How to register a power of attorney via a public document

For cases in which the principal cannot grant power through the Electronic Office of the Tax Agency (due to not having an electronic certificate, Cl@ve or identification eIDAS ), the possibility of presenting the power of attorney in the Electronic Registry of the Tax Agency to generate the power of attorney has been provided. In this type of request for incorporation of powers into the Registry of Powers of Attorney, it is not necessary for the grantor to participate at any time, since he or she already granted the power before the Notary.

One of the types of power of attorney for carrying out procedures over the Internet is that contained in a public or private document with a signature authenticated before a notary, according to section Two.1. b) of the Resolution of May 18, 2010 of the General Directorate of the State Agency for Tax Administration, in relation to the registration and management of powers of attorney and the registration and management of successions and legal representation of minors and incapacitated persons for carrying out procedures and actions online before the Tax Agency:

"b) Power granted through a public document or private document with a notarized signature presented to the Tax Agency. In these cases, the document accrediting the power of attorney must conform to the content included in the form in Annex I."

In this regard, it is admissible to submit electronic deeds of power of attorney or electronic copies thereof to the Electronic Registry of the Tax Agency, regulated in Article 17 bis of the Notarial Law and which meet the requirements established therein. Deeds of power of attorney for carrying out procedures via the Internet in PDF format submitted for this purpose to the Electronic Registry of the Tax Agency will also be accepted.

Prior to its incorporation into the Registry of Powers of Attorney, the Tax Agency will verify the validity of the power of attorney granted by consulting the subsistence of the power granted in the notarial deeds, in compliance with the provisions of the Resolution of May 18, 2010 of the Directorate of the Tax Agency.

In this sense, the powers provided must therefore be verifiable with the information available at the State Tax Administration Agency, so that, for example, those deeds granted abroad whose information has not been previously sent by the corresponding public notaries based on the Agreement signed between the AEAT and the General Council of Notaries on the supply of information, dated February 5, 2020 ( BOE of February 15), could not be subject to the new procedure.

Therefore, the power of attorney deeds granted for carrying out procedures and actions online before the Tax Agency may be submitted by the representative himself with his electronic certificate, Cl@ve or with the identification system for citizens of the European Union ( eIDAS ) using the identification of another country, after which the power of attorney would be incorporated into the Registry of Powers of Attorney, after review by the official authorized to do so.

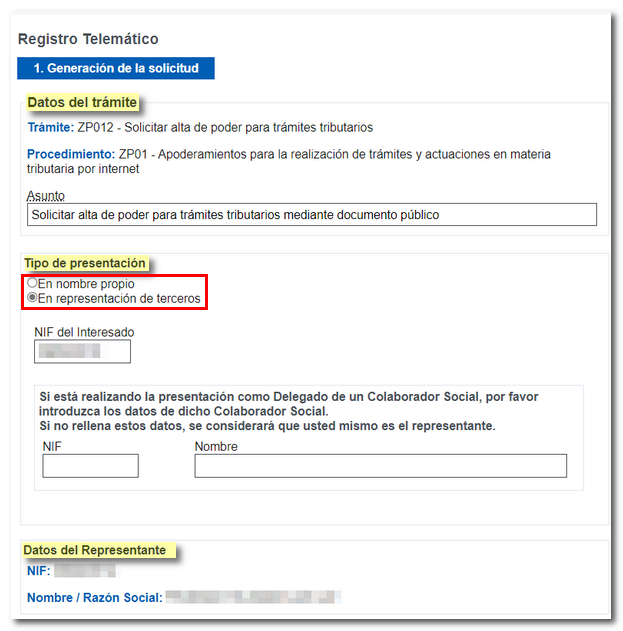

Once you have accessed the online registration, fill in the required fields. The subject, the type of presentation by selecting "On one's own behalf" or "On behalf of third parties".

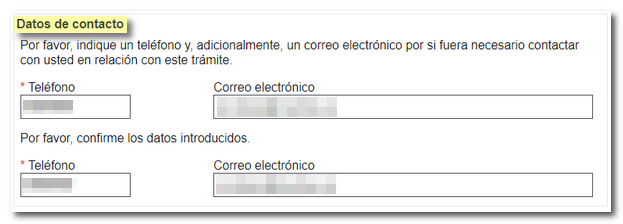

The presenter must then provide a contact telephone number and, additionally, an email address.

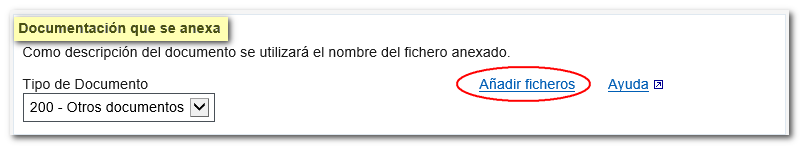

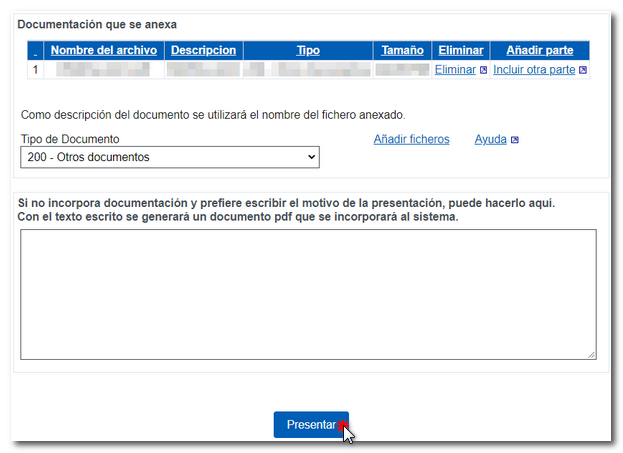

In the "Attached documentation" section, select the type of document and click on the "Add files" link to select the file with the documentation you must submit. In the "Help" link you can check the list of formats accepted for the presentation of files for this procedure, the maximum size allowed for each file being 64 MB.

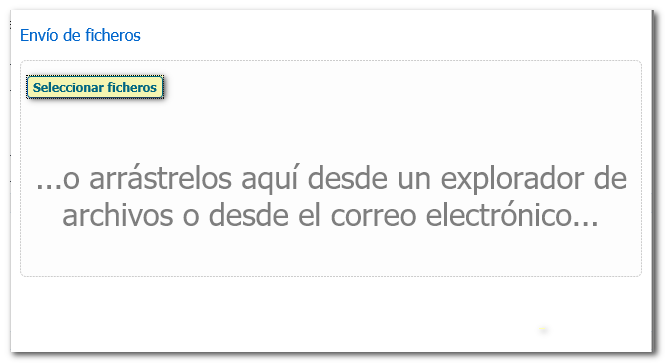

Select or drag the file. It is preferable that the file name does not have punctuation marks and is saved on the local disk, within the folder " AEAT ".

The added file will appear in the "Attached documentation" section. When you finish attaching the files, click "Submit" at the bottom.

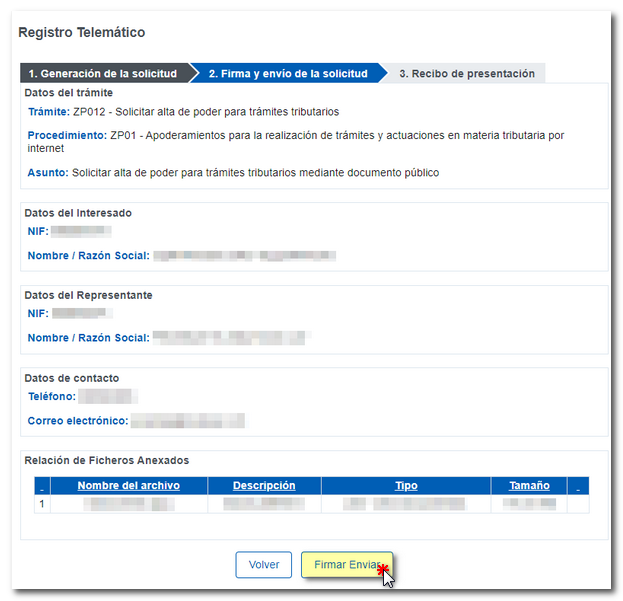

The data to be sent is then displayed. If you wish to make a change, click "Return" and if you agree, click "Sign Send".

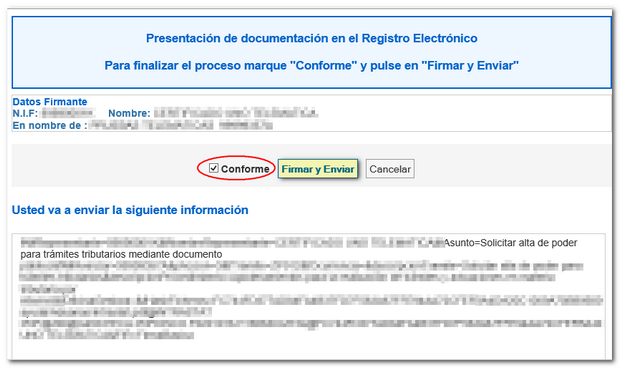

In the pop-up window, check "I agree" and click "Sign and Submit" to complete the submission process.

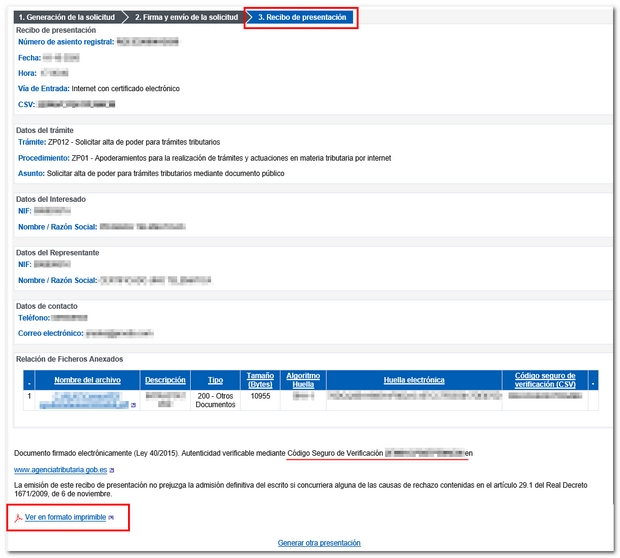

Once this procedure has been carried out, you will receive a receipt for the submission with a registration number and the CSV which you can compare on the website.

Click the "View in printable format" link to obtain the electronic registration receipt.