; Do not use links contained in emails.

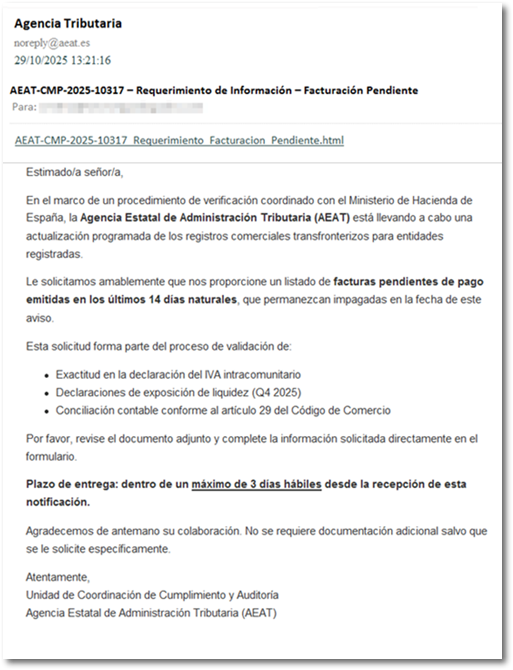

A fraudulent email campaign impersonating the Tax Agency has been detected, originating from the following FAKE email account: noreply@aeat.es.

You can also send similar emails by changing the text and/or the name of the .html file.

Text of the email:

Dear Sir/Madam,

Within the framework of a verification procedure coordinated with the Spanish Ministry of Finance, the State Tax Administration Agency (AEAT) It is carrying out a scheduled update of cross-border business registers for registered entities.

We kindly request that you provide us with a list of outstanding invoices issued within the last 14 calendar days, that remain unpaid as of the date of this notice.

This request is part of the validation process for:

- Accuracy in the declaration of intra-community VAT

- Liquidity Exposure Statements (Q4 2025)

- Accounting reconciliation in accordance with article 29 of the Commercial Code

Please review the attached document and complete the requested information directly on the form.

Delivery time: within a maximum of 3 business days from the receipt of this notification.

Thank you in advance for your cooperation. No additional documentation is required unless specifically requested.

Sincerely,

Compliance and Audit Coordination Unit

Agencia Estatal de Administración Tributaria (AEAT)

NOTICE: This email includes an .html file that directs to a web page that impersonates the Tax Agency.

Remember that the Tax Agency never requests confidential, financial, or personal information, such as account or card numbers, by email, or attaches invoice information or other types of data. If you have any questions, please go directly to the Electronic Office and check if you have any pending communications or notifications; Do not use links contained in emails.

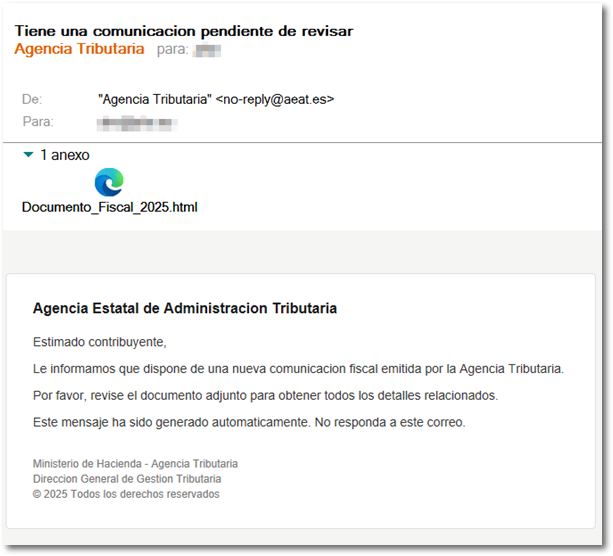

A fraudulent email campaign impersonating the Tax Agency has been detected, originating from the following fake email account: no-reply@aeat.es.

You can also send similar emails by changing the text and/or the name of the .html file.

Text of the email:

State Tax Administration Agency

Dear Taxpayer,

We inform you that you have received a new tax notice from the Tax Agency.

Please review the attached document for all related details.

This message has been generated automatically. Do not reply to this email.

Ministry of Finance - Tax Agency

General Directorate of Tax Management

© 2025 All rights reserved

NOTICE: This email includes an .html file that links to a website that impersonates the Tax Agency's electronic headquarters.

Remember that the Tax Agency never requests confidential, financial, or personal information, such as account or card numbers, by email, or attaches invoice information or other types of data. If you have any questions, please go directly to the Electronic Office and check if you have any pending communications or notifications; Do not use links contained in emails.

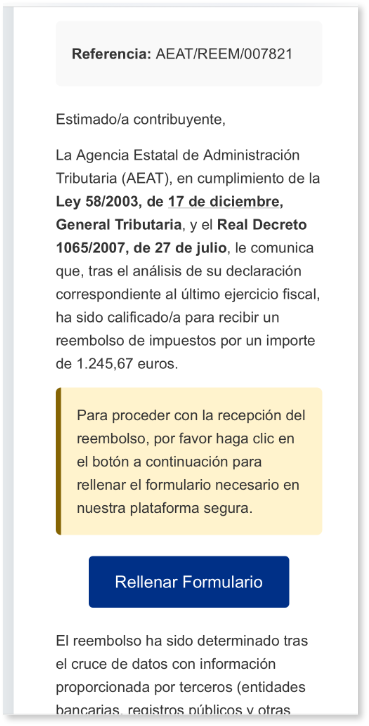

A fraudulent email campaign impersonating the Tax Agency has been detected, originating from the following fake email account: isabelle.rose@imagerie-loire-forez.fr.

Text of the email:

Dear taxpayer,

The State Tax Administration Agency (AEAT), in compliance with Law 58/2003, of December 17, General Tax Law, and Royal Decree 1065/2007, of July 27, informs you that, after analyzing your tax return for the last fiscal year, you have been eligible to receive a tax refund in the amount of €1,245.67.

To proceed with your refund, please click the button below to complete the necessary form on our secure platform.

Fill out the form

The refund was determined by cross-referencing data with information provided by third parties (banks, public registries, and other administrations), in accordance with Article 93 of the General Tax Law. The reasons for this refund are detailed below: ...."

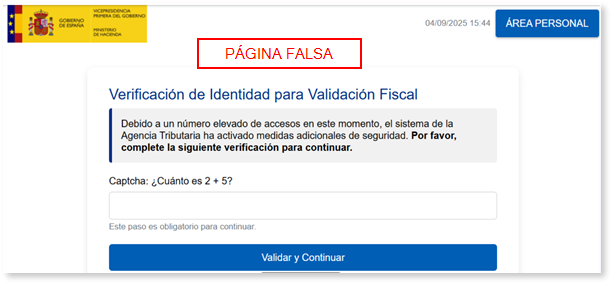

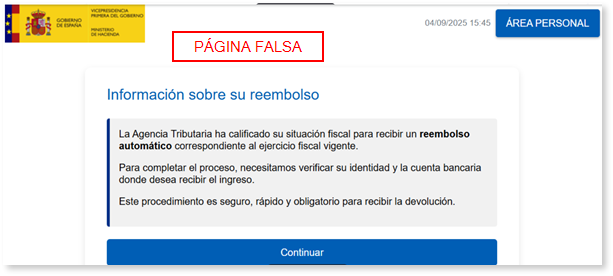

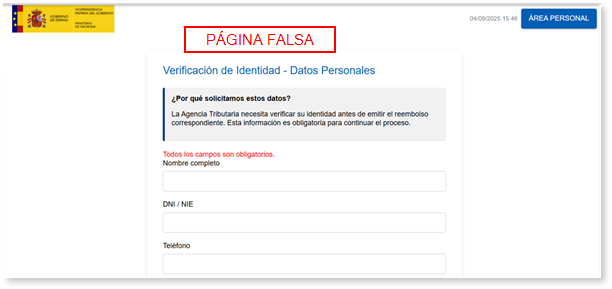

NOTIFICATION: The "Fill Out Form" link redirects to a web page hosting the phishing scam.

Remember that the The Tax Agency never requests confidential, financial or personal information, account numbers or card numbers by email, nor does it attach attachments with invoice information or other types of data.. If you have any questions, please go directly to the Electronic Office and check if you have any pending communications or notifications; Do not use links contained in emails.

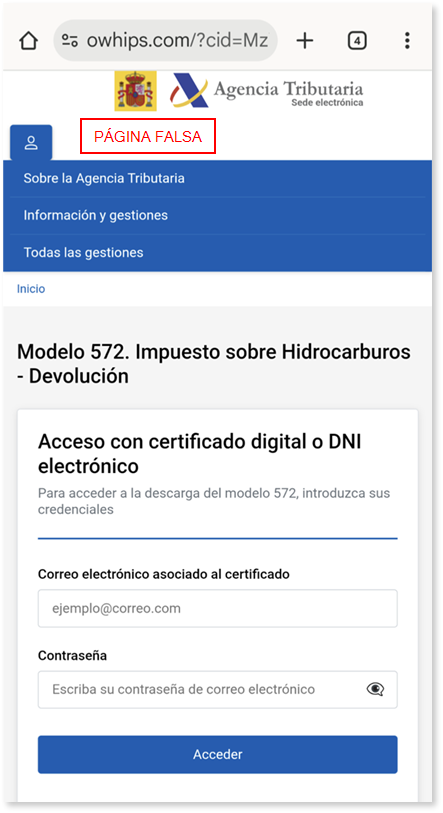

A fraudulent email campaign has been detected impersonating the Tax Agency and including a link to a website hosting the scam, simulating a Form 572 form and requesting personal information.

Do not respond to messages from suspicious sender who request downloading files or providing personal information. The Tax Agency never requests confidential, financial, or personal information, account numbers, or credit card numbers from taxpayers via email, nor does it attach attachments containing invoice information or other types of data.

A fraudulent email campaign impersonating the Tax Agency has been detected originating from the following fake email account: no-reply@paizogps.in.

Text of the email:

Official Tax Refund NotificationDear

We hope this message finds you well.

We are pleased to inform you that, following a recent review by the Tax Agency, you have been determined to be entitled to a tax refund of €263. This refund is part of our commitment to transparency and accuracy in tax management. To proceed with your refund request, please follow these steps:

1. Click the link below to access the application form.

2. Please carefully complete all required fields.

3. Submit the form once you have verified that the information is correct.

Refund Important Notes:

We recommend completing the process as soon as possible to avoid delays in processing your refund.If you have any difficulty completing the form or need more information, please do not hesitate to contact us using the information below.We are here to help you and ensure that your experience with us is satisfactory.

Tax Agency

NOTIFICATION: This email includes a link to a website that impersonates the Tax Agency's online site and requests the taxpayer's bank details.

Remember that the The Tax Agency never requests confidential, financial or personal information, account numbers or card numbers by email, nor does it attach attachments with invoice information or other types of data.. If you have any questions, please go directly to the Electronic Office and check if you have any pending communications or notifications; Do not use links contained in emails.

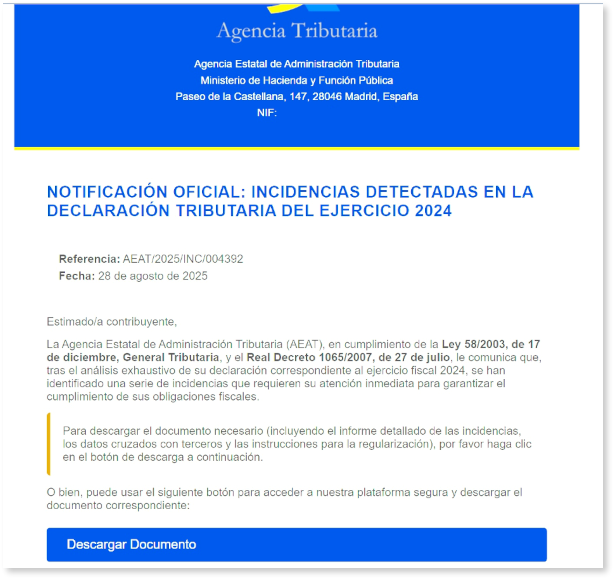

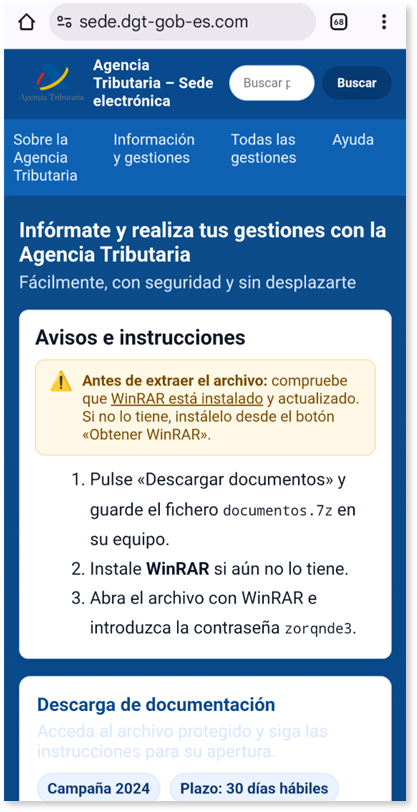

A fraudulent email campaign impersonating the Tax Agency has been detected, reporting alleged issues with income tax returns and urging taxpayers to correct them to avoid potential penalties. The email comes from the following FAKE account, adl@alcasser.es.

Text of the email:

Dear taxpayer,

The State Tax Administration Agency (AEAT), in compliance with Law 58/2003, of December 17, General Tax Law, and Royal Decree 1065/2007, of July 27, informs you that, after a thorough analysis of your tax return for the 2024 fiscal year, a series of incidents have been identified that require your immediate attention to ensure compliance with your tax obligations.

To download the necessary document (including the detailed incident report, third-party cross-referenced data, and instructions for regularization), please click the download button below.

Or, you can use the following button to access our secure platform and download the corresponding document:The incidents were detected by cross-referencing data with information provided by third parties (banking institutions, public registries, and other administrations), in accordance with Article 93 of the General Tax Law. The anomalies identified are detailed below...

NOTIFICATION: This email includes a link to a website hosting the scam, which impersonates the Tax Agency's online site.

Do not respond to messages from suspicious sender who request downloading files or providing personal information. The Tax Agency never requests confidential, financial, or personal information, account numbers, or credit card numbers from taxpayers via email, nor does it attach attachments containing invoice information or other types of data.

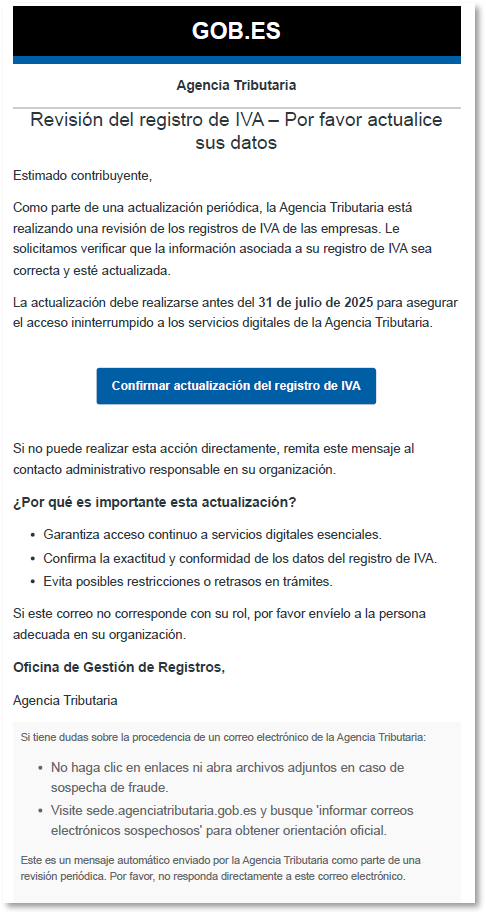

A campaign of fake emails impersonating the Tax Agency has been detected coming from the following email account that DOES NOT EXIST: dehu@agenciatributaria.gob.es.xxx

This email requests the update of the data related to the registration of the VAT. Remember that the Tax Agency never requests personal information by email; be wary of unknown senders. If you have any questions, please go directly to the Electronic Office and check if you have any pending communications or notifications; Do not use links contained in emails.

Text of the email

Tax Agency

VAT Registration Review - Please update your details

Dear taxpayer. As part of a regular update, the Tax Agency is conducting a review of companies' VAT records. We ask you to verify that the information associated with your registration VAT is correct and up to date.

The update must be completed by July 31, 2025, to ensure uninterrupted access to the Tax Agency's digital services.

If you are unable to perform this action directly, please forward this message to the responsible administrative contact in your organization.

Why is this update important?

Ensures continuous access to essential digital services.

Confirms the accuracy and conformity of the data in the registration VAT.

Avoid potential restrictions or delays in procedures.

If this email does not correspond to your role, please forward it to the appropriate person in your organization.

Records Management Office,

Tax Agency

If you have questions about the origin of an email from the Tax Agency: Do not click on links or open attachments if you suspect fraud. Visit sede.agenciatributaria.gob.es and search for 'report suspicious emails' for official guidance.

This is an automatic message sent by the Tax Agency as part of a periodic review. Please do not reply directly to this email.

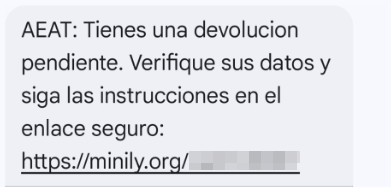

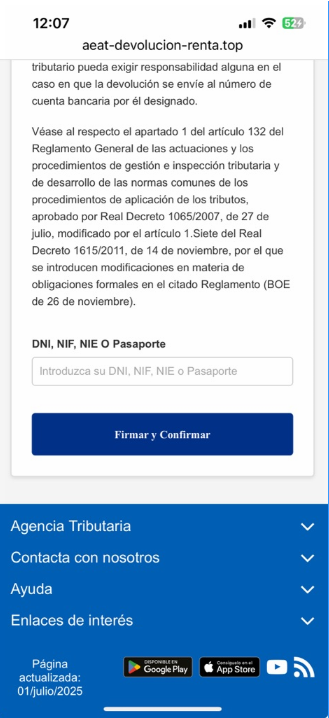

A campaign has been detected SMS false reports of a supposed 2024 Income Tax refund, in which the identity of the Tax Agency is impersonated.

Text of the SMS:

AEAT: You have a pending return. Please verify your details and follow the instructions in the secure link: https://minily.org/rdZrIhXXXX

The link redirects to another page where the phishing/fraud is hosted.

Do not respond to messages that ask you to access a link to manage returns or provide personal information.

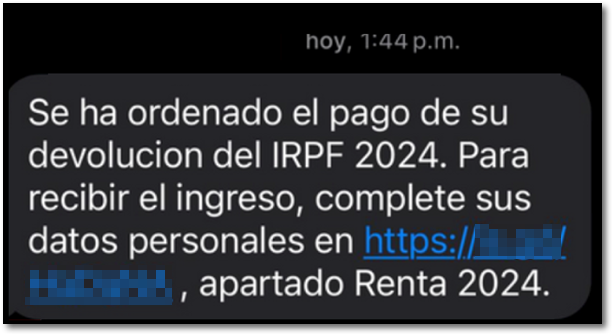

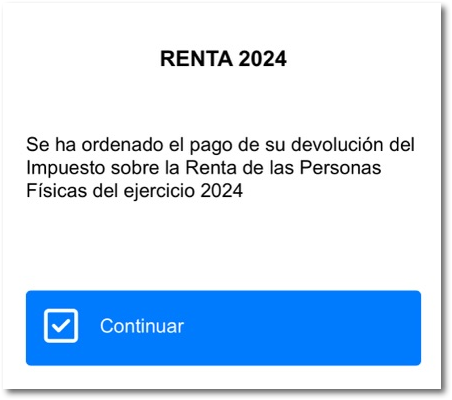

A campaign has been detected SMS fakes that impersonate the Tax Agency with a notice about the 2024 Income Tax refund.

NOTICE: This SMS is accompanied by a link that should not be accessed.

SMS text:

Your 2024 personal income tax refund has been ordered. To receive the income, complete your personal information at https://xx.xx/.xxxxxx, Income 2024 section.

The link redirects to another page where the phishing/fraud is hosted.

Do not answer these messages, they are an attempt to commit fraud by impersonating the Tax Agency.

A type of fake email impersonating the Tax Agency has been detected coming from the following email account that DOES NOT EXIST at the Tax Agency: Contacto-031293@correo.aeat.es

Text of the email

We inform you that we have identified an outstanding balance related to the payment of your taxes. To avoid additional charges, such as interest, fines, or other legal consequences, we urge you to regularize your situation with the State Tax Administration Agency (AEAT) as soon as possible.

We remind you of the importance of carefully reviewing your pending payment to ensure all information is correct. To download the corresponding document and view related data, access the file available below.

We appreciate your commitment to fulfilling your tax obligations. Your collaboration with the AEAT is essential to promote development and strengthen the well-being of our nation.

NOTICE:

The email contains a ZIP attachment called Tax Document that should not be opened or saved.

A fake email campaign has been detected impersonating the Tax Agency, seeking to remind people when a deferral or installment payment is due and urging them to provide specific information.

NOTICE : The email has an attachment in ISO format that contains a malicious EXE file.

Text of email:

AEAT INFORMS REMINDER OF NEXT DEFERRED/INSTALLATION PAYMENT DUE 04/16/2025 No. *******77067DD. Expiration date (04/16/2025) TOTAL AMOUNT 98,157.38. Please provide the requirements indicated.

This is an automated message sent from an unattended email address.